Non-ferrous metal prices on LME move southward

Prices of non-ferrous metals on the London Metal Exchange (LME) witnessed downtrend in the last trading session. Three-month aluminium futures inched down by 1.9% to $2,2...

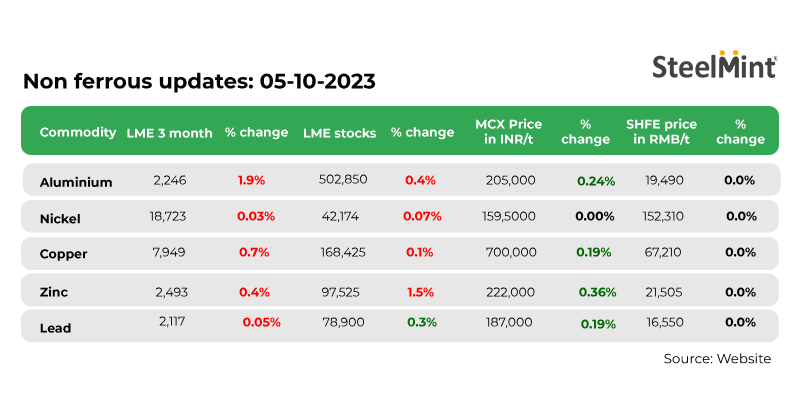

Prices of non-ferrous metals on the London Metal Exchange (LME) witnessed downtrend in the last trading session. Three-month aluminium futures inched down by 1.9% to $2,246/t, nickel prices went down marginally by 0.03% to $18,723/t, copper prices edged down by 0.7% to $7,949/t, zinc prices dipped by 0.4% to $2,493/t and lead prices dropped by 0.05% to $2,117/t. Similarly, metal stocks in LME-registered warehouses witnessed a drop except lead.

COMEX market

Copper prices on the Commodity Exchange (COMEX) fell 1% to reach $7,875/t from $7,963/t on the last trading day.

India's non-ferrous market

Aluminium

India's aluminium scrap market remained stable as of 4 Oct'23. Major players in the market lowered prices due to falling LME prices, while buyers took a cautious "wait and watch" approach. LME aluminium futures dipped by 0.72%, at the time of reporting.

Copper

Yesterday, domestic copper prices remained rangebound due to slow market activity at the beginning of the month and a sudden drop in future prices below $8,000/t. Buyers are cautious and are waiting for prices to decrease before stocking materials.

Global updates

Hindustan Zinc partners with GreenLine Mobility

Hindustan Zinc Ltd will integrate GreenLine Mobility Solution's liquefied natural gas (LNG)-powered fleet into its supply chain and transportation operations to reduce its carbon footprint. GreenLine plans to invest 2 billion rupees in deploying LNG-powered trucks for Hindustan Zinc's road logistics. The move aligns with India's goal of achieving net-zero emissions by 2070, with Hindustan Zinc targeting net-zero carbon emissions by 2050, as per secondary sources.

Barrick invests $2 billion in Lumwana copper mine expansion

Barrick Gold is investing nearly $2 billion in expanding its Lumwana mine in Zambia, with the aim of increasing copper production to around 240,000 tonnes annually. The project is part of Zambia's efforts to revive its copper industry, with Barrick having contributed nearly $3 billion to the Zambian economy since taking over Lumwana in 2019.

U.S. services sector slows in September

The U.S. services sector slowed in September, with new orders declining to a nine-month low, but it remained in line with expectations for solid economic growth in the third quarter. The Institute for Supply Management's survey showed that services sector inflation remained elevated, and employment slowed gradually. This suggests that the Federal Reserve's monetary policy may stay tight for some time.

UK services sector downturn less severe in September

In September, British services companies experienced a milder downturn than initially anticipated, with the final reading of UK Services Purchasing Managers' Index (PMI) falling to 49.3, an eight-month low, but better than the preliminary "flash" reading of 47.2. The unexpected fall in inflation and the Bank of England's decision to leave interest rates unchanged may have contributed to the improved PMI figure. Some companies are becoming more optimistic about cooling price pressures.

Oil prices gain

Crude oil prices slightly rebounded today, recovering from the previous session's significant losses. This increase followed an OPEC+ panel's decision to maintain oil output cuts in an effort to keep the oil supply tight. However, concerns about the uncertain demand outlook limited the gains.

Brent oil futures went up slightly by 0.69% to $86.40 per barrel. Crude oil WTI futures inched up by 0.56% to $84.69 per barrel, at the time of reporting.

Natural gas prices up

Prices of natural gas were recorded at $2.993/MMBtu, up 1.01% at the time of publishing this report.

Dollar index

The dollar index, which gauges value of the greenback in a basket of six different currencies, hovered at 106.56, witnessing a slight dip of 0.22%.

The rupee was recorded at 82.95 against the dollar, remained largely stable against the previous closing.