India's pellet production rises over 10% y-o-y in Apr-Sep'23

...

- Odisha, Karnataka witness 10% growth in output in H1FY24

- JSW top producer followed by AMNS, Tata Steel

- Production may rise around 6% on-year to 88-89 mnt in FY24

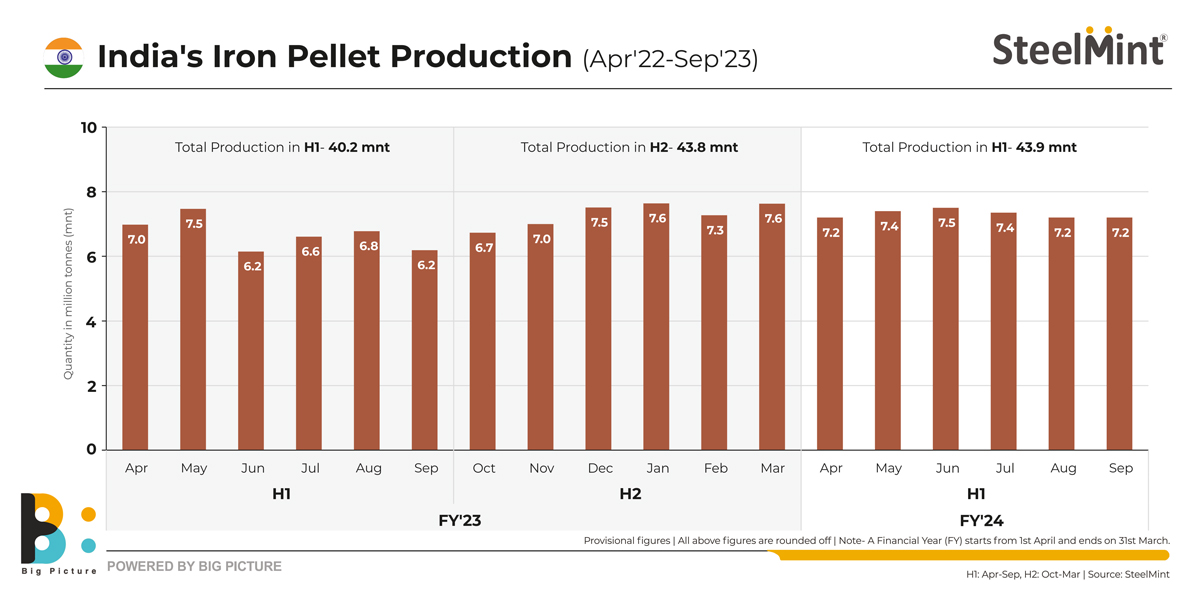

Production of iron ore pellets in India in the April-September 2023 (H1FY24) period stood at around 44 million tonnes (mnt), as per provisional data available with SteelMint. Production increased by 11% compared with over 39 mnt in H1FY23. Production in FY23 was recorded at 84 mnt, higher by 7% compared with 78 mnt in FY22.

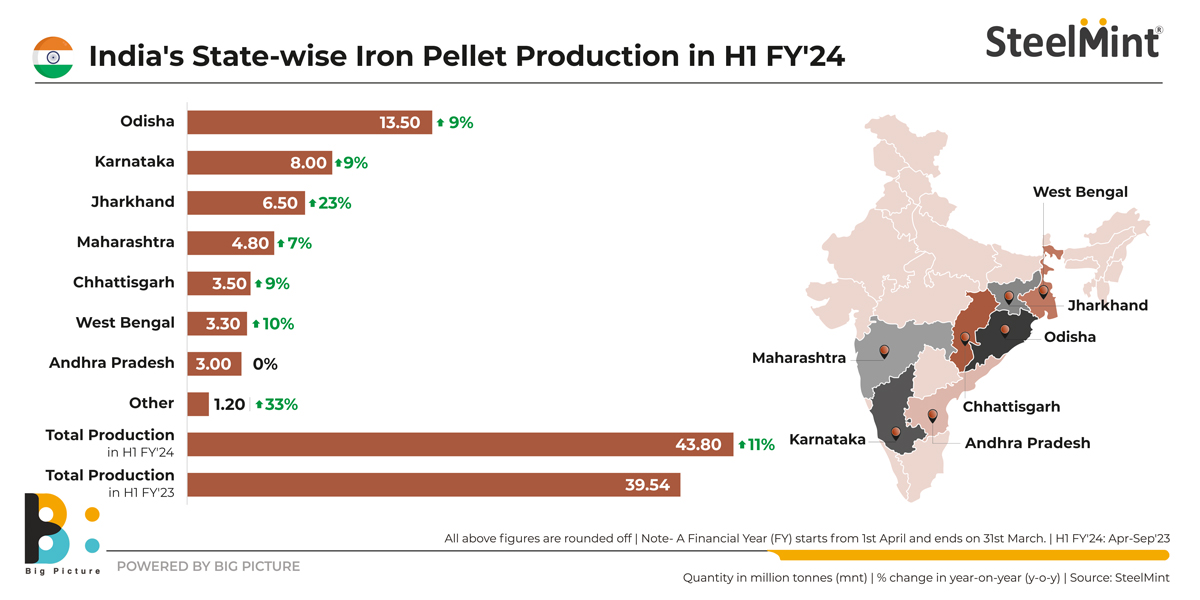

State-wise output

Odisha is India's top pellet-producing state accounting for over 30% of total production. Odisha's pellet output in H1FY24 was assessed at 13.5 mnt, an increase of 10% from 12.3 mnt in the same period of last fiscal. SteelMint data shows that Odisha's share in India's crude steel production in FY23 was around 20%.

Likewise, Karnataka witnessed an increase of 10% in pellet production in H1 of the ongoing fiscal compared with the year-ago period. Production stood at around 8 mnt compared with 7.3 mnt in H1FY23. Karnataka has a share of 11% in India's crude steel output, while states such as Jharkhand and Chhattisgarh accounted for 15% and 13% of the country's crude steel production in FY23. As per provisional data, pellet production from Jharkhand and Chhattisgarh was assessed at 6.5 mnt and 3.5 mnt, respectively, in the period under scrutiny.

On the other hand, production in Maharashtra edged up by 7% y-o-y in H1 to around 4.8 mnt. West Bengal, too, saw pellet output increasing to 3.3 mnt from around 3 mnt in H1 of last fiscal year.

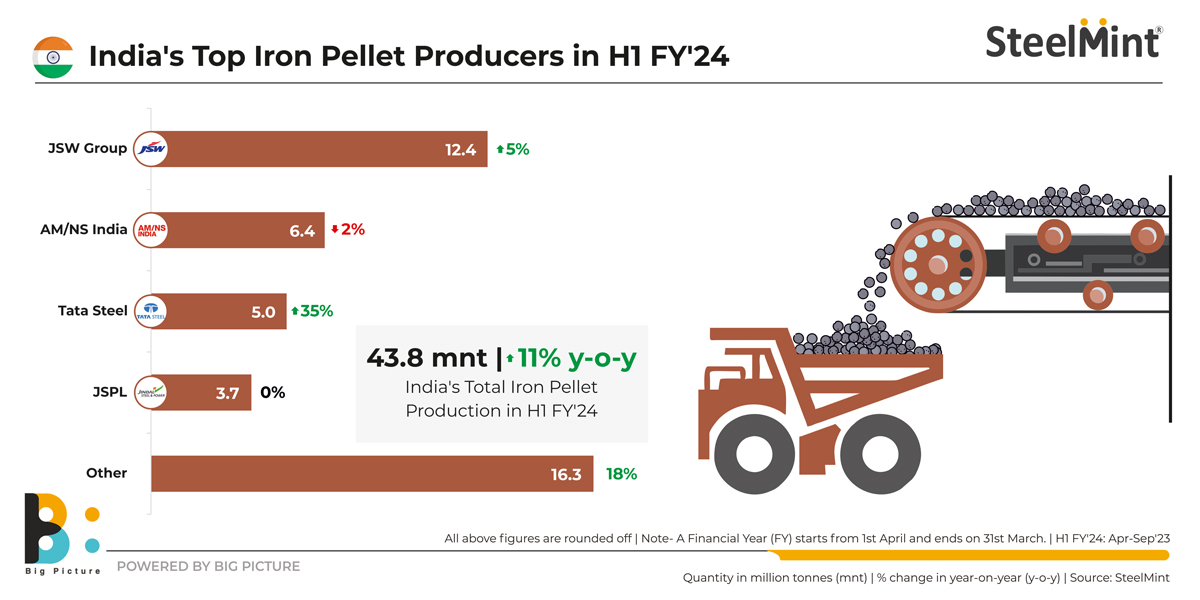

Top producers

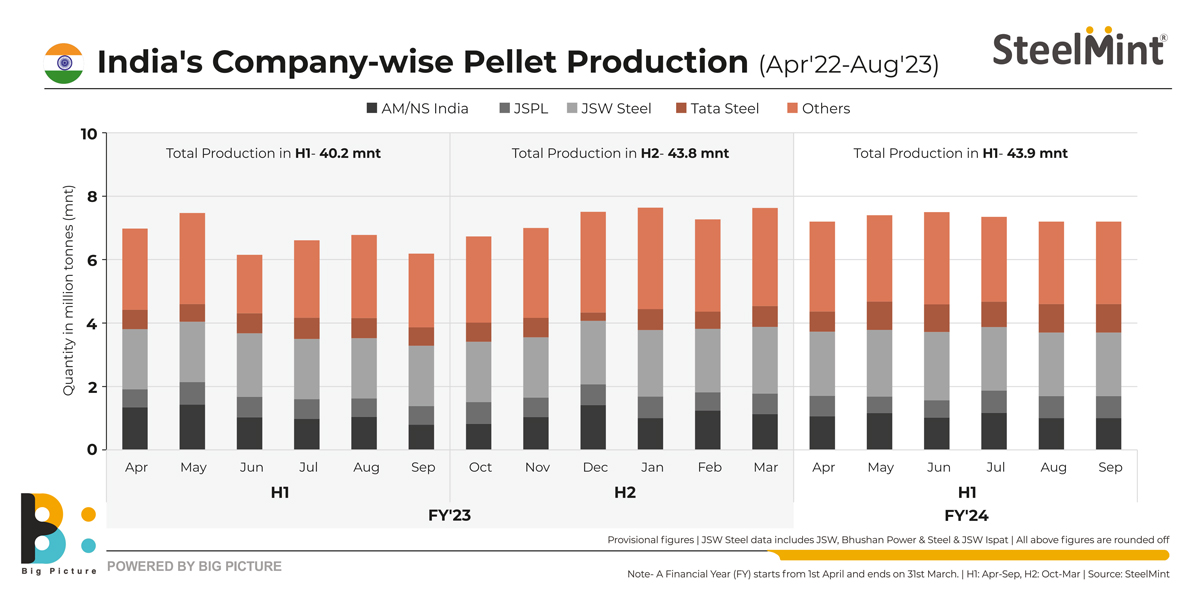

JSW Steel was the top domestic producer in H1, with total output at 12.4 mnt - up 5% from around 11.8 mnt in H1FY23. AMNS recorded total production at 6.4 mnt, while JSPL's total output stood at 3.7 mnt. Tata Steel ramped up production significantly by 35% y-o-y to around 5 mnt in H1. Tata Steel has a capacity of around 7 mnt, which is set to increase with the commissioning of the 6 mnt/year pellet plant in Kalinganagar, Odisha.

The integrated steel plants in the country are the leading producers and captive users of pellets. Capacity-wise, JSW Steel (including subsidiaries) tops the list at 40.55 mnt followed by AMNS at 20 mnt, and JSPL at 10 mnt.

Factors driving production

- Higher crude steel output: India's pellet production has increased parallelly with rising crude steel output. Provisional Steel Ministry data reveals that steel production increased by 12% y-o-y in April-August of this fiscal to 57.26 mnt. Notably, pellet production in the first two quarters of the current fiscal rose by the same margin y-o-y. Moreover, the imposition of export duty on steel, iron ore and pellets in the middle of Q1 of last fiscal had impacted production. Export-oriented units such as state-run KIOCL have witnessed a sharp surge in output of nearly 80% y-o-y in H1 of this fiscal compared to the year-ago period. So, production has surged on a low base in H1.

- Increasing capacities: India's installed pellet capacity was around 133.35 mnt in FY23, an increase of over 18% compared to 112.55 mnt in FY22. JSPL's new pellet plant in Angul with capacity of 6 mnt/year was commissioned in FY24, while the pellet plant at JSW Dolvi, since its commissioning in FY23, has been contributing over 6 mnt annually. Moreover, Shyam Group's pellet capacity has increased to 6 mnt from 3.9 mnt this fiscal. Hence, higher production.

- Preference for pellets: Growing shortage of high-grade iron ore lumps reinforces the dependence on pellets. Producers, especially the integrated plants with captive facilities, looking to enhance productivity and energy efficiency have raised the share of pellets in the ferrous mix to 20-25%. Pellets have lower embodied CO2 emissions than sintered ore, ensure superior gas ventilation in BFs, lead to faster reduction of ore, and reduce slag volume due to much lower silica content than sinter. DRI producers, too, have increased pellet usage because of benefits such as higher DR kiln campaign life, lower specific coal consumption, and maximisation of refractory life due to a lack of accretion compared to iron ore lumps.

Outlook

Domestic crude steel production is expected to reach around 135-140 mnt in the ongoing fiscal riding the wave of strong demand showing a CAGR of 10-12%. SteelMint estimates that the country's pellet production is likely to increase by 5-6% y-o-y in FY24 to around 88-89 mnt compared with 84 mnt in FY23.