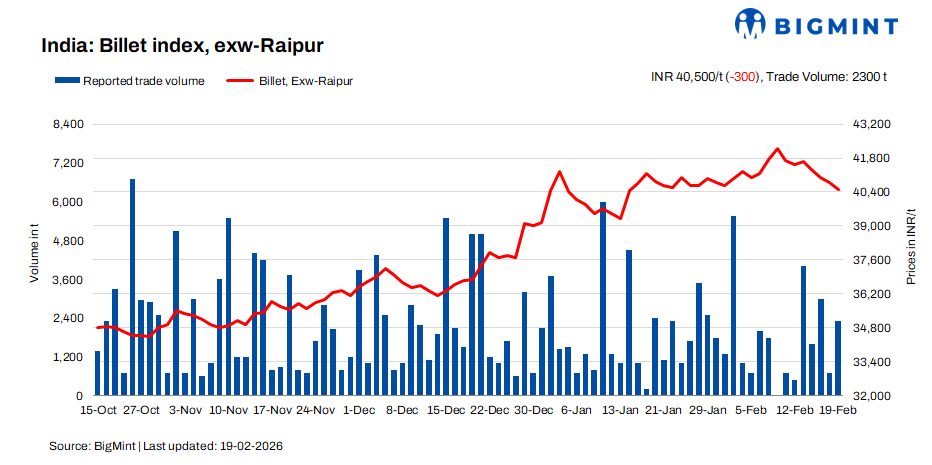

India: BigMint's billet index plunge INR 300/t d-o-d as demand pressure intensifies

...

- Limited semi-finished bookings despite lower offers

- Finished steel price correction deepens in Raipur

BigMint's billet index declined by INR 300/t day-on-day to INR 40,500/t exw-Raipur on 19 February 2026, marking an approximate 3% drop from last week's closing level, as weakening finished steel demand and limited semi-finished bookings exerted sustained pressure on prices.

Market sentiment remained bearish throughout the session. Despite consecutive price corrections, buying interest stayed subdued, with most participants limiting procurement to immediate requirements. Lower spot offers failed to attract significant volumes, reflecting fragile downstream demand and cautious inventory management by re-rollers and traders.

The sharp decline was largely impacted by weak finished steel offtake, which continued to weigh on billet consumption. Market participants indicated that aggressive bidding from buyers forced producers to align offers downward to secure limited bookings. A Raipur-based trader said, "Demand visibility remains poor, and mills are compelled to reduce offers to attract deals."

Finished steel weakens further

In Raipur, finished steel prices declines further. Rebar and wire rod prices declined by INR 300/t d-o-d, pressured by limited enquiries and weak demand. Buying activity remained strictly need-based throughout the day.

Sponge iron eases

Sponge iron prices in Raipur fell by INR 200/t d-o-d, tracking muted buying interest and weaker semi-finished demand.

The conversion spread from sponge iron (PDRI) to billets for the standalone furnaces in the Raipur cluster was recorded at INR 13,400/t.

Rationale

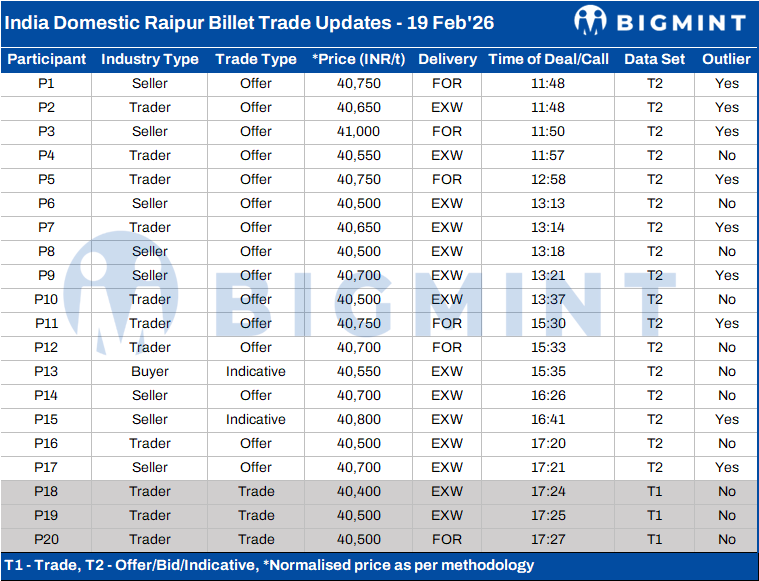

This index is derived based on transactions, offers, bids, and indicative price data sets. Transactions are considered T1 and given a weightage of 50%, whereas other data sets are considered as T2 and given a weightage of the balance 50%.

Transactions (T1) - Three trades at INR 40,400-40,500/t were recorded during the 10:30 am to 5:30 pm BigMint trading window and considered for final price calculation as T1 inputs. The average of these transactions was INR 40,478/t, which was given a 50% weightage in the final price calculation.

Other price indicators - bids/offers/indicatives (T2) - Seventeen offers were reported in the trading window and considered as T2 inputs. The average price of these seventeen was INR 40,562/t and given a 50% weightage in the final price calculation.

The final price of billets was INR 40,520/t exw-Raipur, rounded off to INR 40,500/t exw.

Click here for detailed methodology