India: Low-grade iron ore prices in Karnataka remain firm w-o-w

...

- Buying interest remains irregular across auctions

- C-DRI prices fall on low buying interest

Domestic iron ore prices in Karnataka's Bellary region remained largely unchanged during the week ended 19 February, as market activity stayed muted and buyers continued to adopt a cautious stance. Limited movement in spot transactions and the absence of direct sales further reflected the subdued sentiment prevailing in the market.

BigMint's weekly assessment indicated that low-grade iron ore fines (Fe 57%) were stable at INR 2,700/t ($30/t) ex-mines, excluding taxes, unchanged week-on-week. Similarly, Fe 62% grade fines inched up by INR 50/t ($0.5/t) to INR 5,150/t ($56/t), reflecting a stagnant yet supported pricing environment.

The relative firmness in high-grade material prices was primarily driven by constrained availability. Only a handful of miners in the Bellary region are currently offering high-grade fines, keeping supply tight and underpinning price stability. Strong preference for high-grade ore owing to its superior productivity and better realization in downstream steelmaking has further supported demand fundamentals. However, despite this structural advantage, actual buying activity has remained irregular, with several miners reporting negligible participation even in higher-grade auctions.

On the demand side, buyers cited logistical bottlenecks, particularly dispatch-related challenges in material sourced from NMDC which have dampened auction response compared to earlier cycles. Market participants noted that NMDC's auctions are no longer receiving the aggressive bids witnessed in previous months. At the same time, auctions conducted by other regional miners have also failed to generate strong traction, as sponge iron prices have remained stable, offering little incentive for fresh raw material procurement.

A Bellary-based miner told BigMint, "We have already reduced our offer prices to attract buyers, yet our auction failed to receive any meaningful response."

Echoing the cautious mood, a Bellary-based buyer stated, "We are adequately stocked at the moment and see no urgency to procure additional volumes. Iron ore prices are already elevated, which is limiting further upside."

Rationale

- One (1) trade via e-auction was recorded for Fe 57% in this publishing window and was not taken into consideration. Hence, the T1 trade category was accorded 0% weightage.

- Fifteen (15) offers and indicative prices were reported, out of which eleven (11) were considered as T2 trades. These were accorded 100% weightage.

C-DRI prices remains largely firm w-o-w in Bellary: Prices of sponge iron (CDRI) in Bellary down by INR 150/t ($1.65/t) w-o-w to INR 26,700/t ($293/t). The slight dip was primarily attributed to subdued buying interest from regional steel manufacturers. Despite firm input costs, particularly iron ore and coal, producers faced resistance in passing on higher costs due to moderate demand for finished steel. As a result, price movement remained limited and largely range-bound.

Steelmakers continued to follow a cautious procurement strategy, supported by adequate inventory levels and stable finished steel prices. Buying was largely need-based, leading to thin trade volumes during the week. Transactions were concluded at marginally lower levels to attract limited demand, while overall market sentiment remained steady but restrained in the absence of strong consumption triggers.

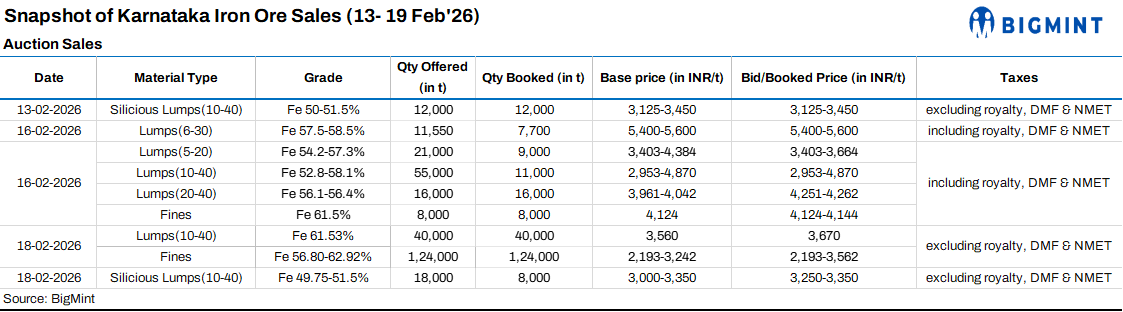

Karnataka iron ore sales scenario (13-19 February 2026)

Outlook

Low-grade iron ore prices in Karnataka are expected to remain muted in the near term, with the possibility of a slight uptick if sponge iron and downstream steel segments lend support to raw material demand. Any improvement in finished steel offtake or revival in sponge iron prices could provide the necessary trigger for upward price movement.

Additionally, miners who stayed inactive during the previous week are likely to re-enter the market and test prevailing demand conditions through fresh offers or auctions. Their participation will play a key role in gauging real buyer appetite and determining the short-term price direction.