Weekly round-up: Indian ferro alloys prices reflect mixed sentiments w-o-w on global cues

...

- Ferro silicon prices remain largely stable on supply tightness

- Ferro molybdenum prices hit 3-years high

Ferro chrome prices shows limited movements on cautious procurement

Domestic high-carbon ferro chrome (60%, Si: 4%) prices edged down by INR 200/t ($2/t) w-o-w to INR 123,800/t ($1,365/t) exw-Jajpur. Sellers continued to maintain firm offer levels amid tight spot availability. However, buying activity remained cautious, with stainless steel mills largely procuring on a need basis.

Imported manganese ore prices remain steady w-o-w

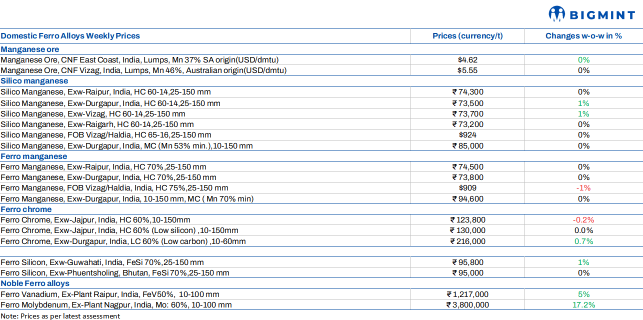

Imported manganese ore prices were largely stable w-o-w. Mn44% Gabon prices increased to $5.19/dmtu, up by $0.01/dmtu, Mn46% Australia to $5.55/dmtu, up by $0.01/dmtu. However, Mn37% South Africa stayed unaltered to $4.62/dmtu w-o-w.

Silico manganese prices edge up w-o-w

Indian silico manganese (60-14) prices inched up by INR 375/t ($4/t) w-o-w to INR 73,200- 74,300/t ($807-819/t) across Durgapur, Raipur, Vizag and Raigarh. Prices maintained stability as acceptance of higher-priced material was limited, as most domestic buyers maintained adequate inventories and adopted a strategic procurement approach, keeping prices relatively steady.

Meanwhile, HC 65-16 silico manganese prices also inched up by $3/t to $924/t FOB Vizag/Haldia.

Ferro manganese prices stays mostly stable w-o-w

Indian ferro manganese (70%) prices remained unchanged w-o-w at INR 73,800/t ($814/t) in Durgapur and went slightly up by INR 300/t ($3/t) to INR 74,500/t ($821/t) in Raipur.Prices remained stable amid need-based procurement and cautious buying sentiment.

However,export prices for 75 grade decreased by $9/t w-o-w to $909/t FOB Vizag/Haldia.

Ferro silicon prices remain largely stable w-o-w

Indian ferro silicon (Si 70%) prices remained largely stable with slight rise by INR 800/t ($9/t) w-o-w at INR 95,800/t ($1,056/t) exw-Guwahati. However, Bhutan prices reamined unaltered at INR 95,000/t ($1,047/t) exw.Primarily due to fewer offerings in the market. While some market participants have also pointed to the shutting of plants in Meghalaya due to pollution control violations affecting prices, no official confirmation has been released on the closures as of writing this report.

Noble alloys prices reflect mixed market movements

Indian ferro molybdenum prices surged by INR 600,000/t ($6,613/t) w-o-w to INR 3,800,000/t ($41,883/t) exw,due to spike in molybdenum oxide prices, particularly in the US, where production outage at one key plant tightened supply, pushed prices higher and lifted import costs. Following this, Indian producers revised prices upward, although buyers maintain a cautious approach.

Indian ferro vanadium (FeV 50%) prices rose INR 60,000/t w-o-w to INR 1,217,000/t ex-Raipur on 11 Feb 2026, driven by spot shortages, limited imports, delayed clearances, and steady alloy steel demand; V2O5 also gained.

Indian ferro titanium prices (Ti 70%, 10-50 mm) held firm w-o-w at INR 305,000/t ($3,365/t) ex-works as of 12 February 2026. The market remained largely stable, underpinned by elevated raw material costs and adequate supply levels, while demand from downstream sectors stayed steady. Overall, market sentiment showed no notable shifts during the week.

IEX spot prices rise w-o-w

Electricity prices on IEX averaged INR 3.38/unit during 7-14 February 2026, up from INR 3.18/unit in the previous week.

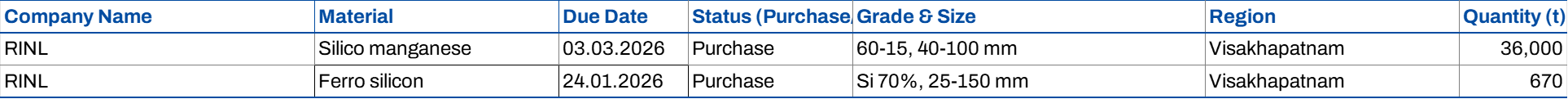

Auction Notice

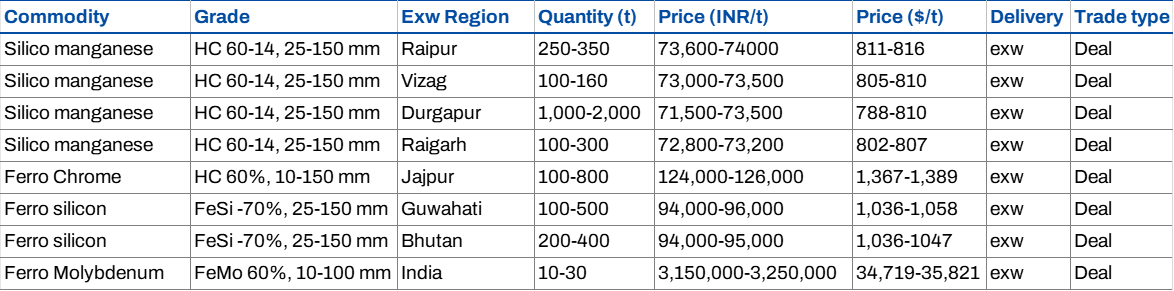

Trade