India : Domestic silico manganese prices marginally down w-o-w on cautious trade, falling billet offers

...

- Panic selling emerges in pockets as margins shrink

- Soft demand drags billet prices lower; buyers stay cautious

Domestic silico manganese prices have witnessed slightly down amid need-based buying by steel mills. Buyers have been procuring material strategically, maintaining cautious purchasing patterns, while limited immediate liquidity in the silico manganese market has exerted pressure on some sellers to offer price reductions. However, a few producers with order books secured until March 2026 are not in a position to lower prices. Meanwhile, smelters holding limited forward bookings and largely dependent on the spot market have mostly kept prices within a narrow range.

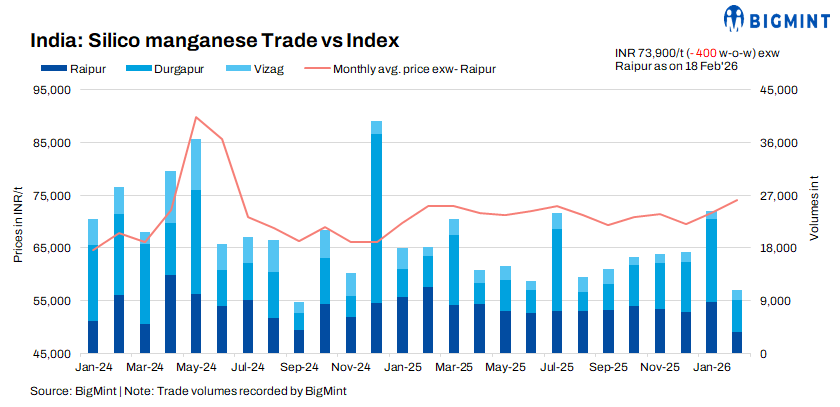

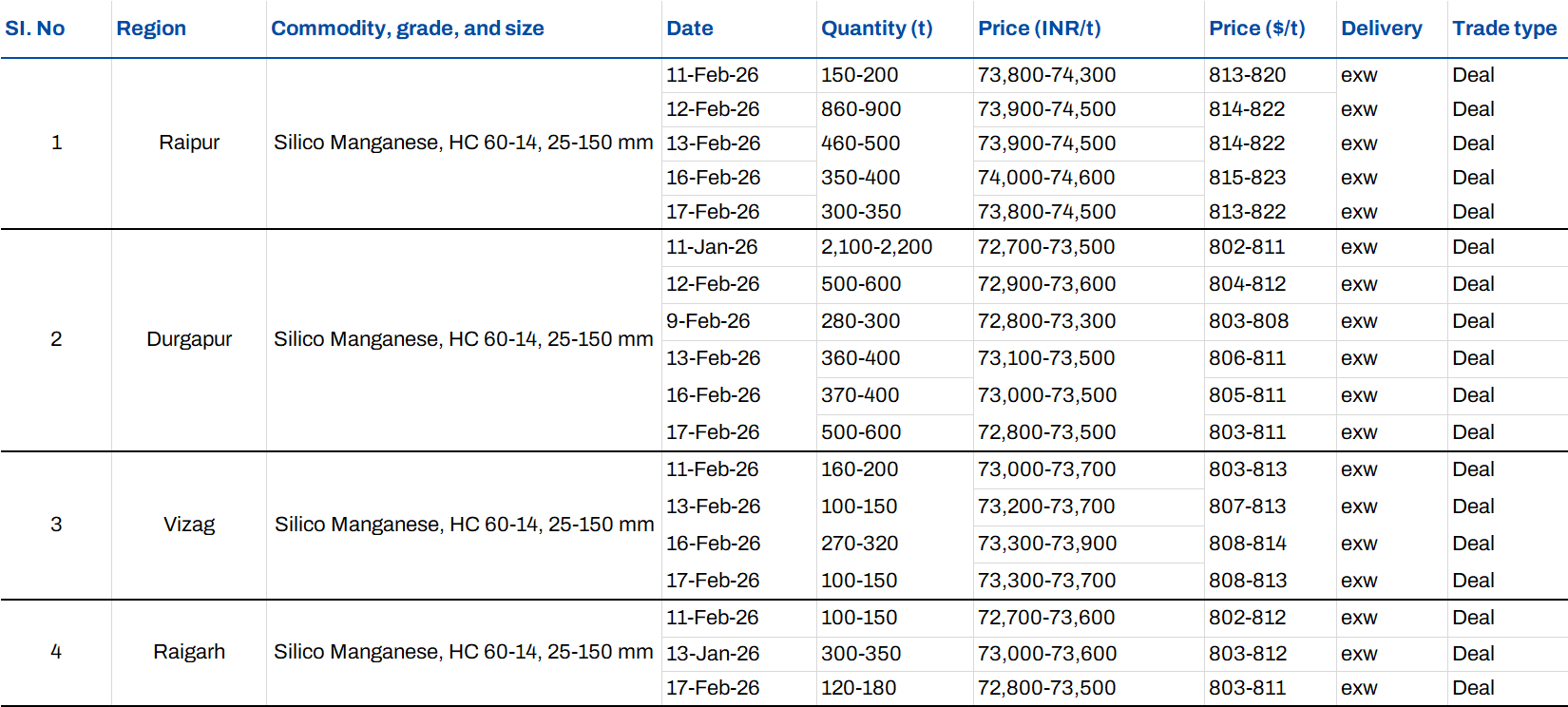

As per BigMint's assessment on 18 February 2026, domestic silico manganese (60-14 grade) prices witnessed rangebound movement w-o-w across major markets, reflecting firm yet cautious sentiment. In Raipur, prices declined by INR 200/t ($2/t) to INR 73,900/t ex-works ($815/t). Durgapur prices saw a slight uptick of INR 100/t to INR 73,200/t ($809/t), while in Vizag, rates remained stable to INR 73,300/t ex-works ($808/t). Meanwhile, in Raigarh, prices remained slightly down by INR 100/t ($1/t) at around INR 73,000/t ex-works ($805/t), indicating that the market may be entering a saturation phase.

Confirmed deals (as per BigMint)

Market Overview

Limited high-price deals weigh on domestic prices: Cautious buying by domestic steel mills kept the market sentiment uncertain. With imported raw material costs rising, many smelters had limited room to offer discounts. However, increasing liquidity pressure and concerns over inventories have placed several sellersespecially those dependent on the spot market - under stress. Market transactions were reported around INR 74,000-74,500/t ex-works Raipur, while buyers asking prices were near INR 73,500/t ex-works. A few smelters have begun selling at reduced rates in a panic-driven environment, which has started to influence overall market levels.

One of the key smelters from Raipur informed BigMint that the market remains uncertain and profit margins are currently under pressure. According to the source, higher ore costs have raised production expenses, while buying interest at elevated price levels remains limited, creating a sense of urgency among producers. Going forward, prices may soften slightly by around INR 500-700/t from current levels.

Selective buying at lower rates fails to lift bearish steel sentiment w-o-w: BigMints billet index fell by INR 700/t w-o-w to INR 41,000/t ex-works Raipur on 18 February 2026, as weak sentiment persisted despite softer spot offers. Trade activity remained limited to need-based buying at lower prices, while subdued downstream demand kept the market bearish. Buyers continued to place lower bids, forcing sellers to trim offers further. Market participants noted that demand recovery remains elusive despite repeated price cuts, which has also added pressure on domestic silico manganese prices.

Outlook

The near-term outlook for the domestic silico manganese market remains cautious to slightly weak. Subdued steel demand, pressure on billet prices, and rising inventory concerns are likely to keep prices rangebound with a mild downside bias. While higher ore costs may limit sharp corrections, limited buying interest and liquidity pressure on spot-dependent smelters could lead to marginal price softening in the coming weeks.