South Asia: Imported scrap buying in Pakistan, Bangladesh slows down ahead of Eid

...

- India cautious amid year-end closures

- Turkish mills delay scrap purchases

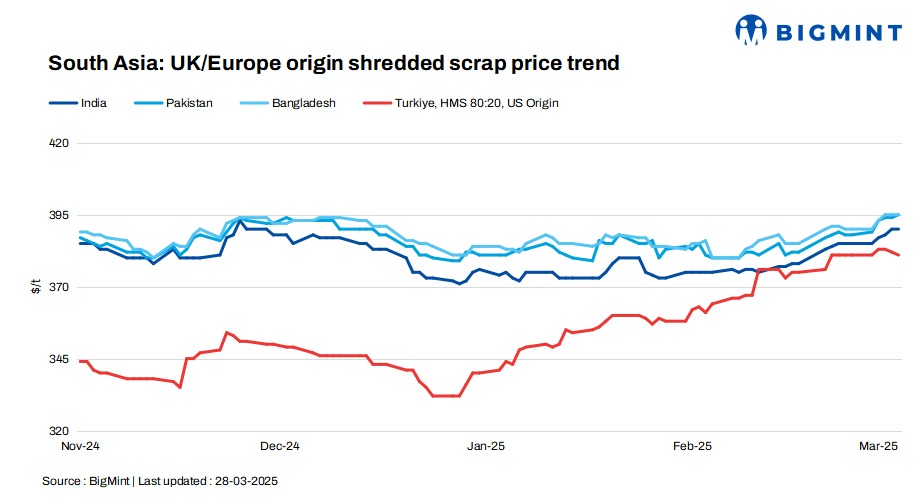

South Asia's imported scrap markets remained sluggish as buyers in India, Pakistan, and Bangladesh grappled with weak demand, financial constraints, and pre-Eid slowdowns. In India, financial year-end closures kept buyers cautious despite some early-week optimism.

Pakistan saw muted activity as buyers awaited market clarity post-Eid, with liquidity issues further dampening sentiment. Bangladesh faced resistance to high offers, with buyers holding back amid limited LC approvals and economic uncertainty.

Meanwhile, Turkiye's scrap market continued its downtrend as mills delayed purchases, citing weak domestic rebar demand. With Eid holidays approaching, market participants anticipate a gradual recovery, though high global scrap prices and economic instability may cap any strong rebound.

Overview

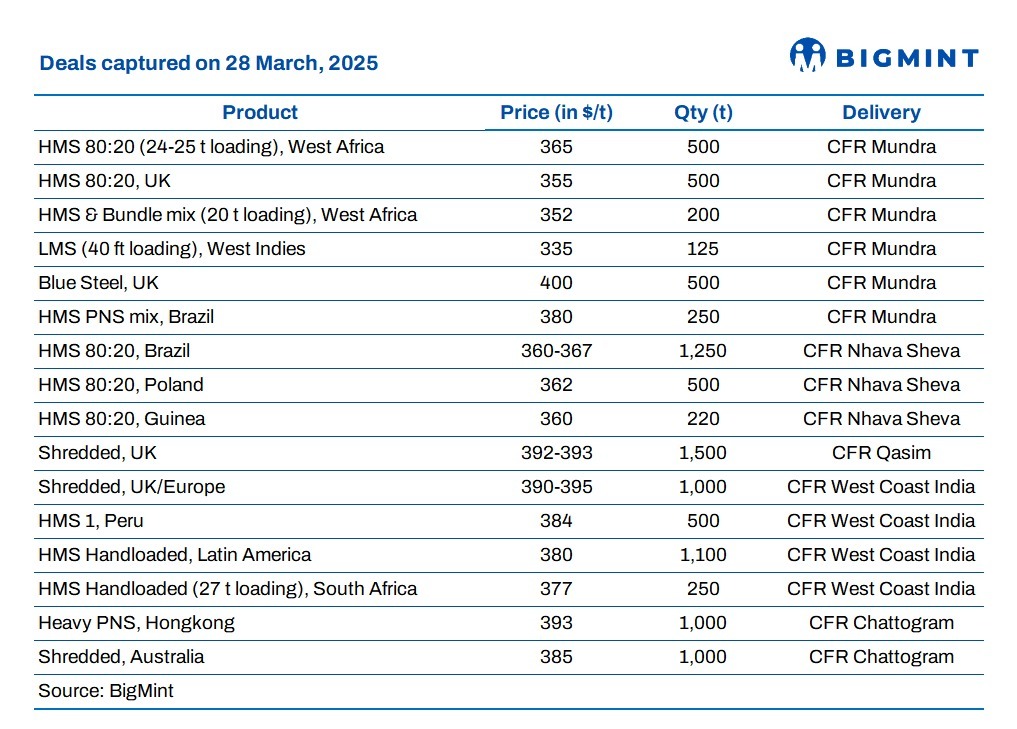

India: India's imported scrap market remained slow today as financial year-end closures kept buyers cautious. In northern, brief optimism led to ample bookings at the beginning of the weel, while Nhava Sheva buyers saw prices rise by $5-7/t. However, overall trade remained slow due to bid-offer mismatches. Shredded scrap offers stood at $390-395/t CFR, but buyers held firm at $385-388/t, limiting transactions.

HMS 80:20 from UK/Europe and West Africa was quoted at $365-375/t CFR, though buyers aimed for $360-365/t.

Pakistan: Pakistan's imported scrap market remained muted as buyers stepped back ahead of Eid, adopting a wait-and-watch approach. UK-origin shredded offers climbed to $395-400/t CFR Qasim, but tradable levels stayed around $390-395/t.

Domestic scrap prices ranged between PKR 140,000-145,000/t, while rebar stood at PKR 240,000-245,000/t.

Mills continued to operate at reduced capacity, with liquidity constraints and LC issues further dampening transactions. While market activity is expected to improve post-Eid, high global scrap prices and economic uncertainty may limit a sharp recovery.

Bangladesh: Bangladesh's imported scrap market remained sluggish as buyers resisted high offers, creating a $5-7/t bid-offer gap. Limited LC approvals had previously kept domestic scrap prices firm, but with a 10-day halt in new LCs ahead of Eid, prices may soften.

K/Europe-origin scrap demand weakened as mills preferred nearshore suppliers.

While deep-sea bookings resumed from the US West Coast, bids for HMS 80:20 remained at $370-380/t CFR against offers of $390-400/t CFR. Market sentiment remains weak amid political uncertainty and slow infrastructure spending, with activity expected to pick up post-Eid.

Turkiye: The Turkish imported scrap market continued its downward trend as mills hesitated to restock amid weak domestic rebar sales. Despite ample cargo availability, demand remained subdued, leading to a further drop in prices. US-origin HMS 80:20 was assessed at $381/t CFR, down $1/t, with most offers below $382/t CFR. EU-origin HMS 80:20 hovered around $372-373/t CFR.

A weakening euro hinted at softer European scrap offers ahead. Market players expected further price declines, with mills likely delaying purchases until after the Eid holiday, while LME scrap futures signaled a bearish outlook for the near term.

Price assessments

India: UK-origin shredded indicatives were assessed at $390/t CFR Nhava Sheva, unchanged d-o-d.

Pakistan: UK-origin shredded indicatives stood at $395/t CFR Qasim, up by $1/t d-o-d.

Bangladesh: UK-origin shredded indicatives remained unchanged d-o-d to $395/t CFR Chattogram.

Turkiye: US-origin HMS (80:20) bulk scrap prices were assessed at $381/t CFR Turkiye, down by $1/t d-o-d