India: Scrap prices in Chennai inch up by INR 100/t w-o-w amid healthy demand - 19 Feb

...

- Mildscrap shortage emerges due to limited import bookings

- Tight sponge iron supply, healthy billet demand lift scrap prices

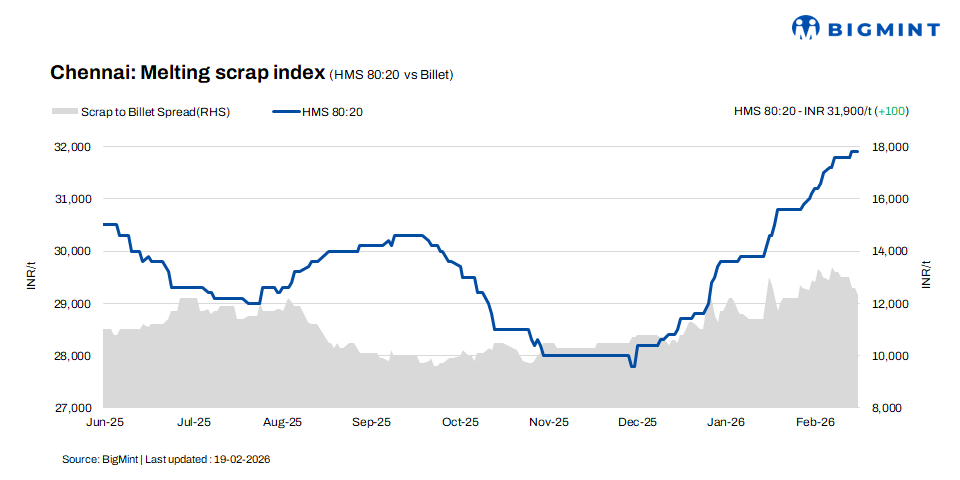

HMS (80:20) scrap prices in Chennai edged up by INR 100/tonne (t) w-o-w to INR 31,900/t on 19 February 2026, driven by healthy offtake, while remaining unchanged on a d-o-d basis, as per BigMints assessment. Billet and rebar prices fell by INR 300/t d-o-d to INR 44,200/t and INR 48,700/t respectively, registering a cumulative decrease of INR 800/t over the week. The market continued to show a mixed trend, marked by stable d-o-d pricing and mild weekly volatility.

Imported and domestic price trends

Market participants indicated that Australia origin imported shredded scrap was offered at $370-375/t CFR Chennai, while HMS (80:20) scrap was quoted at $350-353/t. Buyers were bidding $5-10/t lower. Buying interest remained subdued as the strengthening US dollar continued to push up landed costs, keeping buyers cautious about fresh imported scrap bookings.

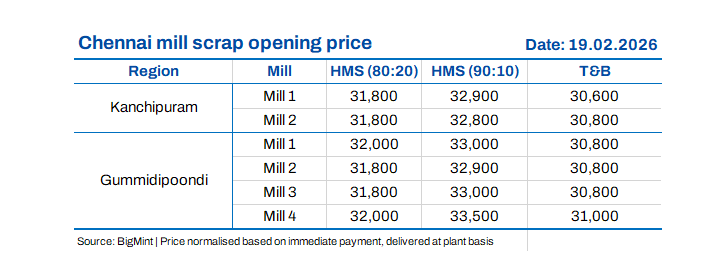

In the domestic market, HMS (80:20) prices were assessed at INR 31,500-32,000/t for immediate payment, while deals on extended credit were concluded at higher levels of INR 32,000-32,500/t. Overall market sentiment remained stable, largely influenced by steady liquidity conditions. Both buyers and sellers adopted a cautious approach, carefully balancing trade volumes with payment terms and financing availability.

Buyer-supplier sentiments

A mill representative stated that sponge iron availability in the merchant market remained limited, as major producers are increasingly diverting material towards captive consumption. This shift is largely attributed to a mild shortage of scrap in the domestic market.

Despite a w-o-w decline in billet prices, demand for billets remains healthy, supported by steady consumption from rolling mills. In contrast, rebar demand slowed in the retail segment due to cautious buying sentiment and price sensitivity. However, demand from the project and infrastructure segments remained stable, providing partial support to overall rebar offtake.

A scrap supplier stated that HMS (80:20) prices were currently in the range of INR 31,500-32,500/t, with price variations largely influenced by payment terms and mill-specific volume requirements. The market is experiencing a mild shortage of scrap, primarily due to limited imported scrap bookings over the past couple of months. Higher imported scrap offers compared with domestic prices have discouraged buyers from active overseas procurement, tightening overall availability in the domestic market.

Regional comparison

In the western India-based Jalna market, rebar and HMS 80:20 prices fell by INR 100/t d-o-d to INR 48,700/t and INR 31,800/t. Meanwhile, billet prices decreased by INR 200/t to INR 42,700/t. Finished steel trading activity softened compared to recent sessions, and prices are expected to remain largely stable in the near term. Scrap arrivals at current price levels are sufficient to meet mills production requirements.

Outlook

Near-term market fundamentals suggest a largely stable trend in domestic steel and scrap prices. While rebar demand remains moderate and payment cycles have improved, lending some support to sentiment, limited imported scrap availability and captive use of sponge iron are keeping scrap prices firm. That said, mills are adopting a cautious procurement approach amid comfortable stock levels, which may cap further price appreciation. Price movements are therefore expected to remain restricted within INR +/- 200-500/t.