India: Ferro molybdenum prices increase sharply w-o-w amid tight oxide supply, rising LME prices

...

- Price surge leads to muted trade, cautious buyer sentiment

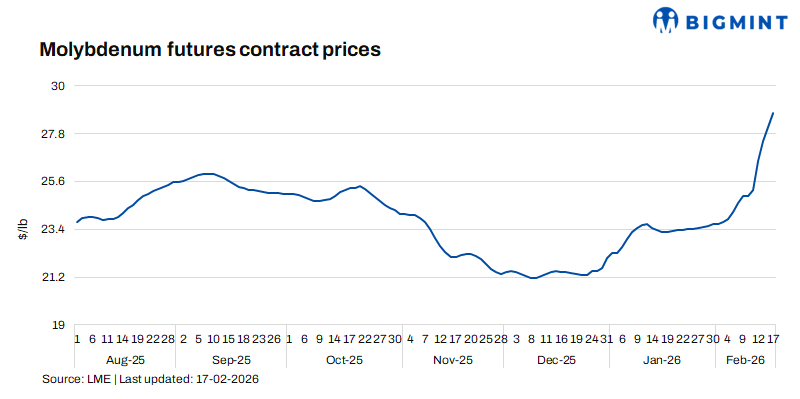

- LME molybdenum prices up $4/lb amid accident at US plant

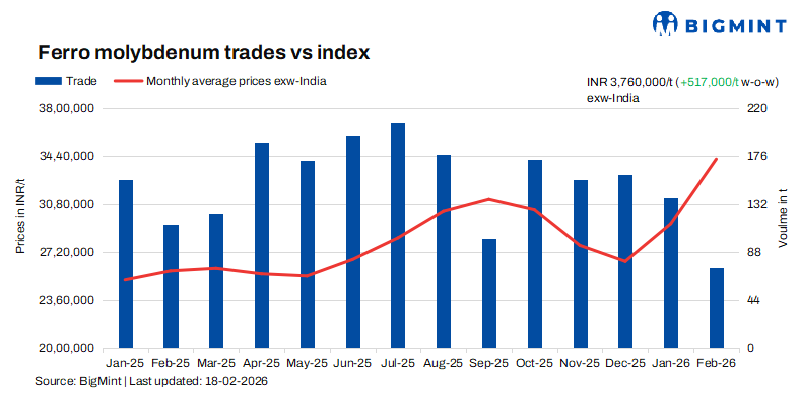

Indian ferro molybdenum prices surged by INR 517,000/t ($5,701/t) on 18 February compared to the previous assessment on 11 February. The rise was driven by higher molybdenum oxide prices, particularly due to tight supply in the US, which prompted domestic sellers to raise offers. However, buyers remained cautious, and rising LME prices further weighed on trade sentiment.

According to BigMint's assessment on 18 February, ferro molybdenum prices were at INR 3,760,000/t ($41,463/t) exw-India. Market activity remained subdued, as higher seller offers kept buyers cautious, resulting in very limited spot transactions during the week.

Market updates (12-17 February 2026)

Chinese prices stable, US prices surge: Ferro molybdenum prices (Mo 60%) in China remained steady w-o-w at RMB 269,000/t ($38,936/t) ex-Inner Mongolia. The market was stable, supported by firm raw material costs. Stable molybdenum concentrate prices, along with strength in the international molybdenum market, continued to provide solid cost support, keeping prices steady despite limited trading activity.

On the demand side, the steel industry largely completed pre-holiday restocking and entered the holiday period, resulting in weak demand and thin spot liquidity. Many manufacturers suspended quotations, leading the market into a consolidation phase. Industry participants generally expect prices to strengthen after the holiday period.

In Europe, ferro molybdenum (Mo 70%) prices remained steady w-o-w at $63/kg amid limited market activity and cautious buying. In the US, ferro molybdenum (Mo 70%) prices rose by $6/kg w-o-w to $71/kg, supported by tight supply following a production outage at one plant.

LME futures prices increase w-o-w: Molybdenum futures on the London Metal Exchange rose by $3.81/lb w-o-w to $28.75/lb on 17 February.

Indian market scenario: Indian ferro molybdenum prices rose sharply over the week, primarily driven by a strong uptick in global molybdenum oxide prices, particularly in the US. This prompted domestic producers and traders to revise offers upward amid rising import costs.

Despite the price increase, buying interest remained cautious. Most consumers limited procurement to immediate requirements, resulting in muted, cautious trading activity.

A seller informed BigMint, "The ferro molybdenum market has become highly volatile, following an industrial accident at a molybdenum plant in the US. Current Indian domestic prices range between INR 3,700,000-3,800,000/t ($40,798-41,901/t) exw."

Stainless steel prices surge: Prices of 316-grade stainless steel hot-rolled coils (HRCs) rose by INR 5,000/t ($55/t) w-o-w to INR 348,000/t ($3,838/t) exw-Mumbai. The increase was driven by higher raw material costs, particularly the recent rise in ferro molybdenum prices. However, demand remained slow, and trading activity stayed moderate amid bid-offer gaps and nickel price volatility.

Outlook

Ferro molybdenum prices are expected to remain at around current levels next week, supported by elevated raw material costs. Fluctuations in global markets and molybdenum oxide price trends are likely to shape the direction of domestic prices.