India: Dry bulk coal freight rates stay firm w-o-w on tight tonnage, outlook optimistic

...

- Freight rates firm w-o-w on tight tonnage and higher bunkers

- Pacific Panamax gains offset subdued overall fixture activity

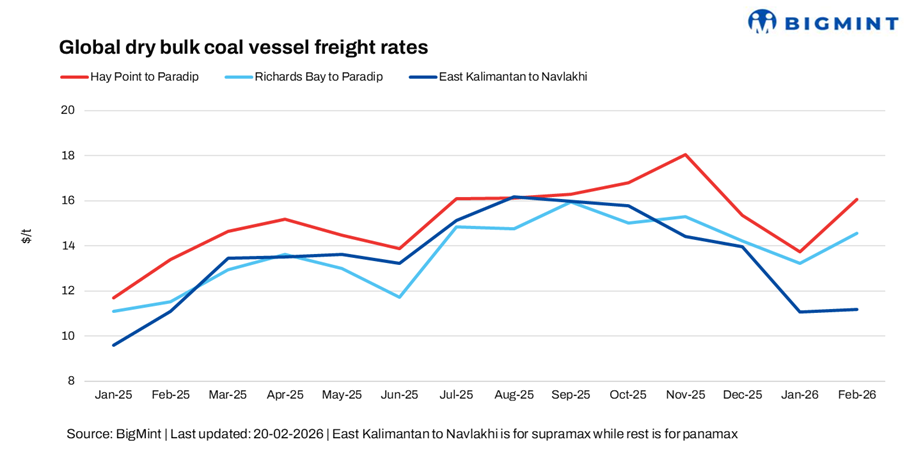

Dry bulk coal freight rates to India remained supported this week across the Pacific and Atlantic basins on higher bunker prices, firmer FFA rates and a supportive Baltic Dry Index; however, limited fixture activity kept overall sentiment subdued.

"Asia-Pacific Panamax freight rates strengthened, supported by a positive Pacific basin outlook, particularly in Australia, amid healthy demand for early March loadings. FFA rates advanced during Asian trading hours, while bunker prices recorded a sharp uptick", mentioned a source.

A ship-broker told, "Asia-Pacific Supramax freight rates strengthened as tonnage availability tightened amid regional holidays."

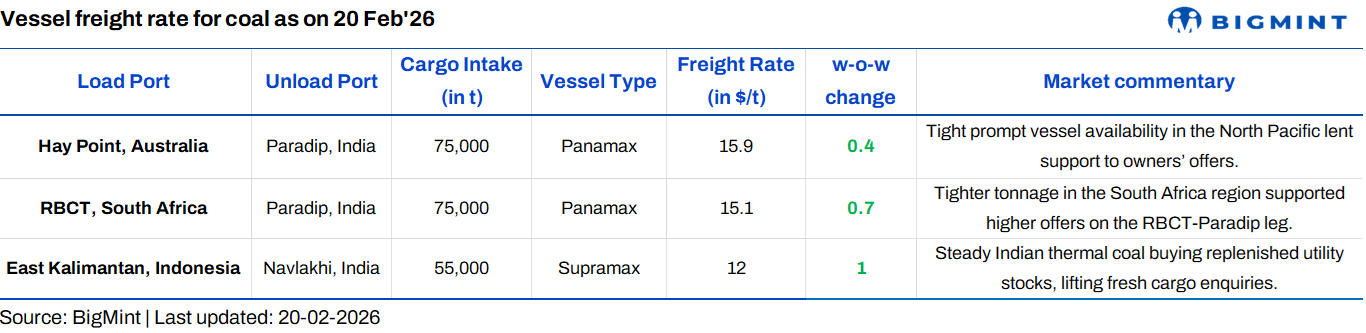

Route-wise updates

Market highlights

- Brent crude oil futures surge w-o-w: Brent crude oil futures gained around $4.04/bbl w-o-w to $70.95/bbl for May 2026 contract on 20 February, supported by renewed geopolitical tensions, expectations of tighter global supply, and improved demand outlook from major consuming economies.

- Higher bunker prices underpin dry bulk freight rates: Rising bunker prices lifted voyage costs this week, underpinning freight rates across key dry bulk segments. Higher fuel expenses kept owners rate expectations firm, particularly on long-haul routes, limiting downside despite moderate cargo enquiries.

- BDI dips w-o-w; Panamax up, Supramax steady: The Baltic Dry Index fell 76 points w-o-w to 2,019 as of 19 February 2026, pressured by weaker Capesize earnings amid slower cargo activity. In contrast, the Panamax index rose 50 points to 1,160 on improved Pacific demand, while the Supramax segment edged down 5 points to 1,160 on limited fresh enquiries.

- DCE coke futures stable w-o-w: DCE coking coal futures for the May 2026 contract remained steady at RMB 1,682/t ($243.46/t) as balanced buying and selling interest kept the market rangebound, with traders awaiting clearer demand signals from the steel sector and no fresh policy triggers to drive price movement.

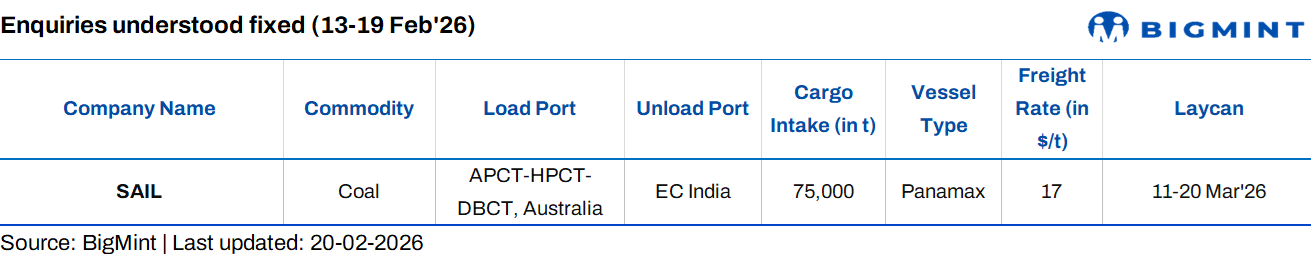

Enquiries understood fixed (13-19 Feb'26)

Outlook

Dry bulk coal freight rates to India are expected to remain supported in the short term on tight tonnage and steady cargo demand as one of the charterer said, "Momentum is building, with rates expected to improve further next week as Chinese participants return to the market."