India: PELLEX remains stable, buyers expect price correction in near term

...

- Sponge iron, billet prices fall INR 500-1,100/t w-o-w

- Sellers keep offers stable despite sluggish inquiries

Pellet prices in the Raipur region remained stable over the past couple of days, even as buyers placed lower bids amid weakening market sentiment. The downtrend in downstream product prices, particularly sponge iron and billets, significantly impacted pellet demand and pricing dynamics in the region. However, sellers kept offers firm, resisting the downward pressure, which contributed to stable prices.

Trades and price movements

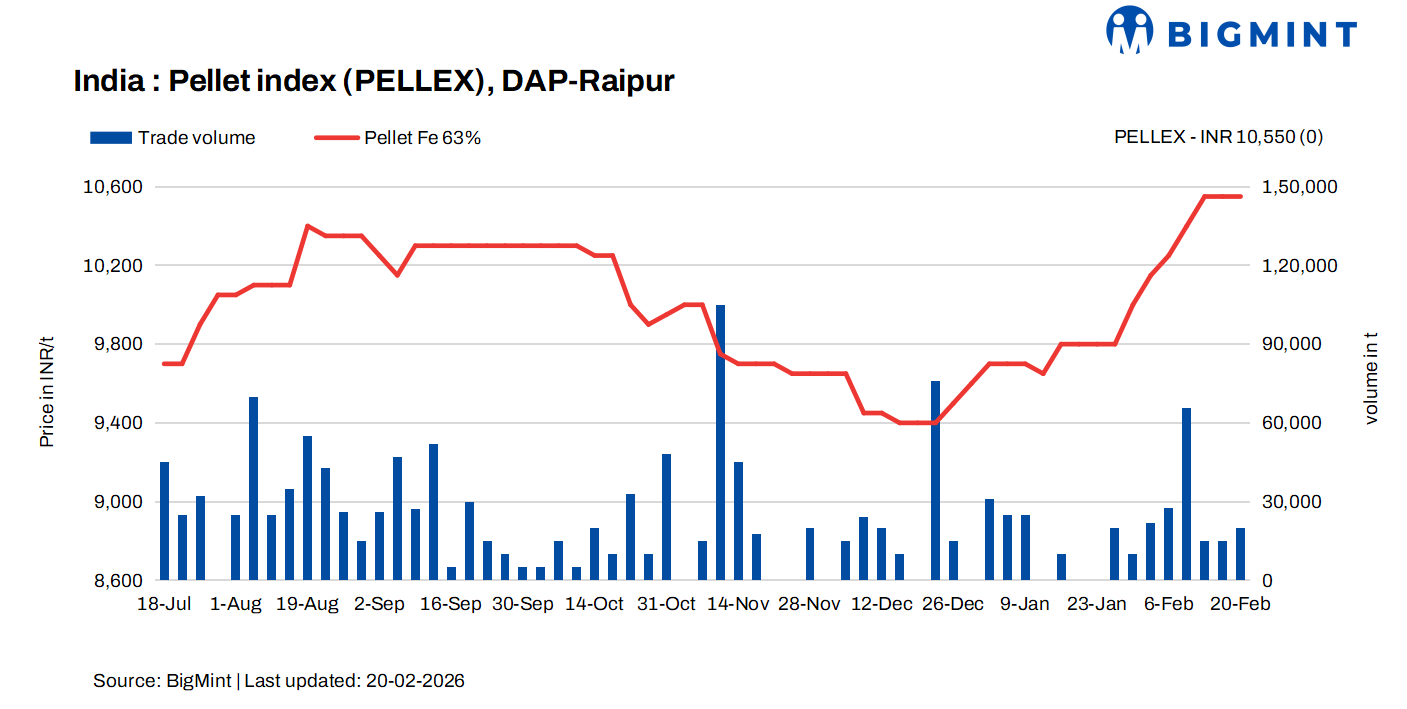

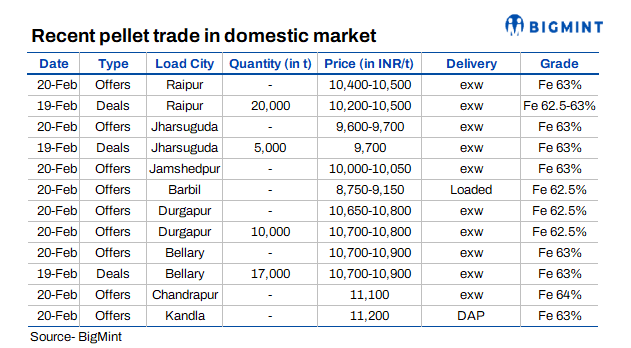

PELLEX, BigMint's bi-weekly domestic pellet (Fe 63%) index for Raipur, remained unchanged at INR 10,550/tonne (t) ($117/t) DAP on 17 February compared to the previous assessment on 13 February. Around 20,000 t of pellet (Fe 62.5-63%) were traded in the market at INR 10,200-10,500/t ($116/t) exw-Raipur.

Raipur-based pellet producers kept offers stable for Fe 62.5-63% (+/-0.5) grade pellets at INR 10,400-10,500/t ($115-116/t) exw. Recent decreases in sponge iron and billet prices made buyers cautious, further impacting the trading volume of pellets in Raipur.

Market dynamics

Market participants noted that a few trades were concluded at reduced prices this week. A steelmaker stated, "Sponge iron and billet prices dropped sharply, which has directly affected pellet procurement sentiment." The correction in finished steel and semi-finished steel prices led to cautious buying, with steelmakers focusing on cost optimization.

Buyers indicated that procurement is currently being done strictly on a need basis. A sponge iron producer informed BigMint, "We are taking pellets only for immediate requirements and that too at discounted prices. Current offers are not viable considering the correction in sponge iron and billet." Several steelmakers have reportedly booked only minimal pellet quantities while shifting preference towards iron ore lumps due to better price viability.

Sources further highlighted that competitive offers for sponge iron from neighbouring regions added pressure to the Raipur market. A buyer said, "Some steel plants from nearby regions are selling sponge iron in Raipur at competitive rates, which is putting additional pressure on local pellet prices. As a result, raw pellet prices are facing resistance at prevailing levels."

Additionally, bids in the recent OMC fines auction declined, while lumps were available at comparatively cheaper rates than pellets. "With OMC fines bids softening and lumps becoming more economical, pellet plants may have to revise their offers," another participant commented.

Due to a decline in inquiries and rising selling pressure, several pellet producers are considering price reductions in the near future.

Another source added, "Pellet prices in Raipur are expected to remain volatile, with new offers anticipated to be announced soon, influenced by changes in the downstream market and trends in raw materials."

Rationale

- PELLEX has been derived using data points, i.e., trades, offers, and bids. To download the detailed methodology, click here.

- Two (2) deals were recorded in this publishing window, and were taken for calculation. Thus, the T1 trade category was accorded 50% weightage.

- Thirteen (13) firm offers, bids, and indicative prices were heard. Twelve (12) were taken for price calculation and given balance 50% weightage.

Key market drivers

- Sponge iron prices fall w-o-w: Sponge iron prices declined by INR 600/t ($5.5/t) w-o-w on 17 February to INR 26,950/t ($296/t) exw-Raipur. Prices in Raipur inched down by INR 150/t d-o-d. Muted downstream offtake weighed heavily on trading sentiment, resulting in thin volumes and limited spot transactions. Buyers largely refrained from aggressive bookings, restricting purchases to immediate requirements amid expectations of further price corrections. The absence of bulk deals underscored the prevailing cautious mood across the market.

- Billet prices decline w-o-w: BigMint's billet index decreased by INR 1,100/t ($12/t) w-o-w to INR 40,550/t ($446/t) exw-Raipur. Meanwhile, prices rose by INR 50/t d-o-d today. Market sentiment remained bearish throughout the session. Despite consecutive price corrections, buying interest stayed subdued, with most participants limiting procurement to immediate requirements. Lower spot offers failed to attract significant volumes, reflecting fragile downstream demand and cautious inventory management by re-rollers and traders.

Outlook

Pellet prices in Raipur may decline, as sellers reduce offers due to a drop in steel prices and lower bids from buyers.