Indonesian RKAB approval delays constrain export flows, elevating portside thermal coal prices in India

...

- Global benchmarks rise w-o-w

- Coal stocks at power plants largely stable w-o-w

Indian portside prices of Indonesian-origin thermal coal increased on a week-on-week (w-o-w) basis during the week ended 20 February 2026. The uptrend was primarily driven by supply-side tightness in Indonesia amid continued regulatory uncertainty surrounding Indonesias Rencana Kerja & Anggaran Biaya (RKAB), or Mining Work Plan and Budget,coupled with steady procurement demand from Indian consumers.

Limited fresh offers from Indonesian miners and constrained availability of mid- to high-GAR material at Indian ports further amplified the price momentum.

Portside price movement: Mid- to High-GAR segments lead gains

Portside thermal coal prices across key Indian ports continued their upward momentum during the week, reflecting tightening spot availability and sustained buying interest. According to BigMint's latest assessment, 5,000 GAR coal prices advanced by INR 600/t week-on-week to INR 8,300/t at Kandla and INR 8,200/t at Vizag.

Similarly, 4,200 GAR coal prices recorded a firm increase of INR 450/t w-o-w, reaching INR 6,450/t at Kandla and INR 6,350/t at Vizag. Lower-grade 3,400 GAR coal also witnessed a notable uptick, rising by INR 250/t w-o-w to INR 4,850/t at Navlakhi.

The sharper increase in mid- and high-GAR segments reflects tighter stock availability and relatively stronger demand preference for higher calorific value coal, particularly from blending-dependent consumers. Market participants indicated that limited inventory replenishment and absence of fresh cargo offers from Indonesian suppliers have restricted spot liquidity, thereby exerting upward pressure on prices.

Supply disruptions in Indonesia: Regulatory uncertainty weighs on exports

The continued uncertainty surrounding RKAB approvals in Indonesia has resulted in cautious production and restrained export activity among miners. The lack of clarity on mining work plan approvals has curtailed near-term shipment visibility, reducing cargo flows to key import destinations such as India. This supply discipline, combined with steady offtake from Asian buyers, has tightened availability of prompt cargoes and supported portside prices in India.

Power plant stock position: Comfortable overall, yet pockets of stress persist

Coal inventory at Indian thermal power plants increased w-o-w to 58.8 million tonnes (mnt) as of 19 February 2026, equivalent to approximately 19 days of consumption. While the overall stock position appears stable, supply imbalances persist at the plant level. Around 23 power plants continue to operate under critical stock levels, including 13 domestic coal-based plants, six imported coal-based plants, and four washery reject-based units.

This uneven stock distribution is likely to sustain near-term procurement activity, particularly among plants facing fuel stress. Consequently, portside demand for imported coal may remain supported despite adequate aggregate national inventories.

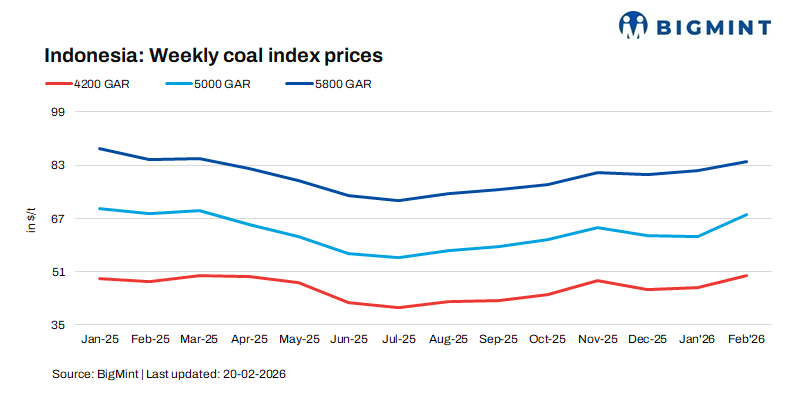

Indonesian benchmark trends: Gradual upward correction

Indonesian weekly benchmark prices also recorded modest w-o-w gains. During the period, 5,800 GAR coal prices increased by $1.05/t, 4,200 GAR by $0.54/t, and 3,400 GAR by $0.23/t. The relatively stronger gains in mid-grade benchmarks align with tightening supply dynamics and firmer buying interest from price-sensitive markets such as India. The benchmark movement further reinforces the supportive cost push observed at Indian ports.

Outlook: Firm bias likely to persist in the near term

Indian portside thermal coal prices are likely to remain firm with a mild upward bias, supported by Indonesian supply uncertainty and selective restocking by power producers. However, improved domestic supply or clarity on Indonesian exports may cap gains. Overall, prices are expected to stay range-bound with a positive bias, particularly for mid- to high-GAR grades.