LME nickel prices remain range-bound w-o-w amid Indonesian production cuts

...

- Prices steady w-o-w despite production curbs

- Indonesia plans sharp RKAB reduction for 2026

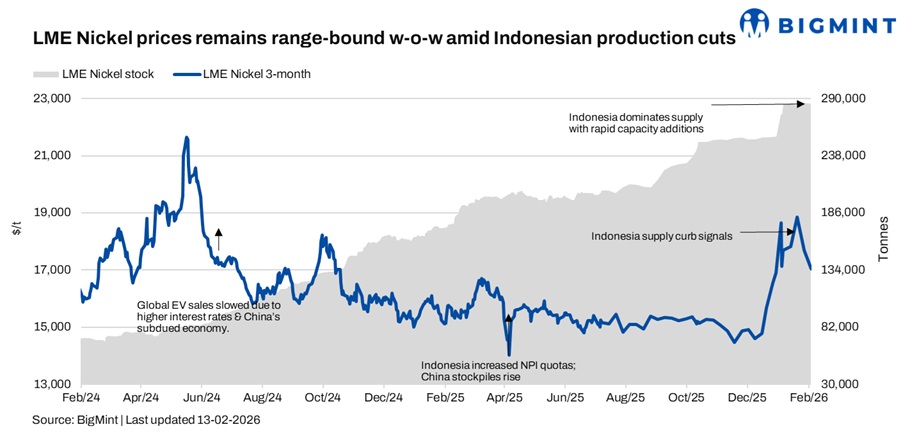

LME nickel prices averaged $17,010/t in the week ending 13 February, remained range-bound from last week's 17,050/t, after recent announcement of Indonesian production cuts. Overall, LME-monitored nickel inventories edged lower to 287,088 t, largely range-bound from 285,282 t a week earlier.

Indonesia to reduce nickel mining quota in 2026

Indonesias Ministry of Energy and Mineral Resources (ESDM) plans to cut the 2026 nickel RKAB quota to 260270 million tonnes (mnt), below the 2025 approved 379 million tonnes and under projected 2026 ore consumption of 330 mnt. While imports may partly bridge the gap, supply tightness could pressure smelters. The move aims to support rising nickel prices, with London Metal Exchange nickel recently touching $18,950/t. Markets await further policy clarity and possible quota revisions later in the year.

Indonesia slashes output at Weda Bay nickel

Indonesia has sharply reduced PT Weda Bay Nickels 2026 ore quota to 12 mnt from 42 mnt in 2025, as part of broader efforts to lift global nickel prices. The Halmahera-based mine, partly owned by Tsingshan Holding Group and Eramet, may seek revisions. The move follows Indonesias plan to cut national output to 260 million tonnes, tightening supply after years of oversupply pressured global markets.

Nickel market clouded by Indonesia delays and Philippine rains

The nickel ore market entered 2026 amid uncertainty as Indonesias delayed RKAB approvals and potential quota cuts raised fears of second-quarter supply tightness. Simultaneously, heavy rains in the Philippines disrupted shipments, tightening near-term availability. While demand from HPAL projects and the new energy sector remains steady, stainless steel producers and NPI makers face margin pressure from elevated raw-material costs. Market direction now depends on Indonesias policy progress and post-April supply recovery.

Outlook

Nickel prices are expected to remain range-bound in the near term, with volatility linked to Indonesias final RKAB approvals and post-monsoon ore flows from the Philippines. A sustained supply deficit could lend upward support, but high inventories may cap sharp gains.