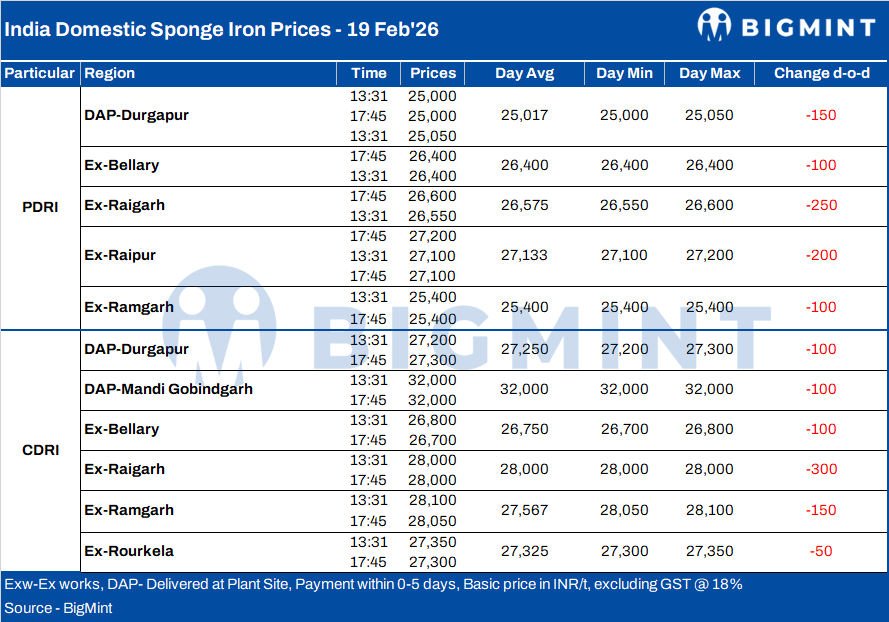

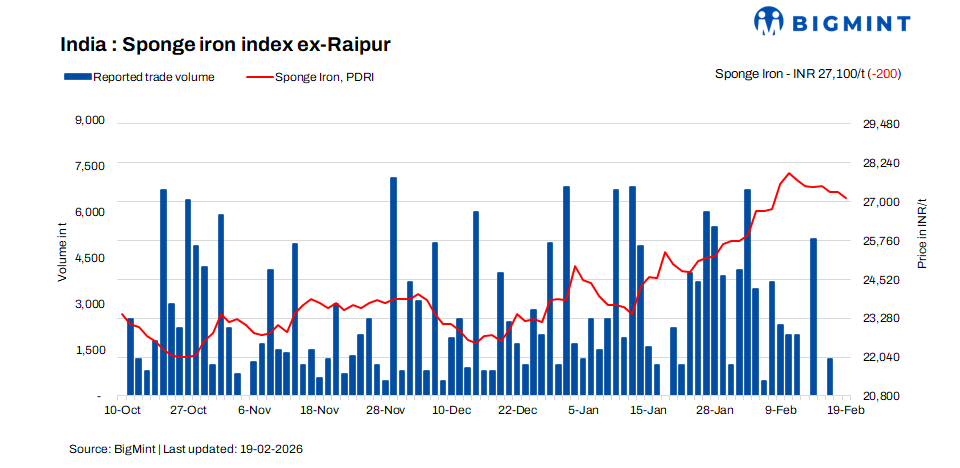

India: Weak buying interest drags sponge iron prices lower across key markets

...

- Subdued finished steel demand pressures DRI offers

- Margin stress persists amid elevated raw material costs

India's sponge iron market witnessed broad-based corrections on 19 February, with prices declining by INR 100-300/t day-on-day across major producing regions, as weak finished steel demand continued to dampen procurement activity.

Muted downstream offtake weighed heavily on trading sentiment, resulting in thin volumes and limited spot transactions. Buyers largely refrained from aggressive bookings, restricting purchases to immediate requirements amid expectations of further price corrections. The absence of bulk deals underscored the prevailing cautious mood across the market.

Despite elevated raw material costs, including iron ore and coal, producers were compelled to reduce offers to stimulate enquiries. However, the downward revisions failed to meaningfully improve liquidity, as bearish sentiment and uncertain steel demand kept participants on the sidelines.

A Raipur-based induction furnace operator said, "Finished steel movement remains slow, and until demand improves, sponge iron consumption will stay under pressure."

The imbalance between firm input costs and weak steel offtake continued to strain producer margins. While sellers attempted to defend realisations, competitive pressure and limited bookings forced price alignment with prevailing bids.

Rationale

Prices have been derived based on transactions, offers, bids, and indicative price data sets. Transactions are considered as T1 and given a weightage of 50%, whereas other data sets are considered as T2 and given a weightage of the balance 50%.

Click here for detailed methodology