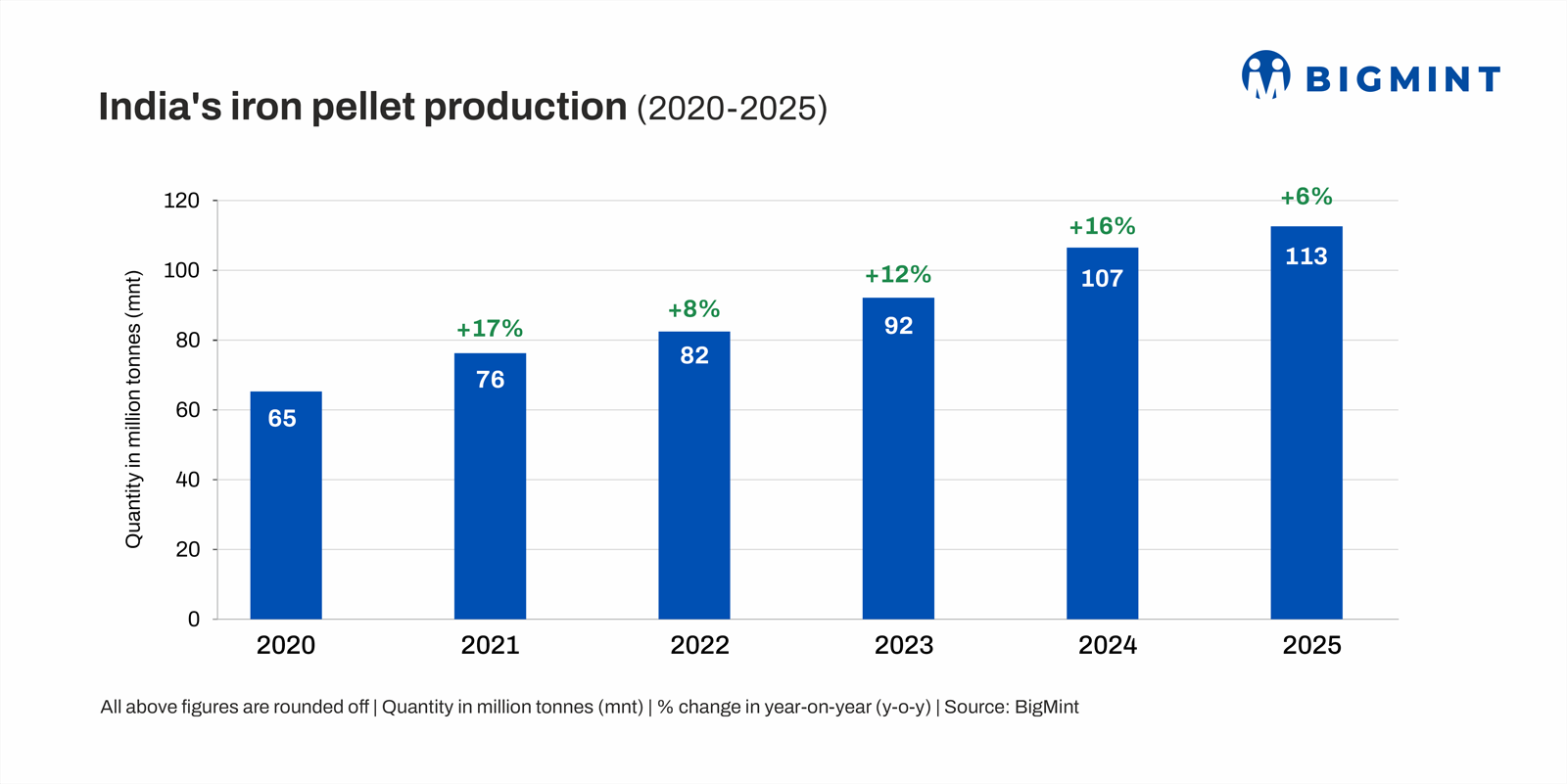

India's pellet production increases by 6% y-o-y in CY'25

...

- Crude steel production rises 10% in CY'25

- Sponge iron output climbs up by 8% y-o-y

- Capacity underutilisation remains concern

Morning Brief: India's iron ore pellet production increased by 6% y-o-y to 112.6 million tonnes (mnt) in CY'25, as per data maintained with BigMint. In the past few years, India's pellet production has accelerated rapidly with rising crude steel production and the growing need for energy efficiency in steelmaking.

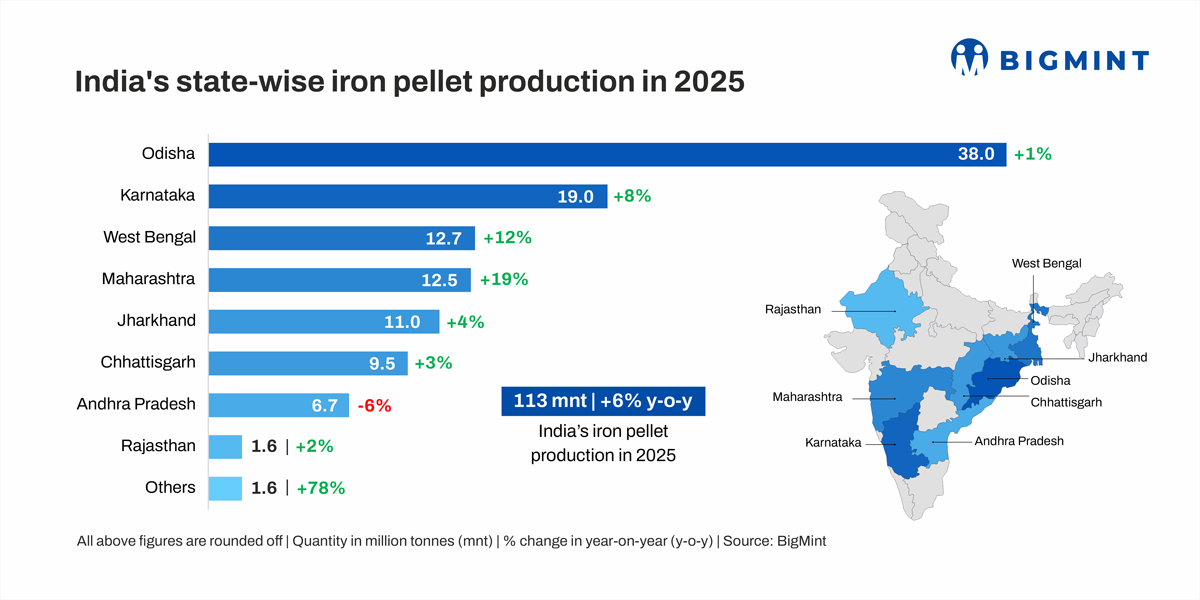

State-wise production

Besides Andhra Pradesh, pellet production increased in all states.

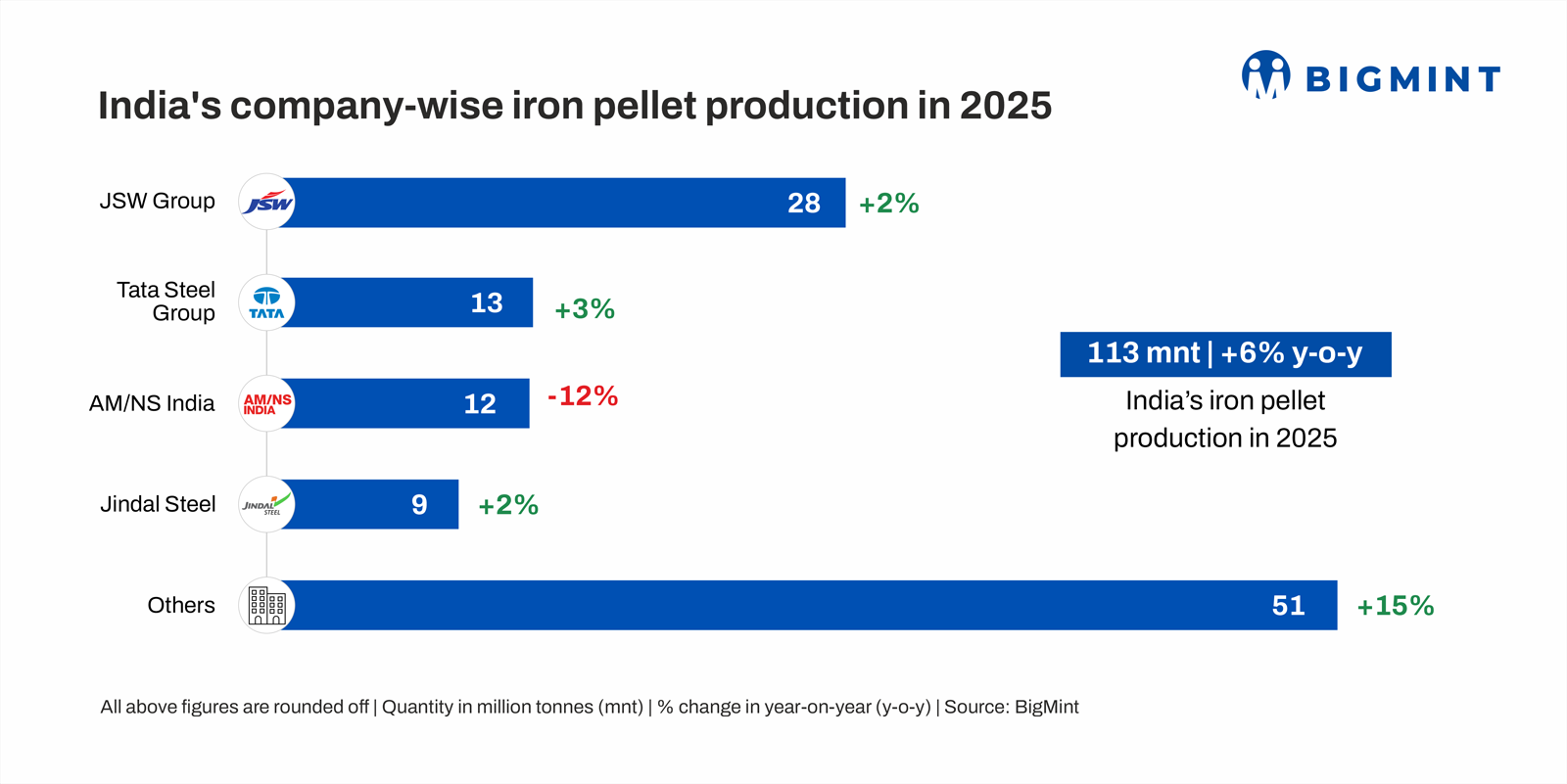

Top producers

All leading producers, except for AM/NS, raised their pellet output in CY'25.

Factors boosting pellet production

- Crude steel production rises 10% y-o-y: India's crude steel production increased by 10% y-o-y to 164 mnt in CY'25 from 149 mnt in the previous year, propelling demand for pellets.

- Sponge iron output climbs up by 8% y-o-y: India's sponge iron production increased 8% y-o-y to 58.8 mnt in CY'25, necessitating higher pellet availability. Secondary steelmakers continued to depend heavily on sponge iron as a substitute for imported scrap, particularly due to affordability and ample availability.

- Capacity additions lift output: Producers such as Lloyds Metal, Bengal Energy, and the Adukia Group have steadily ramped up pellet production capacity in line with India's goal to achieve 300 mnt of steel production by 2030. This has contributed to the sustained increase in output in recent times, especially from West Bengal and Maharashtra.

In fact, over FY'21-25, India's installed capacity for pellet production rose by 69.5 mnt to 161.3 mnt, while output increased by just 37 mnt to 106.3 mnt.

Outlook

India's pellet output is expected to continue rising, driven by growing steel and sponge iron production. Given that some blast furnace-based steelmakers have raised the share of pellets in their raw material mix to over 50% from 25%, pellet consumption is set to rise significantly.

However, low capacity utilisation rates -- currently around 65% -- remain a concern. Lacklustre export demand, limited availability of high-grade ore, tight margins, and a shift to lump-based sponge iron (CDRI) have collectively weighed on pellet production. Rising pellet imports have also worsened the situation for certain producers.