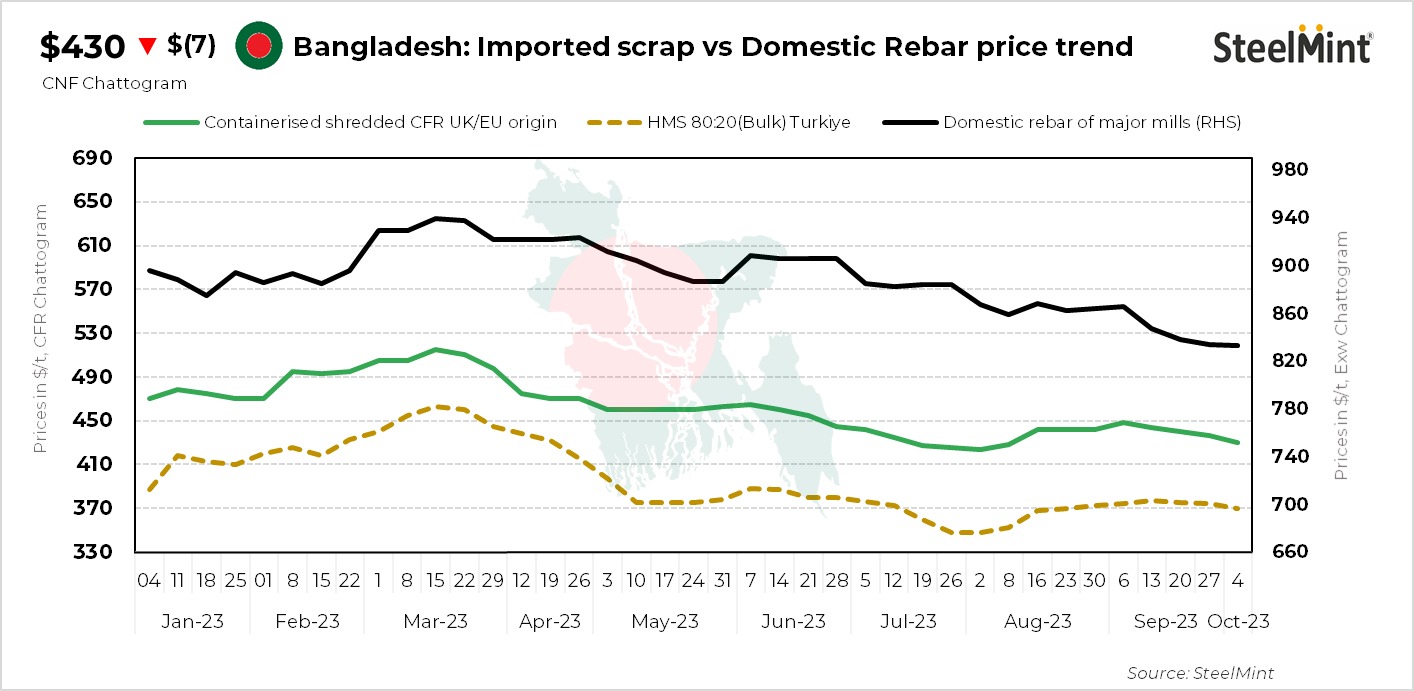

Bangladesh: Imported ferrous scrap offers fall w-o-w on weak market sentiment

The imported ferrous scrap market in Bangladesh remained slow as limited trade has been reported this week. The market is facing challenges like foreign currency shortage...

The imported ferrous scrap market in Bangladesh remained slow as limited trade has been reported this week. The market is facing challenges like foreign currency shortage and mills are prioritising clearing of pending letters of credit (LC) for previous orders. Notably, LCs for bookings made in July and August remain unresolved.

In September, Bangladesh raised its bulk scrap imports to 290,186 t, a 37% surge in volumes compared to the previous month (August). The leading sources of bulk scrap imports are the US (133,443 t), the UK (76,831 t), and New Zealand (31,486 t).

Q3CY23 saw a marginal 0.33% increase in scrap imports compared to the same period in 2022. However, the overall price of scrap declined by 20% during this period. Scrap imports in Q3CY23 reached 1.31 mnt, with the average price assessed at $448/t CFR.

Recent deals and offers

- Approximately 700 t of PNS scraps from Malaysia was booked at $453/t CFR Chattogram

- Around 1,000 t Hong Kong origin PNS Scrap 1,000 t booked at $455/t CFR Chattogram

- Around 1500 t Netherlands origin PNS scrap booked at $440/t CFR Chattogram

- Bids for PNS from Malaysia are at $443-445/t.

- Offers for Australian (80:20) are at $425/t and for shredded at $445/t CFR Chattogram

- HMS 80:20 is being offered at $420-425/t from Australia, while major mills are waiting with a $415/t bid.

- Shredded offers are at $434-438/t from Australia and New Zealand and bushelling at $458-460/t from Malaysia/Thailand/UK.

- The bulk scrap market presents a mixed outlook with workable levels at $410-415/t for HMS cargo.

- Offers are slightly higher with bulk HMS at $420-425/t, shredded bulk at $430/t, and bonus bulk at $435-440/t.

Domestic market: The local steel market saw no significant change, with rebar prices fluctuating due to limited demand. Rebar prices were last heard at BDT 91,000-93,000/t ($826-844/t) exw Chattogram and BDT 81,000-82,000/t ($735- 744/t) exw Dhaka, while domestic billets were assessed at BDT 66,000-68,000/t ($599-617/t). Domestic scrap prices are in the range of BDT 54,000-54,500/t.

As per sources, if a stable government is formed through a credible election, then the economy will recover fast due to improved confidence level.

In a recent development, the Bangladesh Bank has decided to increase its policy rate, also known as the repo rate, by 75 basis points to 7.25% to contain inflation by making money costlier. The decision was taken at the monetary policy committee meeting held today.

Bangladesh maintains its position as the top ship recycling nation despite a 65% decrease in its ship-breaking operations, according to a report by the United Nations Conference on Trade and Development (UNCTAD). Accounting for over one-third of the global ship recycling market, the country witnessed a reduction in recycling volumes from 8.02 mnt in the previous year to 2.8 mnt in the 12 months leading up to January 2023. Of all ships recycled by Bangladesh, 50.4% were oil tankers, 41% were bulk carriers, 2% were ferries and passenger ships, 1.9% were chemical tankers, and 1.1% were general cargo ships.

Outlook: Industry insiders anticipate a $10/t drop in bulk and container scrap prices in the coming week. Despite challenges in LC openings, the market remains a little optimistic about increased activity due to favourable prices for buyers.