India: Imported SS scrap prices remain range-bound w-o-w

...

- Minimal trading activities seen amid FY'25-end

- Scrap demand, prices likely to pick up in Apr-May

India's imported stainless steel (SS) scrap prices remained range-bound w-o-w amid minimal trading activities and need-based buying.

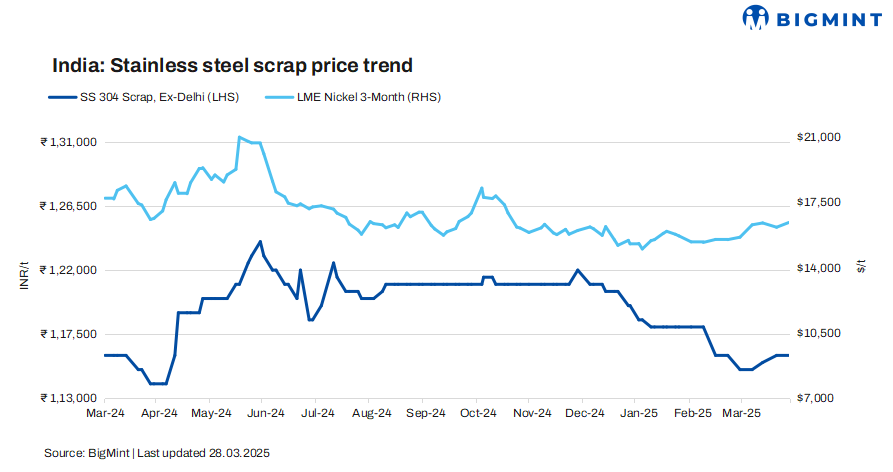

As per BigMint's assessment, domestic 304-grade SS scrap stood at INR 116,000/t ex-Delhi, stable w-o-w, while the imported variant of the same, originating from nearshore regions, was priced at $1,300/t CFR Mundra, up $25/t w-o-w.

LME nickel prices up

At the time of reporting, three-month LME nickel prices stood at $16,425/t, slightly up by 1.5% from last week's $16,170/t. Meanwhile, nickel stocks in LME-registered warehouses stood at 201,300 t, largely stable against the previous week's 200,676 t.

BigMint's daily assessments

- Nearshore-origin SS 316 scrap (loose) was at $2,490/t, up $25/t w-o-w.

- Nearshore-origin SS 201 scrap (loose) was at $685/t, down $5/t w-o-w.

- Nearshore-origin SS 430 scrap (loose) was at $585/t, down $5/t w-o-w.

- SS 316 scrap, ex-Delhi, stood at INR 215,000/t, up INR 500/t w-o-w.

Market scenario

According to market participants, the movement of finished steel has been slow, primarily due to the financial year-end.

One participant noted, "Activity in the market remains sluggish, especially in stainless steel finished products. With the financial year wrapping up in March, we do not expect any major trades in the near term. This is the key factor behind the overall market dullness."

In the imported scrap market, offers remained on the higher side, with SS 304 scrap originating from nearshore regions being quoted at $1,300-1,310/t, while bids were assessed at $1,270-1,280/t. Offers for SS 316 were heard at $2,500-2,520/t and bids at $2,470-2,480/t CFR Mundra.

Outlook

Market expectations point to increased demand for finished stainless steel products in April and May, driven by project-based work, particularly in the western region. This could support a potential price rebound for scrap following the end of the financial year.