India: Aluminium prices decline w-o-w tracking LME, MCX decline

...

- Global cues weigh on domestic aluminium prices

- Premiums stood at $280-300/t over LME

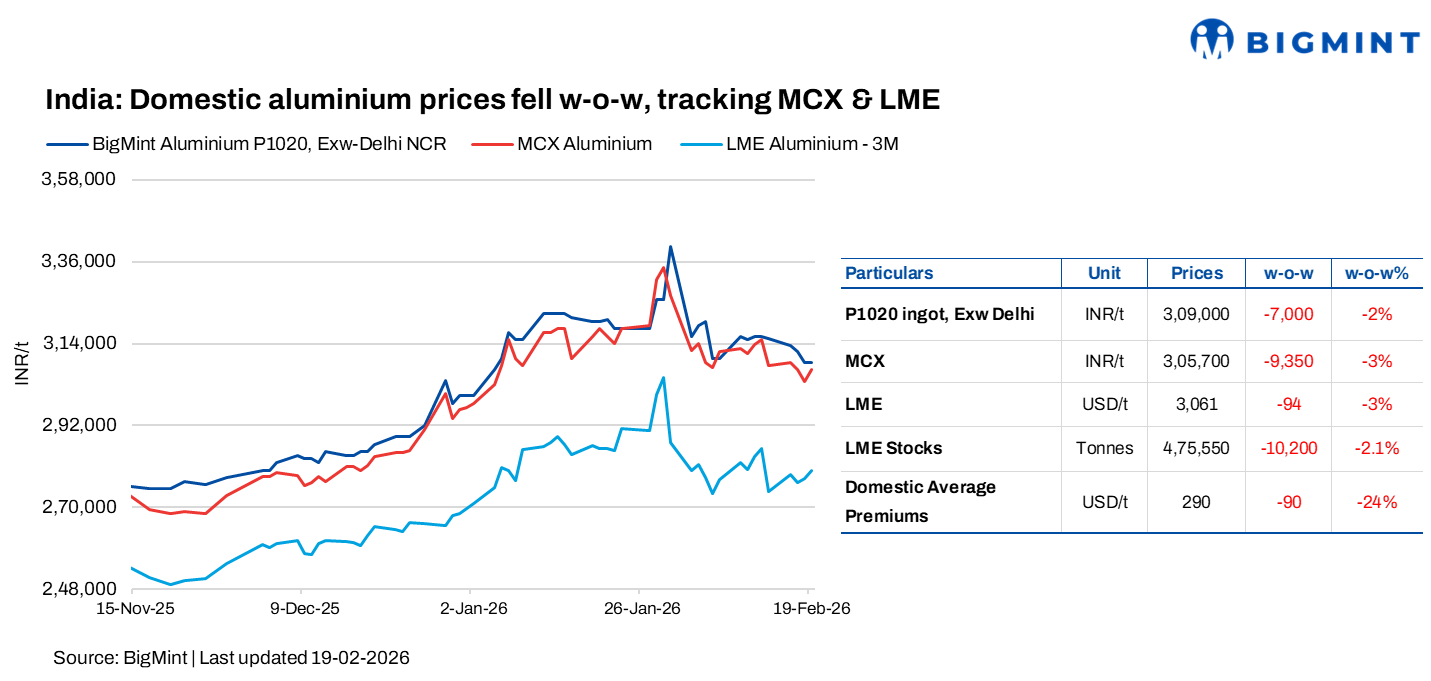

Domestic aluminium prices in India declined w-o-w on 19 February, mirroring the drop in aluminium futures on the London Metal Exchange (LME) and the Multi Commodity Exchange (MCX), amid ongoing global supply concerns.

As per BigMint's assessment, domestic aluminium ingot prices in Delhi NCR declined by INR 7,000/t, or 2%, w-o-w to INR 309,000/t. Similarly, Mumbai prices fell by INR 6,000/t, or 2%, w-o-w to INR 314,000/t as of 19 February 2026.

How did Indian and global exchanges perform?

Domestic aluminium futures on the MCX declined w-o-w by INR 9,350/t, or 3%, to INR 305,700/t, reflecting weaker market sentiment.

In the global market, 3-month LME aluminium prices also fell by $94/t, or 3%, w-o-w to $3,061/t. Meanwhile, stocks at LME-registered warehouses witnessed outflows of 10,200 t w-o-w, marking a 2.1% decline.

LME aluminium prices fell w-o-w amid rising market volatility, risk-off sentiment, and profit-taking. Strong US data, weaker pre-Lunar New Year demand from China, and a firmer US dollar further pressured global aluminium markets.

Market insights

BALCO's P1020 prices witnessed multiple downward revisions during the week, declining by INR 7,500/t, or around 2%, to INR 326,000/t on 18 February from INR 333,500/t on 12 February.

Similarly, Hindalco's P1020 prices also saw successive downward revisions through the week, falling by INR 6,250/t, or nearly 2%, to INR 325,750/t on 19 February from INR 332,000/t on 12 February.

Meanwhile, NALCO cut its P1020 aluminium ingot prices by INR 7,600/t on 18 Feb26 to INR 316,100/t, down from INR 323,700/t on 12 Feb'26.

Market participants reported a notable improvement in domestic aluminium demand, with sentiment strengthening across the market following the trade deal with the USA, which has supported consumption in India. Meanwhile, inventory levels at major primary producers were heard to be at comfortable levels. Domestic premiums remained largely steady w-o-w at around $280-300/t over LME cash, as suppliers continued to align premiums to maintain overall realizations.

Other updates

Despite steep US tariffs in 2025, primary aluminium imports from India rose 17% y-o-y to 146,000 t as buyers accelerated shipments ahead of duty hikes and continued sourcing to bridge the US's large supply deficit. With domestic smelting capacity far below annual demand, the US remained structurally dependent on imports, meaning tariffs increased costs but did not curb the need for primary aluminium from suppliers like India.

Outlook

Domestic aluminium prices may remain range-bound in the near term, tracking global cues from LME and MCX. While improved domestic demand and steady premiums offer support, macro uncertainty, currency strength, and cautious global sentiment may keep prices under pressure in the short term.