Weekly round-up: Global ferrous scrap offers remain firm; Turkiye slows, Asia sees moderate activity

...

- Weak rebar sales, Eid limit buying by Turkish mills

- India's scrap demand rises, but buying remains low

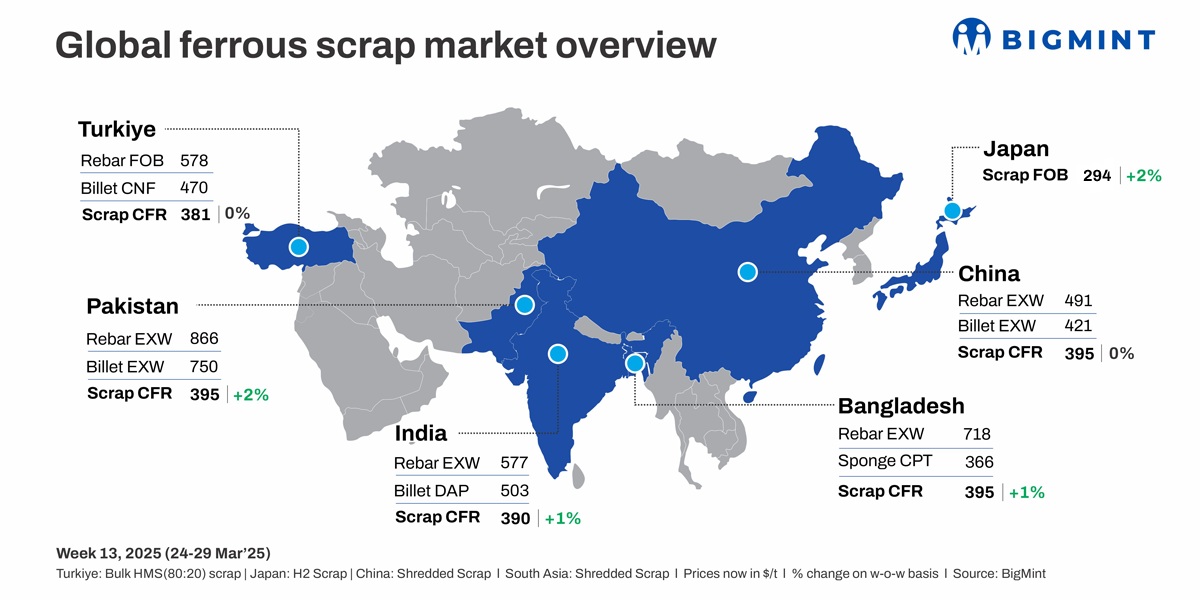

Global ferrous scrap offers remained positive this week, led by trends in Turkiye and supply shifts. Shredded prices in Bangladesh and India rose 1%, while Pakistan faced weak demand due to LC issues. Japan's H2 export offers climbed up, as Tokyo Bay exporters raised offers, aligning with rising seaborne prices. However, Vietnam and South Korea saw limited activity amid stable pricing.

Turkiye: Imported scrap prices remained stable, with US-origin HMS 80:20 at $381/t CFR. However, market sentiment softened, as scrap availability rose while demand stayed weak. Economic uncertainty, slow rebar sales, and tariff concerns pressured prices.

Mills held back from purchases amid weak rebar sales, political unrest, and the Eid holidays. Sellers maintained firm offers, but buying interest was low.

Buyers sought lower prices, while US suppliers held at $384-385/t CFR. Demand for EU-origin scrap weakened amid the currency depreciation, leading to softer bids. Some mills also considered production cuts due to rising costs.

India: The imported scrap market remained moderate, with demand for scrap improving w-o-w, but cost-effective domestic sponge iron and scrap restricted trades. However, eventually, early-week restocking interest faded amid firm supplier offers and fiscal year-end closures. These factors kept trade volumes for imported material low overall.

Shredded prices edged up by 1% to $390/t CFR from $385/t, driven by Turkish market trends. Initial deals were closed at $385/t CFR, but later, offers climbed up to $390-395/t CFR, limiting buying activity.

HMS 80:20 from the UK/Europe and West Africa saw offers rise to $365-375/t CFR from $355-365/t, but buyers resisted above $360-365/t, slowing down transactions.

Sellers preferred Pakistan, where prices were higher at $405-410/t CFR.

An estimated 9,000-10,000 t of scrap were booked during the week, including 3,000-3,500 t of HMS 80:20 at $355-367/t CFR, 1,000-1,500 t of shredded at $390-395/t CFR, and 750-1,000 t of HMS 1 at $378-384/t CFR. Additionally, 1,500-2,000 t of handloaded HMS were traded at $377-380/t CFR, while 2,000-2,500 t of bonus (bulk partial) were booked at $402/t CFR. Smaller lots of HMS bundle mix, LMS, Blue Steel, and HMS-PNS were also booked.

Pakistan: Imported scrap demand remained weak due to liquidity issues, weak steel demand, and ample local scrap. Rising freight costs, currency volatility, and Turkiye's trends added uncertainty. Mills operated at reduced capacity during Ramadan and ahead of Eid.

UK/EU-origin shredded offers rose to $395-400/t CFR Qasim, but tradable levels stayed around $390-395/t. Despite weak demand, UK shredded scrap rose 2% to $395/t CFR Pakistan.

Limited letter of credit (LC) approvals and tight liquidity kept buying low. While activity may resume post-Eid, high global prices and LC constraints could limit recovery.

Bangladesh: The imported scrap market saw a moderate uptrend, with shredded prices rising 1% to $395/t CFR. Buyers remained cautious due to Ramadan and earlier purchases, creating a $5-7/t bid-offer gap. Demand for UK/Europe-origin material weakened, as mills favoured nearshore suppliers such as Australia and Hong Kong. Deals for Australian shredded and PNS from Hong Kong were at $390/t CFR, while HMS 80:20 bids stood at $364-365/t CFR.

Limited LC approvals kept domestic prices firm, but with Eid approaching and a 10-day halt in securing new LCs, prices may stabilise. Deep-sea bookings resumed from the US West Coast, but HMS 80:20 bids at $370-380/t CFR remained below offers of $390-400/t CFR.

Post-Eid, mills are expected to return to the market gradually, though a strong rebound remains uncertain. Sellers tracked Turkish trends, while buyers monitored financial constraints and demand recovery.

Japan: H2 scrap export offers rose, driven by Tokyo Steel's price hikes. BigMint assessed H2 offers at JPY 44,300/t ($294/t) FOB Tokyo Bay, up JPY 800/t ($5/t) w-o-w.

Rising seaborne tags drove adjustments, though suppliers remained cautious amid uncertain price direction. Domestic FAS collection prices for H2 stood at JPY 41,000-42,000/t ($272-279/t).

Additionally, Tokyo Steel raised Utsunomiya's scrap prices by JPY 1,000/t ($7/t) to JPY 41,000/t ($272/t) on 26 March, while keeping prices stable at other plants.

Vietnam: The imported scrap market remained stable as mills preferred domestic scrap due to competitive pricing. Japanese H2 offers stood at $335-345/t CFR, but buyers held at $325-330/t CFR. US-origin HMS 80:20 at $370/t CFR saw limited interest due to high import costs and exchange rate pressures.

Domestic H1 scrap ranged within VND 8,300-9,100/t ($325-356/t) DDP, while rebar prices rose by VND 100/t ($4/t) to VND 13,450/t ($526/t) exw. However, construction sector demand remained moderate.

South Korea: Imported scrap arrivals rose to 53,500 t in late March from 50,713 t mid-month, driven by steady mill demand. Bar steel firms took 49.5%, while special steel sheet firms took 50.5%. Hyundai Steel led with 22,500 t, followed by SeAH Besteel at 21,000 t.

Despite this, seaborne demand remained weak due to low mill operations, sluggish rebar sales, and bearish construction sentiment. Rising domestic scrap inventory from mills' production cuts added further pressure.