Weekly Round-Up: Iron ore, pellets firm, semi-finished mixed as coal tightens, demand cautious

...

- Upstream bullish: Iron ore auctions, pellets, coal and scrap stayed firm on tight supply and cost-side support.

- Downstream cautious: Semi-finished and finished steel showed mixed trends amid uneven demand and wait-and-watch buying.

India steel raw materials mixed-to-firm as iron ore auctions, pellet exports, coal tightness support prices amid cautious demand downstream markets

Iron ore and pellet

- In the NMDC Chhattisgarh auction held on 12 February 2026, 43,000 t of DRCLO (1040 mm, Fe 67%) from Bacheli was booked at a 17% premium over the base price of INR 5,290/t, while 35,200 t of ROM (10150 mm, Fe 65.5%) was sold at INR 4,640/t; however, 78,100 t of fines (-10 mm, Fe 60%) remained unsold. Meanwhile, 40,100 t of fines (Fe 64%) from Kirandul was booked at a 0.5% premium over the base price of INR 4,030/t.

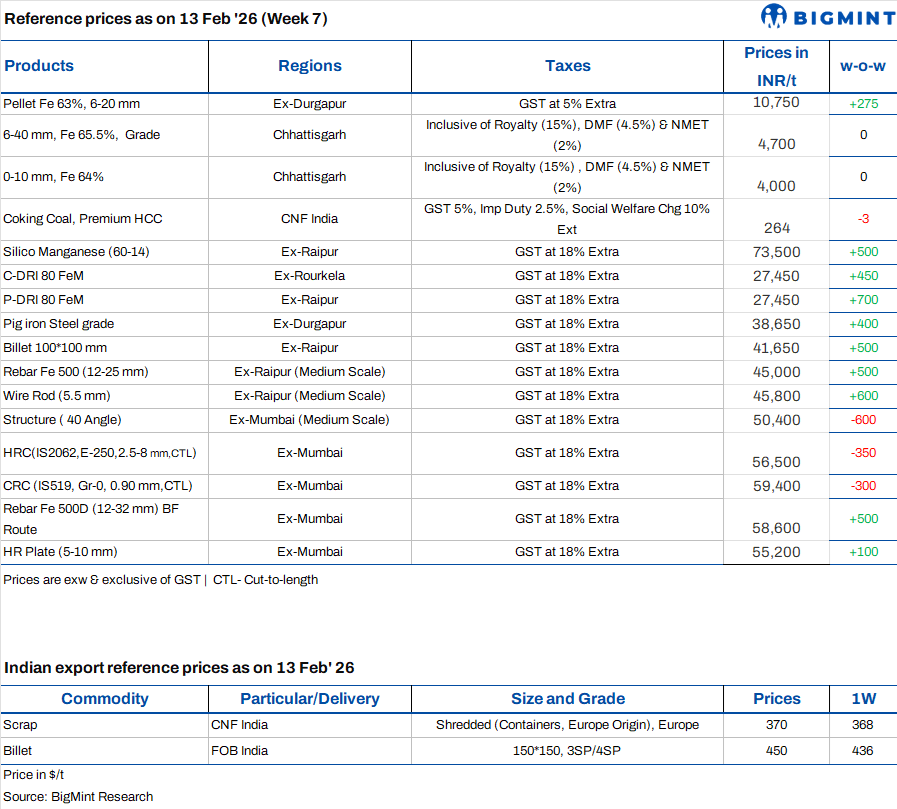

- PELLEX, BigMints bi-weekly domestic pellet (Fe 63%) index for Raipur stood at INR 10,550/t ($117/t) DAP on 13 February, up INR 300/t w-o-w. Around 85,000 t of pellet deals were concluded by Raipur-based pellet producers this week. Prices remained firm, supported by stable sponge iron and billet rates, while pellet offers were largely maintained despite minor fluctuations in downstream steel sentiment.

- An Indian pellet producer recently concluded export deals for around 50,000 t of pellets (Fe 63%, 8% AlO and SiO) through a tender at $107108/t FOB India. In a separate transaction, another supplier sold 75,000 t of pellets (Fe 62%, 33.5% AlO) in the seaborne market at $108109/t CFR China. The cargoes, scheduled for shipment after the Chinese holiday, attracted healthy buying interest, keeping export trading activity firm

Coal

- South African thermal coal prices at Indian ports increased w-o-w due to tight availability. Exw-Paradip 5,500 NAR rose by INR 300/t to INR 10,000/t and 4,800 NAR by INR 400/t to INR 8,600/t. At Vizag, 5,500 NAR gained INR 400/t to INR 9,900/t and 4,800 NAR rose INR 500/t to INR 8,500/t, close to Jul24 levels. Export offers moved above $90/t FOB, with freight near $14.40/t. Deals included 13,500 t at INR 9,550/t and several 10,000 t parcels at INR 10,20010,600/t. Port stocks rose 3% to 13.35 mnt, while sponge iron P-DRI DAP Durgapur fell INR 900/t to INR 25,500/t, though overall sentiment remained firm.

- Domestic non-coking coal prices increased w-o-w after nearly two months of stability. As per BigMints assessment, 4,500 GCV rose by INR 50/t to INR 4,850/t and 5,000 GCV increased by INR 100/t to INR 5,850/t exw Bilaspur, without tax. Stronger bidding at the 12 February SECL auction indicated better buying interest, as consumers preferred domestic coal over higher-priced imported material and firm portside offers.

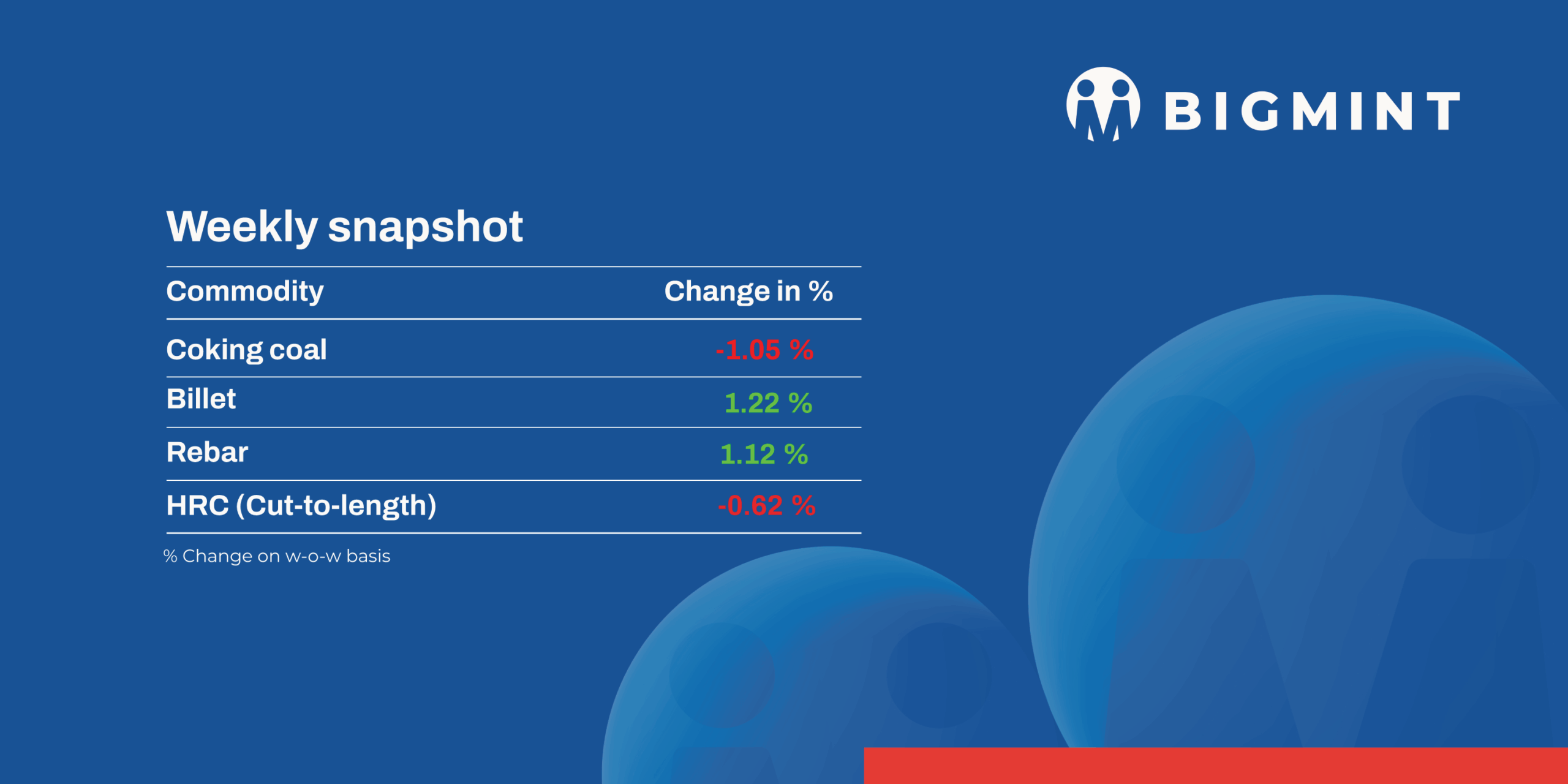

- BigMints premium hard coking coal index was assessed at $249/t CNF Paradip on 13 February 2026, down $5/t from the previous assessment on 06 February, reflecting softer Australian FOB offers and muted Chinese demand. Australian PHCC FOB prices corrected $5 w-o-w as supply normalised after Cyclone Koji disruptions. Australias exports declined 19% m-o-m to 11.21 mnt in January.

- Indian BF-grade metallurgical coke prices moved higher w-o-w, supported by firm coal costs and stronger import parity. In eastern India, prices rose by INR 500/t to INR 34,800/t ex-Jajpur, with offers at INR 35,50036,000/t. Western India increased by INR 100/t to INR 30,400/t ex-Gandhidham. Indonesian BF coke was heard at $270275/t CFR India. Foundry-grade coke stayed at INR 36,100/t ex-Rajkot. SAIL-Bhilai sold 2,990 t pig iron at INR 37,400/t, up INR 550/t, while steel demand remained cautious.

Ferrous scrap

- India: Imported scrap market strengthened this week, with prices edging higher amid tightening overseas supply and firm offers from key origins. Containerised HMS 80:20 trades were reported at $339-350/t CFR across Nhava Sheva, Chennai and Mundra, with workable levels trending upward.

- UK-origin shredded increased to $370-375/t CFR, with bids trailing offers by around $5-10/t. Middle East-origin shredded firmed further to $378-380/t CFR amid tighter domestic availability, while PNS (blue steel and super grades) was quoted at $380-385/t CFR Mundra. A Middle East-origin HMS 80:20 cargo was booked at $370/t CFR, and Brazilian LMS was concluded at $330/t CFR.

- In the past seven days, India imported around 5,000 of ferrous scrap, including 1,000-1,500 t of HMS 80:20 from the Middle East at $370/t CFR Mundra and 1,500 t of HMS 60:40 from Costa Rica, along with LMS, GI bundles and car bales from Brazil, the EU, Australia and New Zealand.

Ferro alloys

- Silico Manganese:Indian silico manganese (60-14) prices inched up by INR 375/t ($4/t) w-o-w to INR 73,200- 74,300/t ($807-819/t) across Durgapur, Raipur, Vizag and Raigarh. Prices maintained stability as acceptance of higher-priced material was limited, as most domestic buyers maintained adequate inventories and adopted a strategic procurement approach, keeping prices relatively stable.

- Ferro Manganese:Indian ferro manganese (70%) prices edged up by INR 300/t ($3/t) w-o-w to INR 74,500/t ($823/t) in Raipur, while remaining steady at INR 73,800/t ($815/t) in Durgapur. The market remained stable, supported by need-based procurement and cautious buying sentiment.

- Ferro Silicon:Indian ferro silicon (Si 70%) prices inched up by INR800/t ($9/t) w-o-w to INR95,800/t ($1,058/t) exw Guwahati, driven by limited market offerings and reports of temporary plant shutdowns in Meghalaya over pollution violations, though no official confirmation of the closures has been released. Prices in Bhutan remained steady at INR95,000/t ($1,049/t) exw

- Ferro Chrome:Indian high carbon ferro chrome (HC 60%, Si4%) prices edged down by INR200/t ($2/t) to INR123,800/t ($1,367/t) exw- Jajpur. Sellers maintained firm offers amid tight spot availability, while buying activity stayed cautious, with stainless steel mills largely procuring on a need basis.

Semi Finished

- India's semi-finished steel market witnessed a mixed trend this week, with regional price divergence reflecting uneven downstream demand across the country. As per BigMint's assessment, domestic billet prices across key regions increased by INR 100-500/t ($1-5/t) week-on-week, supported by higher raw material costs. However, cautious buyer sentiment and limited finished steel offtake kept transactions largely need-based. In contrast, Punjab and Gujarat markets recorded declines of INR 200-300/t ($2-3/t) w-o-w, as weaker regional demand and competitive offers exerted pressure on prices. Market participants noted that despite cost-side support, limited procurement activity capped the upside in most regions.

- Sponge iron (DRI) segment mirrored variation this week, prices across key producing regions increased by INR 100-700/t ($1-8/t) w-o-w, influence by sharp rise in raw material costs. Sellers revised offers upward amid tighter availability and modest booking interest. However, Durgapur diverged from the broader uptrend, with prices declining by INR 600-700/t ($6-8/t) w-o-w, weighed down by subdued regional demand and slower offtake.

- SAILs Rourkela Steel Plant (RSP) auctioned 1,700 t of steel-grade pig iron on 13 Feb26, with the entire quantity sold at an average INR 39,100/t exw. Prices increased by INR 1,950/t from the 28 Jan26 auction, where 1,000 t were booked at INR 37,150/t exw, indicating firmer pricing sentiment and improved buyer participation.

- SAIL-BSP conducted an auction for 2,990 t of steel-grade pig iron on 9 Feb'26, with the entire quantity booked at an average price of INR 37,400/t exw. The price marks an increase of INR 550/t compared to the previous auction held on 23 Jan'26, where 4,940 t were fully booked at an average of INR 36,850/t exw.

- NMDC's Nagarnar Steel Plant auctioned 12,000 t of steel-grade pig iron on 13 Feb'26, with the entire volume booked at a base price of INR 36,500/t exw. Bids were unchanged from the 6 Feb auction, when 10,000 t was sold at the same price.

- Indian DRI export sentiments remained mixed. Offers to Nepal increased by $6/t to $340/t CPT Raxaul, while Bangladesh-bound prices fell by $3/t to $345/t CPT Benapole. Enquiries from Bangladesh were limited, as sufficient bookings had been concluded earlier at favourable levels, while election-related uncertainty further dampened fresh buying interest.

Finished Long Steel

- IF-rebar: IF-Indias Induction Furnace (IF) route rebar prices saw mix-trend w-o-w basis. Buying activity was limited at increased price levels, and fresh order bookings were lacking as buyers preferred need-based procurement and adopted a wait-and-watch approach. Manufacturers preferred either to lower their offers or to increase trade discounts, depending on their historical booking orders. Mill inventories are currently assessed at around 8-12 days across regions. As per current scenario, prices are likely to remain range-bound in the near term.

- On a weekly basis, Rebar prices increased by INR 100-1,200/t w-o-w across regions except in Jaipur and Muzaffarnagar where prices were fell by INR 300/t and INR 200/t respectively, as per BigMint's assessment.

Trade reference prices of Fe 500 grade rebars manufactured via the IF route (10-25 mm size) were assessed at INR 44,800-45,200/t exw Raipur, INR 49,000-49,600/t exw Jalna.

- Trade reference prices of heavy structural steel for the base size 150 mm channel stood at INR 46,200-46,600/t exw-Raipur.

Trade reference prices of wire rod stood at INR 45,600-46,200/t ex-Raipur.

- BF-rebar-Indian primary steelmakers increased rebar prices by up to INR 1,000/tonne (t) ($11/t) this week, sources informed BigMint. Post-revision, list prices stood at INR 58,000-59,500/t ($640-656/t) on landed basis.

- Trade-level BF-rebar prices (distributor to dealer) rose by INR 400/t ($4/t) w-o-w to INR 58,600/t ($646/t) exy-Mumbai as per BigMints assessment on 13 February 2026. Market participants noted that buyers are reluctant to place fresh orders at elevated price levels following the recent sharp price increase, leading to cautious procurement behaviour.

- In the projects segment, prices hovered at around INR 59,000-60,000/t ($651-662/t) FOR basis. Demand from projects segment remained steady with the dispatches of previously booked

Flat Steel

- Trade-level prices of hot-rolled coils (HRC) in India showed mixed-trends w-o-w on 10 February amid slow trading activity, with HRC prices assessed in the range of INR 52,000-54,700/t ($574-604/t). Reflecting this trend, cold-rolled coil (CRC) prices also showed a mixed trends, with prices assessed at INR 56,500-61,400/t ($624-678/t).

- India's trade-level HRC market showed mixed trends recently, aligning with reports of regional variations and supply constraints. A slight price uptick in the northern region was observed amid shortages, while in other regions prices remained stable.

- India's bulk imports of HRCs touched 70,702 t as of 9 February, based on vessel line-up data. Around 1,03,847 t of additional cargoes are expected by mid-February.

- India's bulk exports of HRCs touched 30,250 t as of 9 February.

- BigMint's India HRC (S275) export index for the European Union (EU) rose by $25/t w-o-w to $575/t FOB main port on 10 February, up from $550/t a week earlier, driven by higher domestic EU prices. Meanwhile, in the Middle East, Chinese offers remained competitive, while no firm offers from India were heard due to higher domestic realisations.