Our forecasting model blends historical data, real-time sentiment, and predictive analytics to deliver highly accurate, market-aligned steel price forecasts.

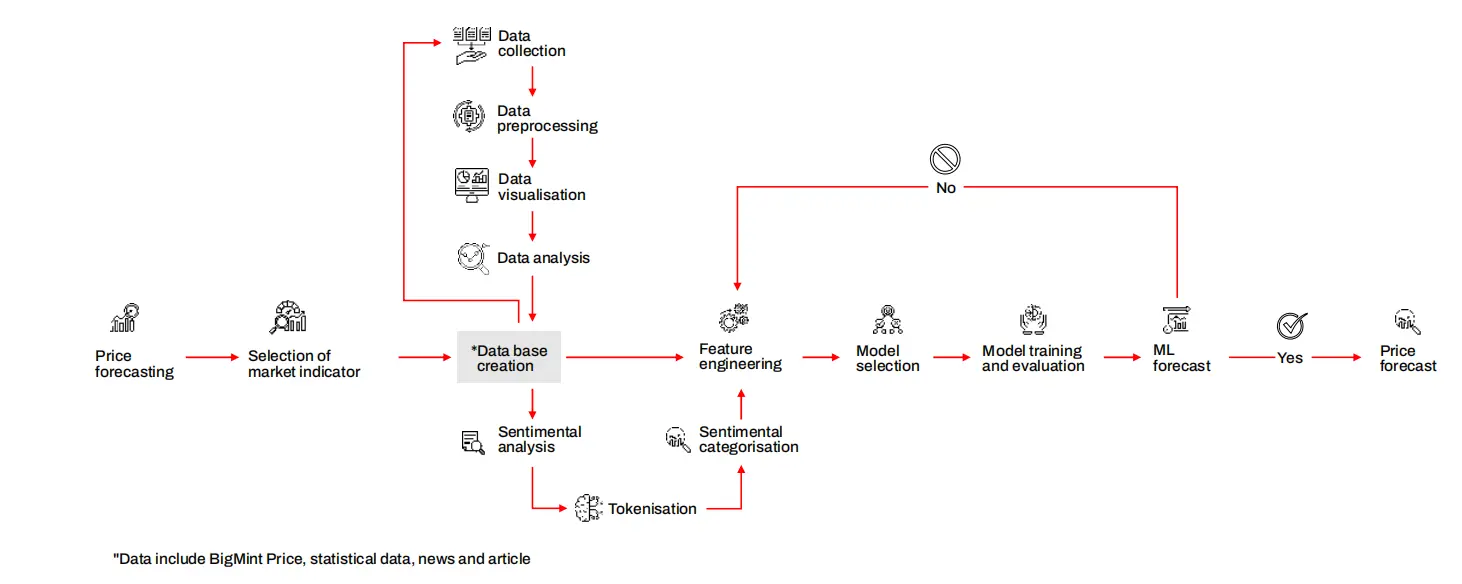

Our price forecasting mechanism uses a hybrid approach for predicting the prices of steel by combining machine learning models and sentiment analysis.

It considers following key factors: cost drivers, upstream-downstream prices, global prices, supply & demand, macro-economic factors, and market sentiment.

Our forecasts deliver ~98% price accuracy, helping you improve the overall operational efficiency of the business.

Our deep historical repository of prices, data and trends gives us a clear view of market behavior, enabling sharper insights and better forecasting inputs.

Our forecasting model has been trained on our 15+ years of back data with a delta ranging from 1-2%, giving you highly reliable price projections, you can plan around.

Each forecast includes a breakdown of key influencing factors making the logic behind price shifts transparent and helping you in the decision-making process.

Multi commodity forecast coverage Get forecast visibility across the full value chain, from raw materials to finished goods. BigMint’s models span multiple product categories, ensuring comprehensive market understanding.

Create personalized dashboards that let you select, compare, and analyze multiple commodities and their historical trends in one streamlined view through our portals.

To align your purchases with market direction across the steel value chain, ensuring cost stability and optimal contract timing.

Adjust finished product pricing confidently based on regional outlooks. Whether it’s billets, rebar, or HRC, pricing becomes proactive, not reactive.

Plan what to produce, where to supply, and when to stock, all based on forecast-backed price trends. Avoid overstocking and missed opportunities.

Offer dynamic, market-aligned pricing to your customers. Structure flexible or fixed-term contracts with confidence in price trajectories.

Integrate forecasted prices into project costing and financial plans. Stay on budget, anticipate cost escalations, and support contract clauses with solid data.

Enter discussions with suppliers and buyers backed by market signals. Use forecast trends to hedge against volatility and secure better deal outcomes.

Stay ahead with BigMint! unlock smart insight, transparent pricing, and global data for better decisions every day.