India: BigMint's ferrous scrap index hits 6-week low amid surplus scrap arrivals

...

- Weak demand, rising steel inventories weigh on scrap prices

- Tight liquidity, market uncertainty limit imported scrap trade

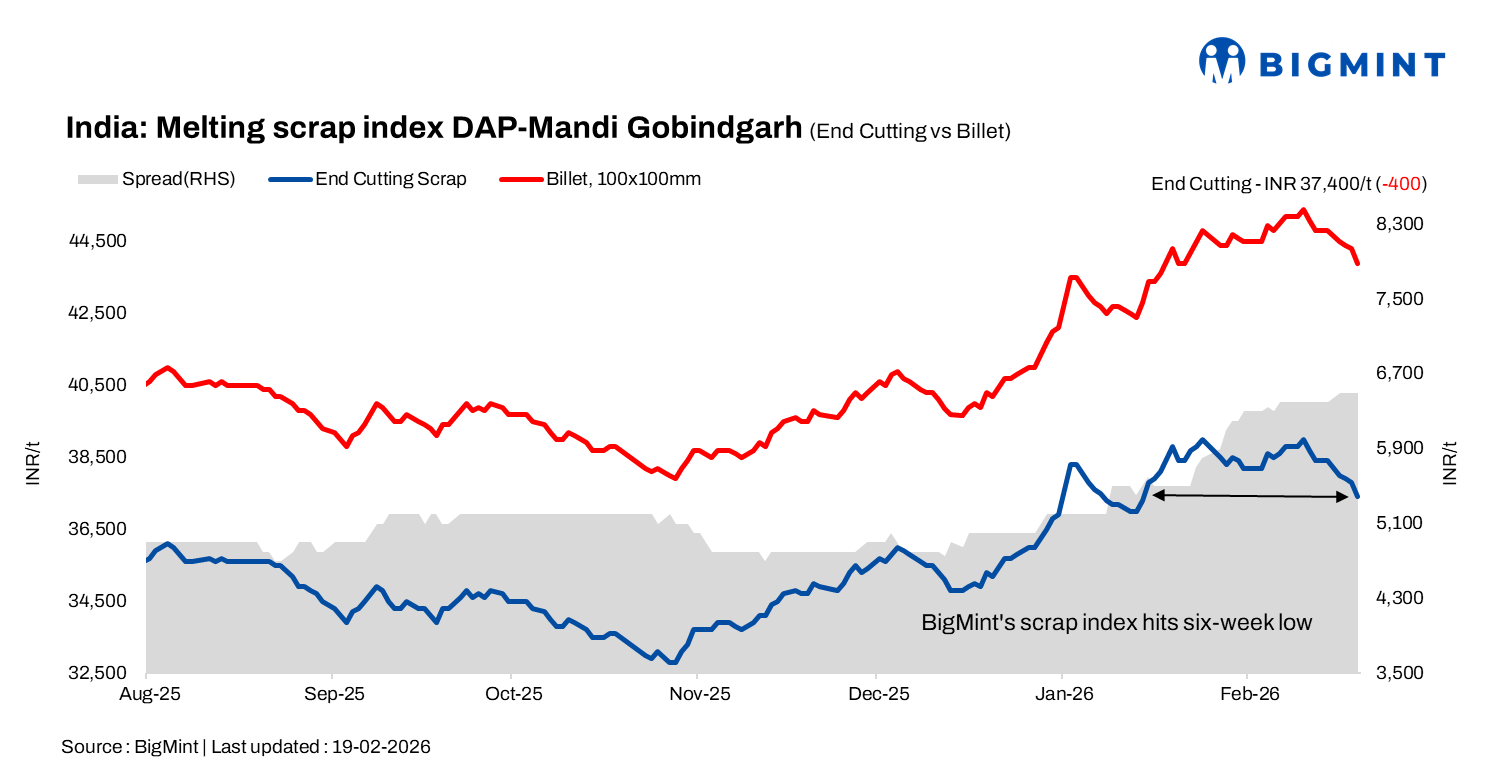

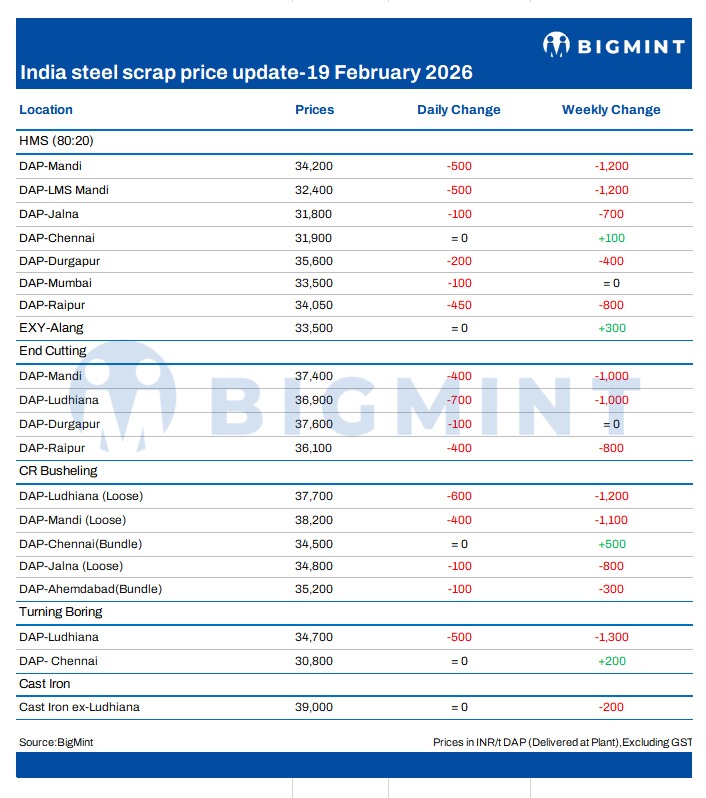

BigMint's domestic end-cutting scrap index, tracking the Mandi Gobindgarh market, decreased by INR 400/tonne (t) d-o-d to INR 37,400/t DAP on 19 February 2026. In Mandi Gobindgarh, India's key secondary steel market, steel scrap prices reached a six-week low due to excessive arrivals of domestic scrap from neighbouring states. Limited demand from steel buyers, compounded by inventory pressures on key mills from slowed finished steel sales, further depressed scrap prices amid overall subdued market momentum.

A mill owner informed BigMint, "The imported scrap market remained muted due to ample availability of domestic steel scrap. Additionally, persistent liquidity challenges and market uncertainty kept imported scrap buyers on the sidelines."

Alternative raw material prices

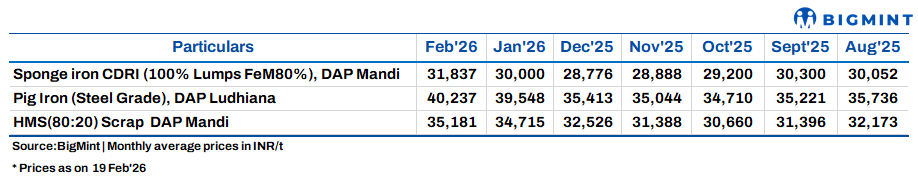

Sponge iron (CDRI) prices dipped by INR 100/t d-o-d to INR 32000/t DAP, while steel-grade pig iron decreased by INR 200/t to INR 40,000/t DAP.

Steel market

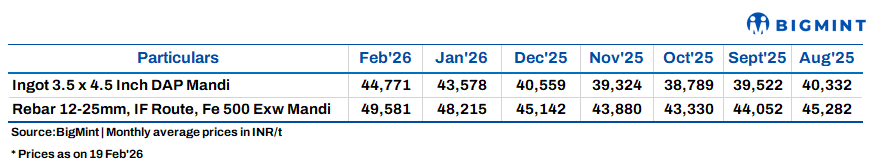

Semi-finished steel (ingot) prices in Mandi Gobindgarh declined by INR 400/t d-o-d to INR 43,900/t DAP. Other major production hubs saw decreases of INR 100-600/t in today's trading session. Ingot prices in Muzaffarnagar witnessed the largest d-o-d fall of INR 600/t today.

Rebar (Fe500) prices in Mandi Gobindgarh fell INR 400/t d-o-d to INR 48,700/t ex-works. Over the last eight working days, the cumulative price drop reached INR 1,200/t, driven by mounting inventories and persistently weak demand from buyers.

HR strip (patra) prices in Mandi Gobindgarh declined INR 300/t d-o-d to INR 45,100/t ex-works.

Overview of Mumbai market

Rebar (Fe 500) prices on the Mumbai IF route decreased by INR 200/t d-o-d to INR 49,400/t ex-works. Trading activity remained dull, as buyers waited for further clarity regarding market directions. On the raw material front, semi-finished billet prices decreased by INR 300/t to INR 43,000/t. HMS (80:20) was assessed at INR 33,500/t DAP, while the scrap-billet conversion spread stood at around INR 9,500/t.

Price highlights

End-cutting to billet spread: In Mandi, the spread between end-cutting scrap and billets stood in the range of INR 6,400-6,700/t

Domestic vs imported scrap: Imported melting scrap prices at Nhava Sheva Port were assessed at $348/t, approximately INR 34,020/t (inclusive of freight). HMS (80:20) prices in Mumbai fell by INR 100/t to INR 33,500/t DAP. Indicative prices of shredded from Europe stood at $373/t CFR Nhava Sheva.

Raipur sponge iron-billet spread: The conversion spread (margin) between pellet-based DRI (P-DRI) and steel billets in Raipur stood at INR 13,400/t.

To provide feedback on this index or if you would like to contribute by becoming a data partner, please contact - support@bigmint.co

To check BigMint's melting scrap assessment, pricing methodology, and specification documents, click here.