India: SteelMint's ferrous scrap index remains stable on 4 Oct'23

SteelMint’s domestic steel scrap (end-cutting) index remained unchanged d-o-d at INR 40,000/t DAP Mandi Gobindgarh on 4 October’23. In Mandi, mills ar...

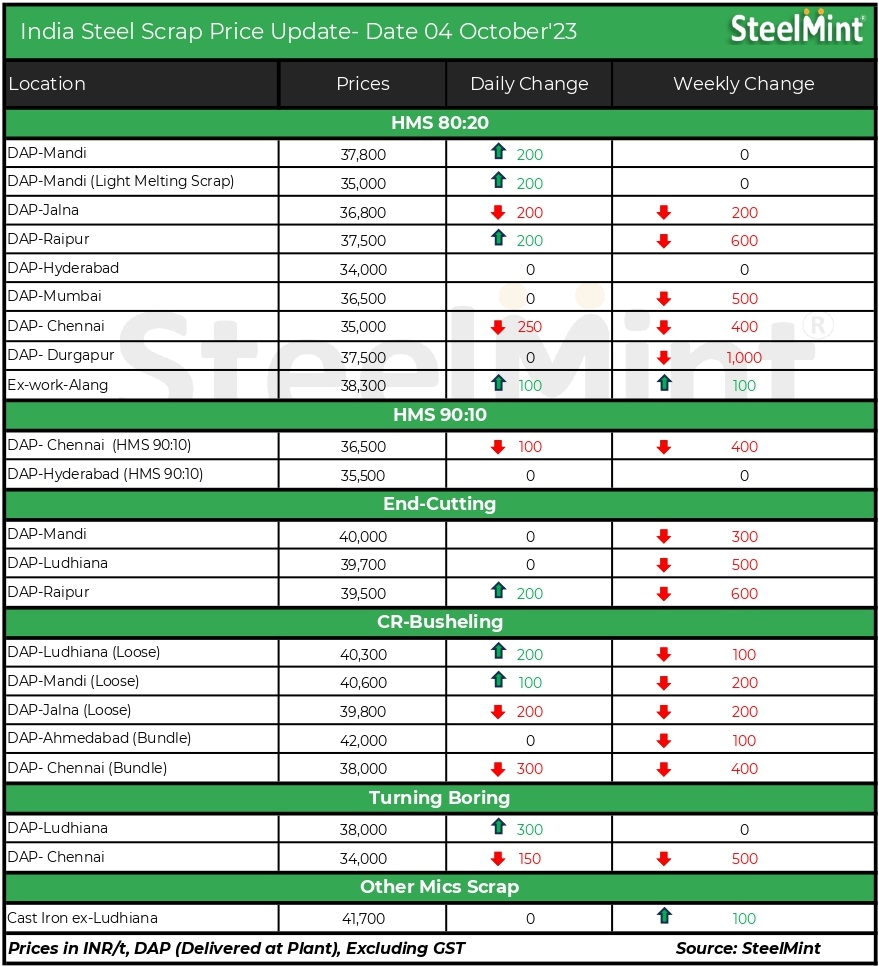

SteelMint's domestic steel scrap (end-cutting) index remained unchanged d-o-d at INR 40,000/t DAP Mandi Gobindgarh on 4 October'23. In Mandi, mills are sourcing from local scrap suppliers due to a decline in available imported material. However, demand for semi-finished and finished steel remained lacklustre in today's market.

Semi-finished steel market

Steel ingot prices in Mandi increased by INR 100/t to INR 46,000/t at the time of reporting and price normalisation. Meanwhile, prices in other key markets increased by INR 200/t-400/t. Prices for semi-finished steel (ingot) rose, while rebar prices remained stable at INR 50,500/t even as inquiries remained subdued.

Overview of other markets

On 4 October, ship-breaking melting scrap prices in Alang, Gujarat, increased by INR 100/t d-o-d. HMS (80:20) prices are at INR 38,300/t ex-yard. While trading of semi-finished and finished steel in western India was subdued, the uptick in scrap prices was backed by higher purchase inquiries yesterday.

In Raipur, the steel market remained moderate with no significant uptick in trade flow. However, billet prices increased by INR 500/t reaching INR 43,500/t, and rebar prices rose by INR 600/t to INR 46,300/t d-o-d.

Price highlights

End-cutting-billets spread: In Mandi, the end-cutting scrap and billets spread stood at INR 5,500-6,000/t.

Domestic vs imported scrap: Imported melting scrap prices at Nhava Sheva Port were at around $398-$400/t, which equates to approximately INR 35,501/t (including freight). Meanwhile, in Mumbai, local scrap prices stood at INR 36,500/t, stable d-o-d.

Indian imported ferrous scrap witnessed a sudden drop in offers as a few deals were concluded at comparatively lower prices. Market sentiments remain slow.

A few market participants informed that demand was sluggish due to cash flow problems. Furthermore, buyers are bracing for a potential price drop which has brought the market to a standstill.

Offers for shredded scrap from Europe were assessed at $415/t CFR Nhava Sheva, while HMS (80:20) scrap was offered at $395-$400/t CFR Nhava Sheva and Chennai.

Raipur sponge iron-billet spread: The current conversion spread (margin) from pellet-based DRI (P-DRI) to steel billets in Raipur stands at INR 13,050/t.

To see SteelMint's melting scrap assessment, pricing methodology and specification documents, Click here

To provide feedback on this index or if you would like to contribute by becoming a data partner, please contact - info@steelmint.com.