Weekly coal report: SA portside trends mixed, Indonesian prices volatile (week 13, 2025)

...

- Supply disruptions impact Indonesian prices

- SECL auction may put pressure on Indian prices

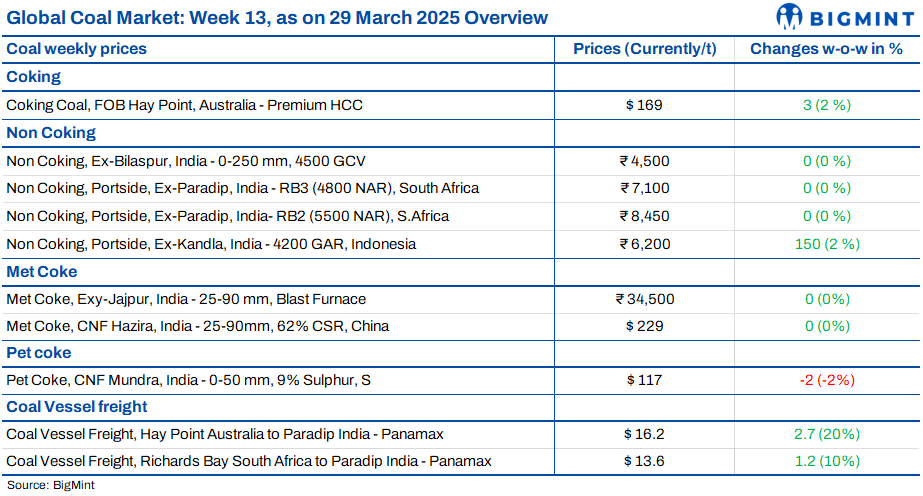

Portside South African thermal coal prices showed mixed trends, remaining stable at some ports while others saw increases. However, trading activity remained subdued. Indonesian thermal coal prices remained volatile due to supply disruptions, but fresh cargo arrivals post-Holi may ease prices. Domestic coal prices remained stable, but SECL's upcoming auction could push rates lower due to surplus supply. Met coke prices stayed unchanged amid slow trading, with potential support from the steel sector. Thermal coal stocks at Indian ports declined slightly, while rising coal vessel freight rates indicate increased seasonal demand and limited vessel availability.

SA offers mixed; Indian sponge prices range-bound

Portside South African thermal coal prices in India showed mixed trends w-o-w. RB2 (5500 NAR) remained steady at INR 8,450/t exw-Gangavaram, while RB3 (4800 NAR) stayed at INR 7,100/t exw. However, at Paradip, RB2 rose to INR 8,500-8,600/t exw, and RB3 increased to INR 7,350/t exw, though no deals were concluded. Thermal coal inventories at Indian ports dipped by 0.9% w-o-w to 11.72 mnt, with stocks dropping at Vizag, Gangavaram, and Mundra. Meanwhile, South African RB2 export offers declined by $0.50/t to $75.50/t FOB, while RB3 rose by $1/t to $59.50/t FOB. Indian sponge iron prices fell marginally by INR 50/t w-o-w to INR 27,350/t exw-Rourkela.

Indonesian prices volatile; Indian power plants' stocks up

Portside Indonesian thermal coal prices in India fluctuated w-o-w due to supply disruptions. At Kandla, 5000 GAR remained steady at INR 7,800/t, while 4200 GAR rose by INR 150/t to INR 6,200/t. At Navlakhi, 3400 GAR stayed at INR 4,950/t, but 4200 GAR increased by INR 200/t at Vizag to INR 6,100/t. Prices may ease post-Holi as fresh cargo arrives. Meanwhile, coal stocks at Indian power plants rose to 56.87 mnt on 27 March, up from 55.85 mnt on 19 March. Indonesian 5800 GAR coal fell by $1 to $84.13/t, while 4200 GAR dipped slightly to $49.66/t. The Ramadan holidays in Indonesia may impact shipments, adding short-term volatility to global coal markets.

Domestic prices stable; SECL auction may boost supply, lower rates

India's domestic coal prices saw minimal fluctuations w-o-w. The 4500 GCV grade remained unchanged at INR 4,500/t, while 5000 GCV dropped slightly by INR 50/t to INR 4,950/t exw-Bilaspur. The minor price dip reflects stable supply conditions. Meanwhile, South Eastern Coalfields Limited (SECL) is set to auction 2.5 million tonnes (mnt) of non-coking coal on 29 March 2025. The increased availability post-auction could exert downward pressure on prices if demand remains subdued. Industries relying on non-coking coal may benefit from lower procurement costs, depending on the auction's outcome and subsequent market sentiment.

Indian met coke prices stable amid slow trades

India's domestic met coke prices remained largely unchanged w-o-w, with 25-90 mm BF grade coke assessed at INR 34,500/t exw-Jajpur and INR 32,300/t exw-Gandhidham. Trades were slow ahead of the fiscal year-end, though western India saw decent demand from foundry players. Meanwhile, China's met coke prices stabilised after 11 consecutive cuts. The market is expected to remain stable, with potential price support from the steel sector.

Imported pet coke dip; US sanctions may limit further fall

Imported pet coke prices into India dropped by $1-2/t w-o-w. West coast offers declined to $117-118/t CFR, while east coast prices stood at $119-120/t CFR. However, Saudi pet coke prices remained stable as increased Chinese buying offset US pet coke tariffs. Despite the recent decline, prices may stabilise in the coming days as US sanctions on China-linked vessels restrict global shipping capacity, potentially limiting further price reductions.

India's coal freights rise on demand, vessel shortage

Coal freight rates in India increased w-o-w due to limited Panamax vessel availability in the Pacific region. Higher coal imports ahead of peak summer and steady demand from steel and cement industries have pushed rates higher. Freight for the Australia-India routes rose by $1.2/t to $16.2/dmt, while South Africa-India rates inched up by $0.2/t to $13.6/t. Indonesia-India freights also increased by $0.3/t to $14.2/t. Meanwhile, thermal coal inventories at Indian ports declined by 0.9% w-o-w to 11.72 mnt. The Baltic indices showed mixed trends, with the Baltic Dry Index (BDI) falling by 26 points, while the Baltic Panamax and Supramax indices recorded weekly gains. Freight rates may stay firm amid ongoing vessel shortages.