India: Imported aluminium scrap prices remain mixed w-o-w; domestic prices firm up on tight supply

...

- Exporters keep offers firm, Indian buyers place lower bids

- Secondary producers continue buying to meet OEM contracts

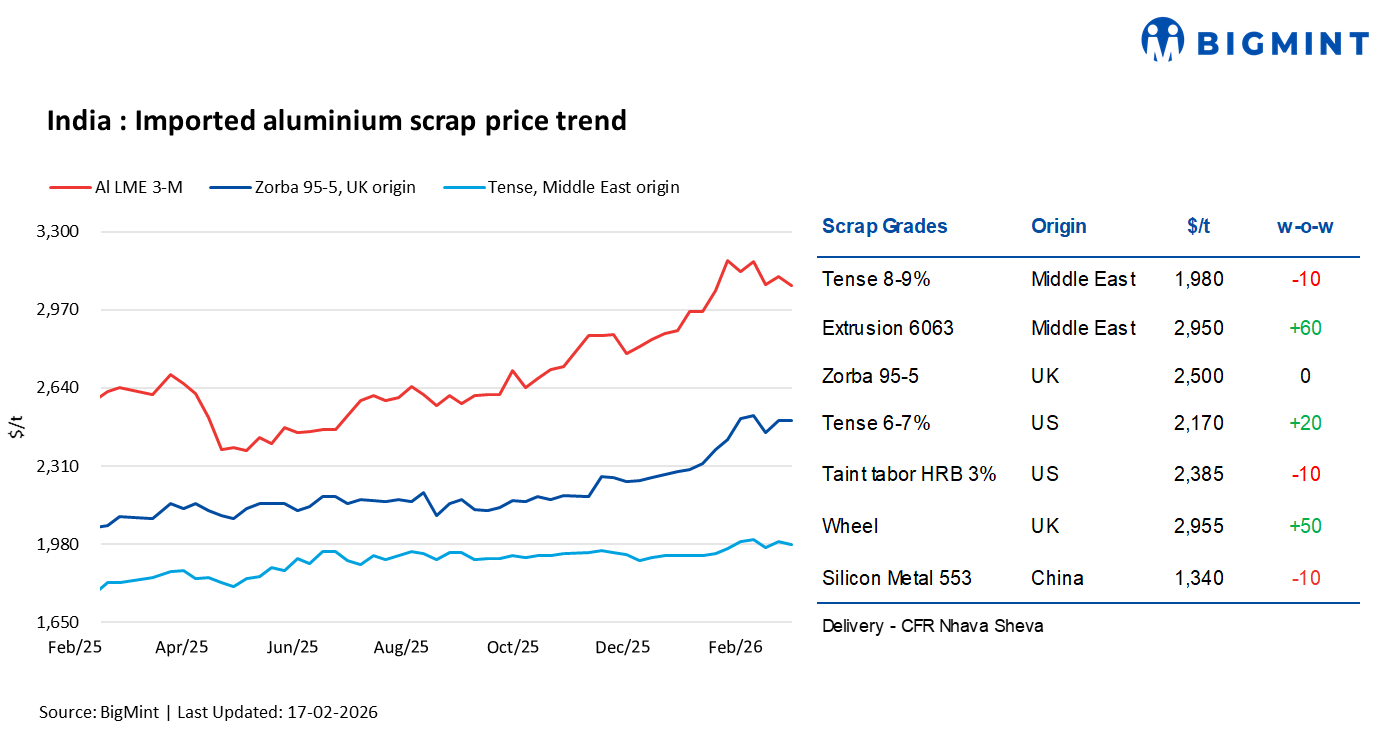

India's imported aluminium scrap prices showed a mixed trend w-o-w on 17 February 2026, despite a decline in London Metal Exchange (LME) aluminium prices. While some grades remained supported due to steady demand, others faced mild corrections. Meanwhile, domestic Tense scrap prices firmed up on tight supply.

As per BigMint's assessment, Middle East-origin Tense (8-9%) declined by $10/tonne (t) w-o-w to $1,980/t, whereas Extrusion 6063 rose sharply by $60/t w-o-w to $2,950/t.

LME aluminium prices ease

LME aluminium three-month prices declined by 1.1% w-o-w to $3,074/t on 16 February 2026 from $3,108/t on 9 February 2026. Meanwhile, LME aluminium inventories recorded an outflow of 1.9% or 9,425 t from 488,975 t to 479,550 t over the same period.

LME aluminium prices declined w-o-w, as heightened market volatility, growing risk-off sentiment, and profit-taking weighed on global commodities. Fading expectations of near-term interest rate cuts by major central banks triggered broad-based selling across metals, while weaker pre-Lunar New Year demand from China and strong US labour data added further pressure. A roughly 1% rise in the US dollar index made dollar-denominated aluminium more expensive for overseas buyers, with macro uncertainty and cautious investor positioning contributing to a notable pullback in both physical and futures markets.

Market insights

Despite the w-o-w decline in LME aluminium prices, imported aluminium scrap markets witnessed a mixed trend. While certain grades corrected slightly, others registered gains.

Even in segments where prices softened, overseas suppliers largely maintained firm offers, whereas Indian buyers continued to place comparatively lower bids, leading to a widening bid-offer spread and subdued deal activity.

At the same time, secondary aluminium producers with long-term supply agreements with OEMs remained active in the market, securing raw materials to fulfil contractual obligations despite elevated scrap prices.

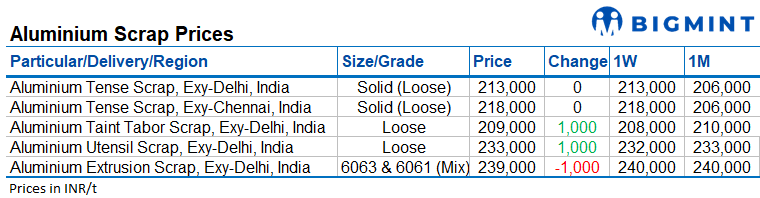

Domestically, scrap prices stayed firm, particularly for Tense scrap, amid tight availability and improving demand for ADC12 alloy. In southern regions, Tense scrap was reported to be trading at premiums, with a southern alloy manufacturer indicating offers in the range of INR 217,000-220,000/t ex-Chennai.

Chinese silicon prices

According to BigMint, China-origin silicon metal 553 prices declined by $10/t w-o-w to $1,340/t on a CFR Nhava Sheva basis, amid steady demand from aluminium alloy producers.

Outlook

Next week, imported aluminium scrap prices are likely to remain at around current levels, with LME weakness and a firm dollar limiting upside, while tight supply and steady demand from secondary producers keep domestic Tense prices supported, particularly in the southern market.