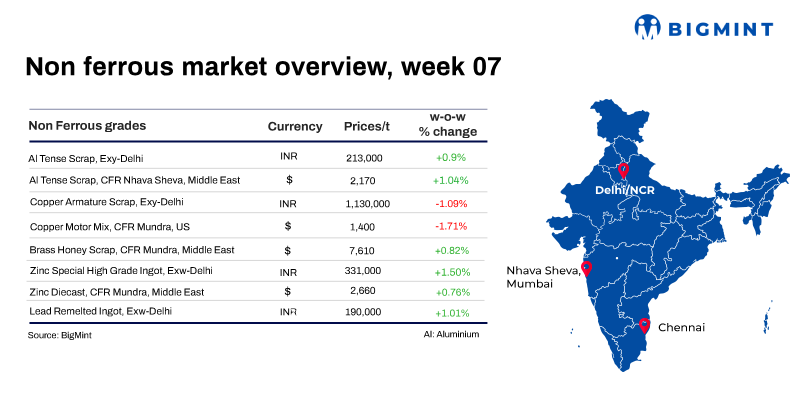

Weekly round-up: Base metal prices decline globally; Indian markets show mixed trend

...

- Aluminium, lead, copper record steepest decline on LME

- Indian aluminium scrap prices rise, copper edges down

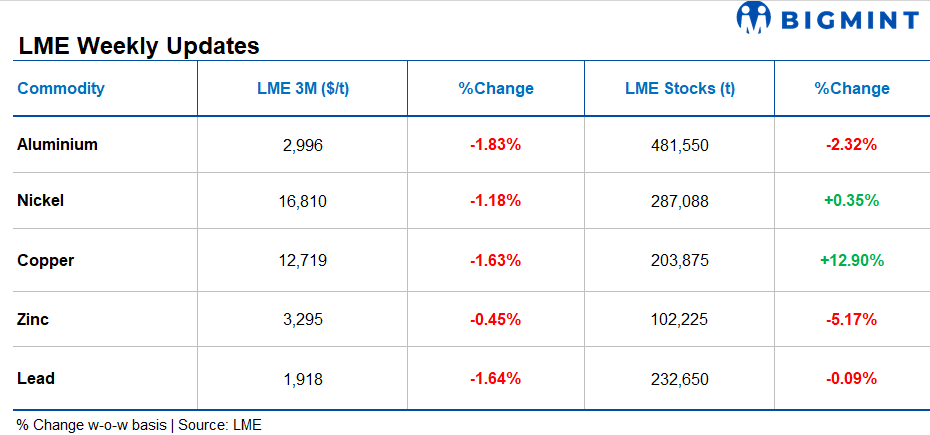

LME base metals traded lower on a w-o-w basis during the week ended 6 February 2026, reflecting cautious market sentiment. Aluminium prices declined by 1.83% to $2,996/tonne (t), nickel fell 1.18% to $16,810/t, while copper dropped 1.63% to $12,719/t. Zinc and lead also registered losses of 0.45% and 1.64%, closing at $3,295/t and $1,918/t, respectively.

On the inventory front, trends remained mixed. Copper stocks recorded a sharp increase of 12.90% to 203,875 t, while nickel inventories edged up 0.35% to 287,088 t. In contrast, aluminium stocks declined 2.32% to 481,550 t, zinc inventories fell 5.17% to 102,225 t, and lead stocks were largely stable, down marginally by 0.09% to 232,650 t.

Aluminium

Imported, domestic scrap: India's imported aluminium scrap prices gained w-o-w, aligning with a rise on the LME earlier in the week. Meanwhile, domestic scrap prices held firm amid tight domestic supply.

BigMint assessed Middle East-origin Tense (8-9%) at $1,990/tonne (t), up $25/t w-o-w, whereas Extrusion 6063 edged up by $25/t to $2,890/t, CFR Nhava Sheva.

Domestic aluminium prices in India edged higher w-o-w on 12 February, tracking gains in aluminium futures on the LME and the Multi Commodity Exchange (MCX), as global supply concerns persisted.

As per BigMint's assessment, domestic aluminium ingot prices in Delhi increased by INR 6,000/t, or 2%, w-o-w to INR 316,000/t. Similarly, Mumbai prices gained by INR 5,000/t, or 2%, w-o-w to INR 317,000/t as of 12 February 2026.

ADC12 ingot: India's aluminium ADC12 alloy ingot prices surged m-o-m in February 2026 across regions amid a rise in raw material prices and sustained firm auto demand.

BigMint'smonthly assessmentfor OEM-grade ADC12 showed slight price hikes across key regions:

Delhi:INR 258,000/t, up by 3.4% m-o-m

Pune:INR 258,000/t, up by 4.5% m-o-m

Chennai:INR 260,000/t, up by 4.2% m-o-m

These prices are based on30-day payment terms.

Copper

Imported, domestic scrap: Imported copper scrap prices in India edged down w-o-w on 11 February, although copper futures on the LME remained largely stable. Domestic copper scrap prices also moved lower.

According toBigMint'sassessment, Middle East-origin Birch Cliff scrap was assessed at $12,240/t CFR Mundra, falling by 1% w-o-w, while armature scrap prices fell 3% w-o-w to INR 114,5000/t ex-Delhi. US motors mix prices also fell w-o-w to around $1,400/t CFR Mundra.

Domestic brass honey scrap prices moved lower w-o-w. BigMint assessed brass honey, exw Jamnagar, Gujarat, at INR 680,000/t on 13 February, down INR 15,000/t from INR 695,000/t a week ago.

Market participants indicated that brass honey scrap prices edged higher during the first week of February, assessed at INR 695-900/kg ex-Jamnagar, as new trades actively took place after the slowdown in January due to the start of the new year. Moreover, record-high LME prices urged market participants to sell material immediately.

Zinc

Primary ingot: India's zinc ingot (99.995%) prices edged up by INR 500/t w-o-w to INR 332,300/t ex-Delhi on 10 February, despite softer import premiums and selective buying interest in the spot market.

On 9 February 2026, Hindustan Zinc Limited (HZL) reduced its zinc ingot prices by INR 6,100/t ($67/t) to INR 334,400/t ($3,696/t) ex-Chanderiya, tracking recent corrections in global benchmarks and improving domestic availability.

Imported, domestic scrap:Indian zinc scrap prices remained mixed in the week ended 12 February, as stronger global prices contrasted with subdued downstream demand in select segments. While imported scrap tracked gains in zinc prices on the London Metal Exchange (LME), domestic by-products recorded a marginal fall in prices amid cautious buying.

BigMint assessed zinc diecast scrap (Middle East origin) at $2,675/t CFR west coast India, up by $35/t w-o-w. Market participants attributed the rise to the sharp increase in global zinc prices, with buyers adjusting bids in line with LME-linked import parity.

Lead

Domestic primary lead ingot prices stood at INR 198,200/t, down by 1% w-o-w, while re-melted ingots stood at INR 188,200/t, down by 1% w-o-w.

Meanwhile, HZL's lead ingot prices increased by INR 1,000/t ($11/t) to INR 207,900/t ($2,294/t) compared to the previous revision on 9 February.