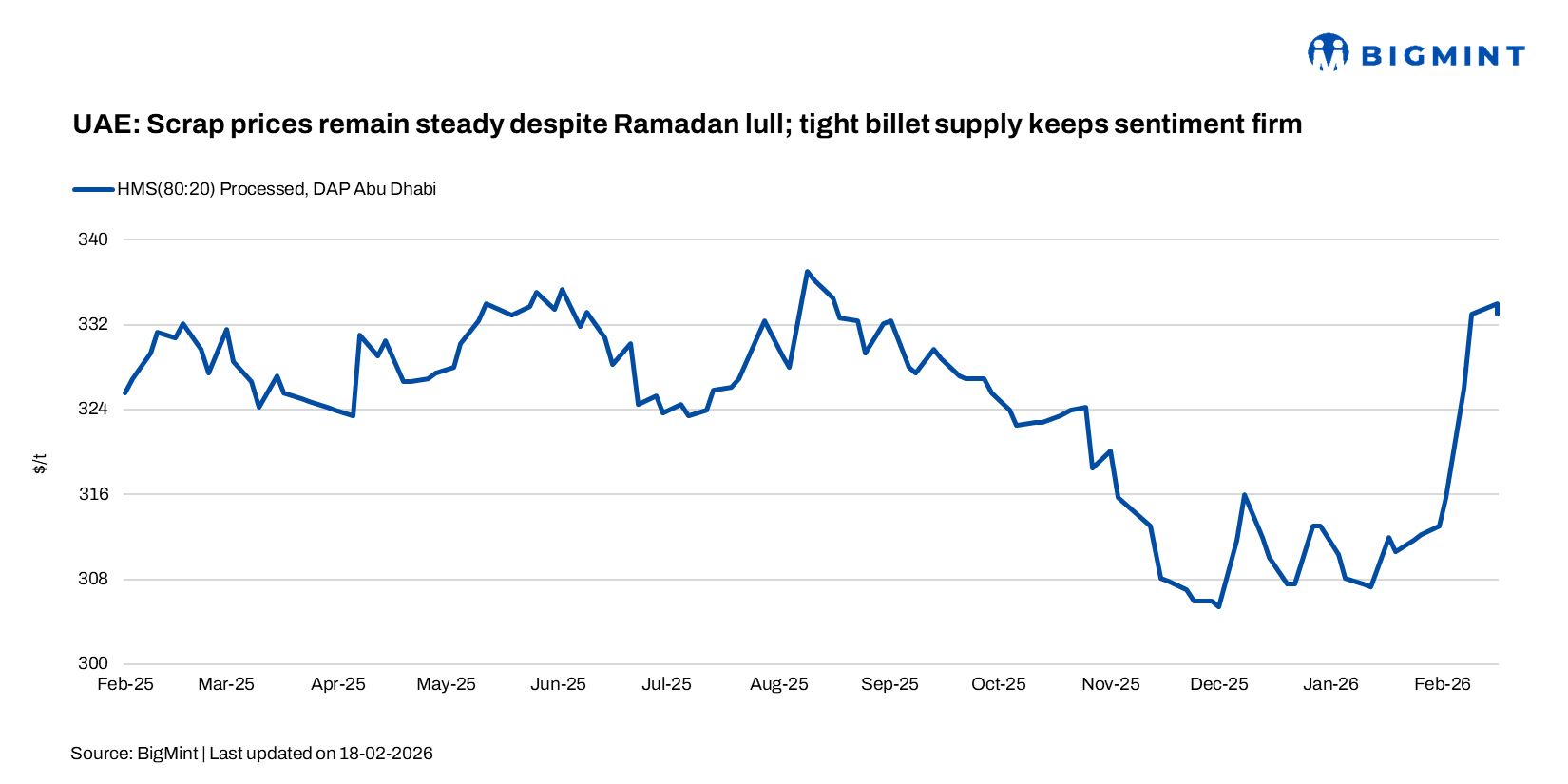

UAE: Scrap prices remain steady despite Ramadan lull; tight billet supply keeps sentiment firm

...

- Subdued mill buying caps scrap upside

- Firm rebar sales tighten billet availability

Scrap prices in the UAE remained largely steady w-o-w as of 18 February, easing marginally by AED 1/t ($0.3/t) w-o-w to AED 1,222/t ($333/t) amid muted mill buying during Ramadan and weak export demand to Pakistan. Spot liquidity stayed thin, with most traders and recyclers adopting a wait-and-watch approach as finished steel demand slowed. However, tight billet supply supported market sentiment, contributing to the stability in pricing.

Market participants indicated that major induction furnace and EAF-based mills curtailed active procurement, citing adequate raw material inventories. "Scrap buying is strictly need-based; mills are not building positions during Ramadan," a local trader said.

The following prices were heard in the market (excluding 5% VAT):

- LMS: AED 920-940/t ($251-256/t).

- HMS super: AED 1,150-1,170/t ($313-319/t).

- HMS sheared (processed): AED 1,220-1,225/t ($332-334/t).

- PNS unprocessed: AED 1,190-1,200/t ($324-327/t); processed: AED 1,220-1,230/t ($332-335/t).

Export market

In the export segment, UAE-origin fabrication scrap was booked at $375/t CFR Qasim for a 2,000-t cargo, while HMS 80:20 was heard at $365/t CFR Qasim for a 250-t lot. Subdued buying sentiment from Pakistani mills, with procurement remaining cautious amid weak finished steel demand during Ramadan.

UAE billet availability tightens as rebar sales accelerate

Firm rebar sales in the UAE lifted billet demand, but prompt supply with domestic and GCC mills was limited. This pushed re-rollers to rely on traders for spot cargoes.

Asian ECAS (Emirates Conformity Assessment Scheme)-certified billet was heard at $470-480/t CFR, broadly stable m-o-m, with minor variations depending on origin and shipment size. Tight inventories and rebar backlogs are expected to keep billet sentiment firm in the near term.

Selective buying supports UAE HRC activity during Ramadan

Despite the typical Ramadan slowdown, selective buying by hot-rolled coil (HRC) consumers continued in the UAE market, reflecting cautious but persistent demand for competitively priced prompt cargoes.

An Indian supplier sold HRC at $505-515/t CFR UAE, about $10/t below initial offers. The cargo was the last prompt full-vessel shipment for late March-early April, which supported the deal price despite subdued market activity.

Outlook

Scrap prices are likely to remain stable in the coming days, with Ramadan-induced demand softness offsetting firm billet and rebar fundamentals. A clearer direction may emerge post-Ramadan as mills reassess raw material restocking needs.