LME copper stays strong above $10,000/t as demand holds, inventories fall

...

- LME copper closes at $10,050/t, up $100 from 5 Sep

- Inventories across exchanges fall below 200,000 t

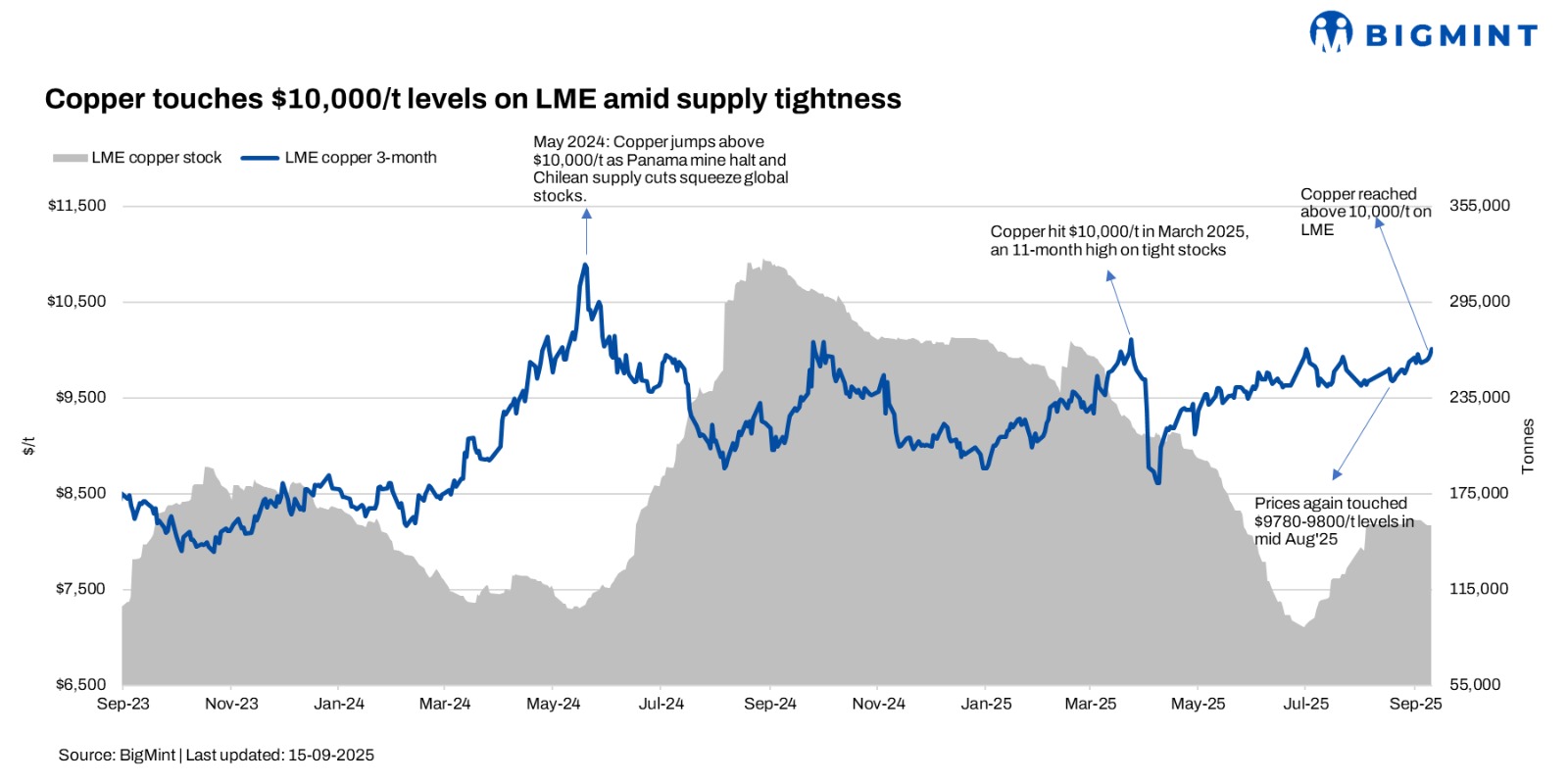

The benchmark three-month copper contract on the London Metal Exchange (LME) closed at $10,050/tonne (t) on 12 September 2025, up by $100/t compared with its settlement on 5 September. The move marks a continuation of bullish sentiment in the red metal, underpinned by both supply constraints and structural demand growth.

Copper inventories in LME warehouses remain historically low, with stocks trending downward in recent months, tightening availability for near-term delivery. Any disruption in major mining regions such as Chile or Peru immediately translates into upward price pressure. Meanwhile, trade measures, including proposed US tariffs on Chinese goods and logistical hurdles in global shipping, have further unsettled supply chains.

One of the biggest drivers remains tightening inventories. LME copper stocks are hovering close to multi-year lows, with visible inventories across exchanges collectively estimated at under 200,000 t -- barely enough to cover a few days of global consumption. This has heightened concerns over supply tightness, particularly with disruptions at Indonesias Grasberg mine and ongoing labour disputes in Chile weighing on production.

Industry consolidation adds momentum

Beyond short-term dynamics, structural shifts are also underway. The recently confirmed US$53 billion Anglo American-Teck Resources merger, forming Anglo Teck, will create one of the worlds top five copper producers, with output projected at 1.2-1.35 mnt annually by 2027. The move is widely seen as a strategic bet on coppers role in electrification, electric vehicles (EVs), and clean energy technologies.

Outlook remains bullish

Looking ahead, analysts expect copper to remain volatile but biased upward, with risks tilted towards tighter supply. The global copper surplus narrowed to just 36,000 t in June from 79,000 t in May, signalling tightening balances. With inventories low, Chinese demand stable, and structural demand drivers strengthening, copper prices are likely to hover near the $10,000/t threshold, with potential for fresh highs if supply disruptions persist or global economic momentum improves into Q4CY'25.