India: Power generation grows modestly y-o-y in early Feb'26, but fuel mix shifts markedly

...

- Power generation from renewables, nuclear sources surges y-o-y

- Demand crosses 240 GW on 8 days in Feb'26 against nil last year

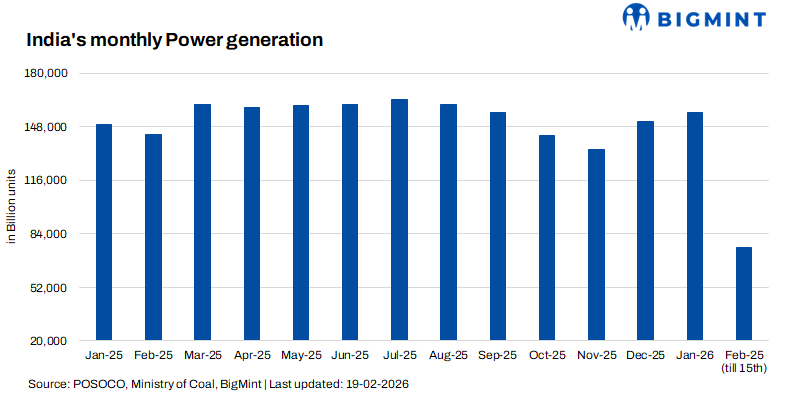

India's power sector entered February 2026 with a clear signal of structural change. While total electricity generation in the first half of the month grew only modestly y-o-y, the composition of supply, the behaviour of demand, and the dynamics of the spot market all shifted in ways that suggest the transition toward a more flexible, lower-cost power system is now firmly underway.

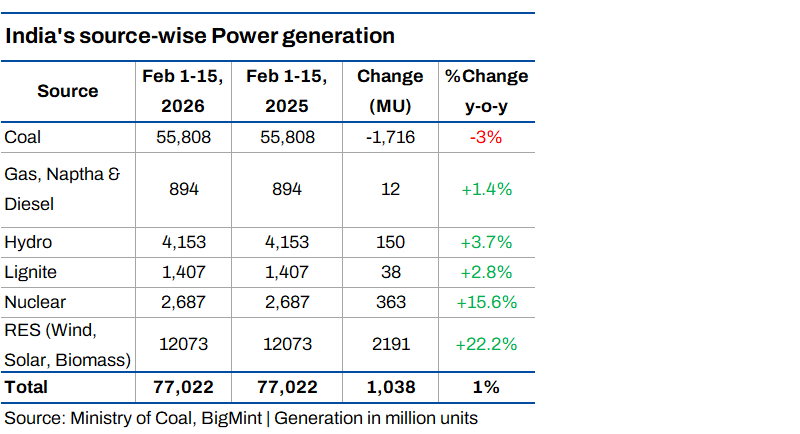

Modest growth hides a major shift in generation mix

Between 1-15 February 2026, India generated 77,022 million units (MU) of electricity, up roughly 1.4% y-o-y. At first glance, this suggests continuity rather than transformation. But the underlying source data points to a reallocation of supply.

The data shows that renewables alone contributed more than twice the systems total growth, while nuclear output also rose strongly. Coal, by contrast, declined in absolute terms. This confirms that low-carbon sources are no longer merely supplementing thermal generation -- they are increasingly displacing it in the merit order.

The shift is equally visible in market shares. Coals share fell by about three percentage points, while renewables gained nearly three percentage points and nuclear edged higher. Even over a short 15-day window, this represents a meaningful structural change.

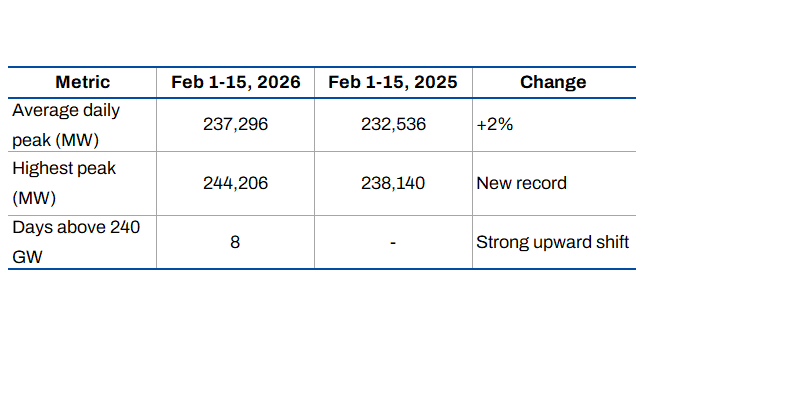

Demand strengthens, peak curve moves upward

Despite coals declining share, the system is not weakening. Peak demand met in early February 2026 rose materially, averaging roughly 237 GW, about 2% higher y-o-y, and reaching a new high of 244,206 MW on 13 February.

Peak demand comparison

The distribution of peak days shows the most important insight: in 2025, none of the first 15 days crossed 240 GW. In 2026, more than half did. This indicates that the demand curve itself has stepped up rather than simply fluctuating around prior levels.

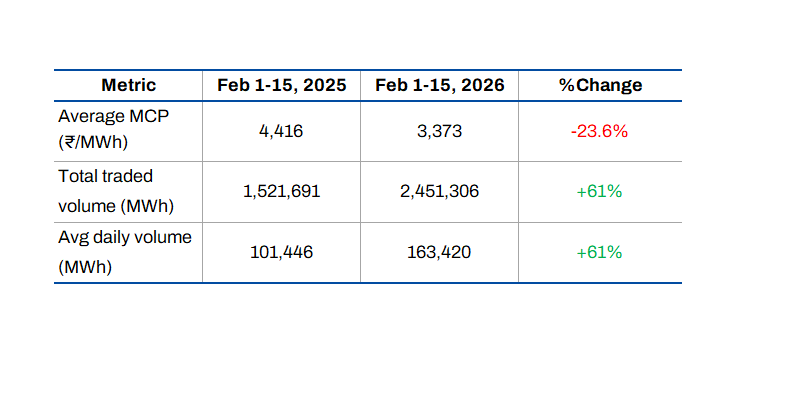

IEX market undergoes structural reset

If the physical system is changing, the spot market reflects it even more clearly. On the Indian Energy Exchange (IEX), the first half of February saw both a surge in volumes and a collapse in prices.

IEX performance: Feb 1-15 comparison

The implication is clear: more electricity is clearing on the exchange, yet at significantly lower prices. This can only occur when cheaper generation -- primarily renewables and nuclear -- is sufficiently abundant to push higher-cost thermal power out of the marginal slot.

For distribution companies, the economics are shifting. Spot purchases increasingly offer lower costs than legacy contracts, encouraging portfolio optimisation and more active exchange participation.

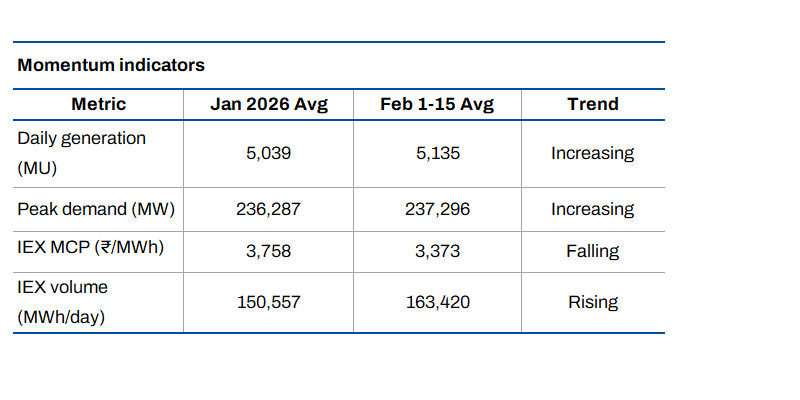

Jan'26's upward momentum carries into Feb

Comparing February's first half with January averages reinforces the same conclusion.

Renewables and nuclear continue to climb, coal has stabilised at a slightly lower baseline, and market prices continue to soften as liquidity deepens.

A system at an inflection point

The first half of February 2026 paints a clear picture of a power sector entering a new phase. Generation growth is steady rather than spectacular, but the composition is shifting quickly. Demand is strengthening, yet prices are falling -- a sign of improved supply depth and growing renewable influence. And the exchange is evolving from a balancing mechanism into a central procurement platform.

Taken together, these trends suggest that February 2026 may mark the point at which Indias energy transition becomes unmistakable - not only in installed capacity or policy targets, but in daily dispatch patterns, peak demand behaviour, and market price formation itself.