LME base metals prices show mixed trends d-o-d; BHP shares near record high on strong earnings

...

- MCX zinc prices fall slightly on Chinese holiday lull

- Dollar stays firm ahead of key economic data release

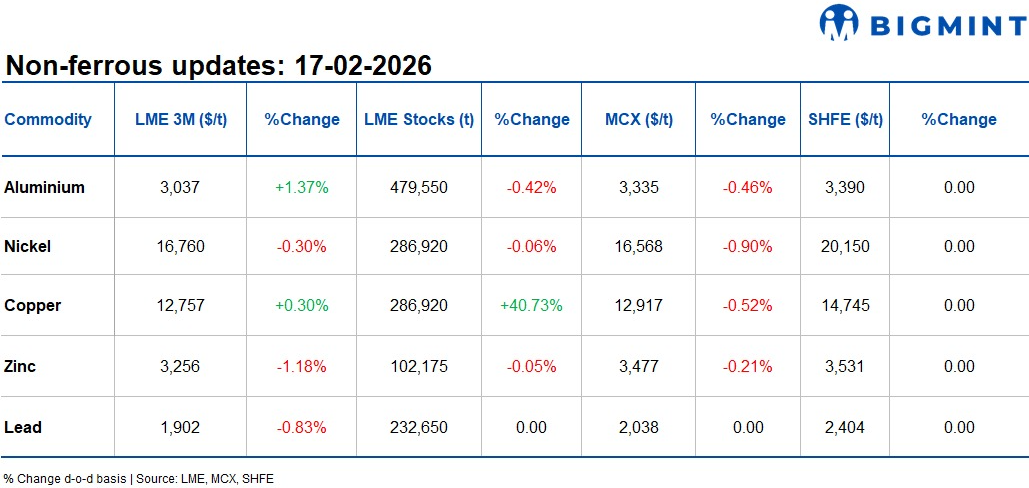

Base metals on the London Metal Exchange traded mixed d-o-d. Aluminium rose 1.37% to $3,037/tonne (t), while copper edged up 0.30% to $12,757/t. In contrast, nickel slipped 0.30% to $16,760/t, zinc fell 1.18% to $3,256/t, and lead declined 0.83% to $1,902/t.

Warehouse inventory movements were also varied. Aluminium stocks eased 0.42% to 479,550 t, and zinc inventories dipped 0.05% to 102,175 tonnes. Nickel stocks edged 0.06% lower to 286,920 tonnes, while copper inventories surged 40.73% to 286,920 tonnes. Lead stocks were unchanged at 232,650 tonnes.

Domestic market overview

Domestic non-ferrous scrap prices in India were mostly unchanged across key markets. Aluminium Tense Scrap (Loose), ex-Delhi, held steady at INR 213,000/t, while Aluminium Tense Scrap (Loose), ex-Chennai, was also unchanged at INR 218,000/t, indicating stable trade activity.

Meanwhile, Copper Armature Scrap (Cu 99%), ex-Delhi, declined by INR 3,000 or 0.3% to INR 1,127,000/t from INR 1,130,000/t, reflecting mild selling pressure in the copper scrap segment.

Other market updates

BHP share price nears record high after strong half-year results

BHP Group Ltd delivered a strong performance for the half-year ending in December 2025, reporting a 25% rise in underlying EBITDA, a 58% margin, and $6.2 billion in attributable profit. Notably, for the first time ever, copper surpassed iron ore in the miner's earnings, as prices of the former surged following concerns over tight supply amid robust demand. Record output from its Western Australia Iron Ore division and increased copper production guidance -- up by 150,000 t over the next two years -- highlighted solid operational momentum. Supported by firm commodity prices and disciplined cost control, the miner declared a $3.7 billion interim dividend and maintained a strong balance sheet. Shares have climbed about 13% year-to-date in 2026, moving closer to previous record highs as investor confidence remains underpinned by copper-led growth and resilient global infrastructure demand.

MCX zinc prices fall in broad sell-off amid Lunar New Year

Zinc prices on India's Multi-Commodity Exchange (MCX) slipped about 0.76% d-o-d to INR 321.15/kg as markets experienced a broad metals sell-off with many Chinese traders stepping back ahead of the Lunar New Year holiday. Sentiment was also dampened by rising inventories on the Shanghai Futures Exchange (SHFE). Stocks on the SHFE jumped more than 23% w-o-w, as demand softened after pre-holiday restocking was completed.

However, losses on the MCX were somewhat limited by ongoing supply concerns from smelter curbs in Kazakhstan and Japan and temporary mine closures in China, even as restarts at mines such as Bolidens Tara mine and expansion at Ivanhoe Mines' Kipushi project point to improving output. Overall, the market remains technically under pressure with inventories building and demand subdued during the seasonal lull.

Dollar holds gains as markets await Fed minutes, US GDP data

The US dollar held onto recent gains in thin trading on Tuesday, as many markets were quiet due to the Lunar New Year and President's Day holidays. Investors focused on upcoming key economic events -- namely the Federal Reserves meeting minutes and early US GDP figures later this week. The dollar index sat around 97.1, while the euro and pound weakened slightly, and the yen recoveredmodestly after weak Japanese data lifted hopes of more stimulus. Market pricing currently points to a likely Fed rate cut in June, with some strategists also expecting another cut in July, reflecting ongoing bets on easing later this year.