India's ferro chrome output drops 5% y-o-y in CY'25 on weaker ore supply, soft exports

...

- Chrome ore production falls by 6% y-o-y to 3.21 mnt

- Ferro chrome exports edge down 14% y-o-y to 0.49 mnt

- Average domestic high-carbon ferro chrome prices fall by over 4% y-o-y

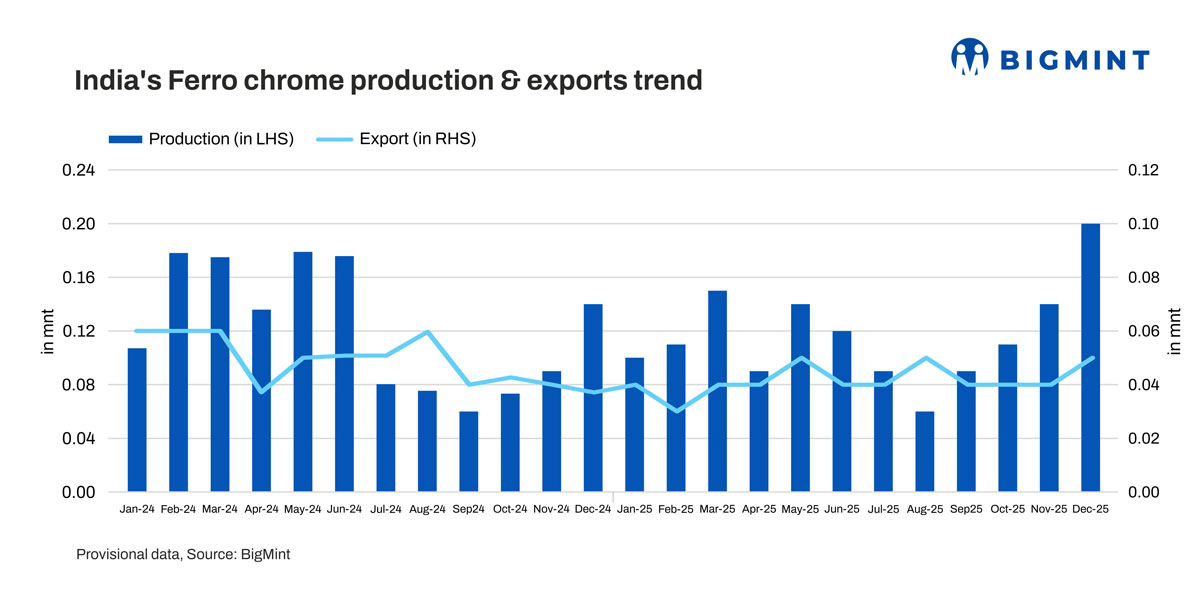

Morning Brief: India's ferro chrome production declined 5% y-o-y to 1.39 million metric tonnes (mnt) in calendar year 2025 (CY'25), down from 1.46 mnt in CY'24, as lower chrome ore availability and weaker export demand weighed on output.

Chrome ore output declines

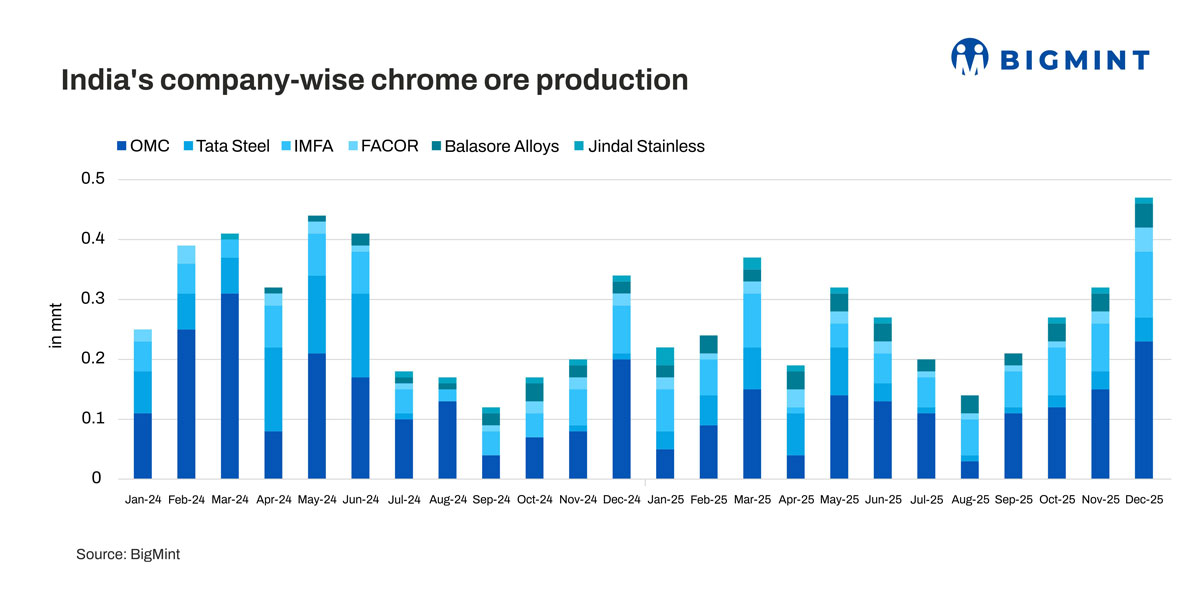

India's chrome ore production fell 6.4% y-o-y to 3.21 mnt in CY'25 compared with 3.43 mnt in CY'24.

State-run Odisha Mining Corporation (OMC), India's largest chrome ore producer, reported a 23% decline in output at 1.35 mnt in CY'25. Extended monsoon disruptions in Odisha curtailed mining activity and logistics, limiting production and dispatches for OMC and other miners. Subdued demand from ferro chrome and stainless steel also dampened offtake.

Tata Steel's output fell by 29% y-o-y to 0.45 mnt in CY'25, as only two of its three chrome ore mines were operational for large parts of the year.

Chrome ore dispatches dropped 9% to 2.94 mnt in CY'25 from 3.23 mnt a year earlier, reflecting weaker downstream consumption. Production of the commonly traded 40%-52% grade ore declined 13% to 1.80 mnt in CY'25 compared with 2.07 mnt in CY'24.

Exports drop on weak Chinese demand

Exports, a key outlet for Indian ferro chrome producers, fell by 14% y-o-y to 0.49 mnt in CY'25, down from 0.58 mnt in CY'24.

China, the largest buyer, reduced imports from India to 0.13 mnt in CY'25 from 0.18 mnt a year earlier, a decline of nearly 28%. At the same time, Chinas domestic ferro chrome production edged up 1% to 8.64 mnt, reducing its reliance on imports.

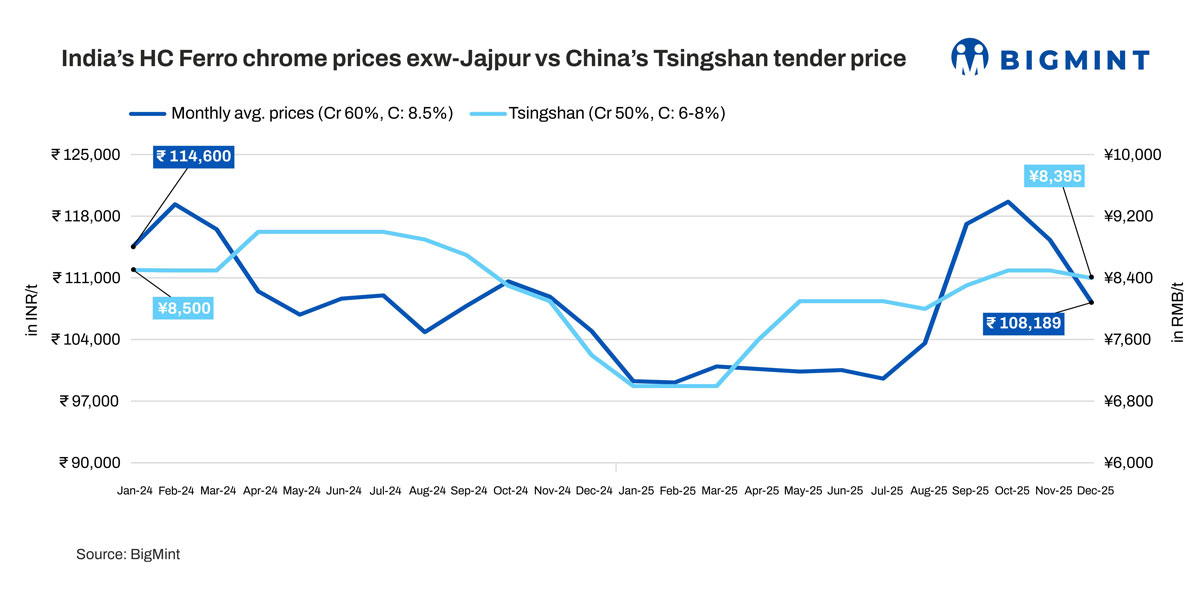

Pricing also weakened. Average monthly tender prices set by China's largest stainless steel producer, Tsingshan Holding Group, fell by about 8% y-o-y to RMB 7,900/t ($1,144/t) in CY'25 from RMB 8,600 ($1,245/t) in CY'24 - a drop of roughly RMB 700/t. Lower benchmark prices reduced realisations for Indian exporters.

Spot export offers to China declined about 7 cents per lb, or 7.4%, to 88 cents per lb CNF China in CY'25, compared with 95 cents per lb a year earlier.

Domestic prices under pressure

In the domestic market, average monthly high-carbon ferro chrome prices fell by about 4.4% y-o-y, or INR 4,800/t, to INR 105,300/t in CY'25.

The decline was driven by soft stainless steel demand, with mills adopting cautious procurement strategies. End-use demand from construction, infrastructure, kitchenware and consumer goods remained uneven. Although some ferro chrome producers undertook output cuts and scheduled maintenance, ample spot availability and steady raw material and energy costs limited any meaningful price support.

Auction prices, particularly from Vedanta-FACOR, also trended lower, with bids dropping around INR 4,800/t y-o-y in CY'25.

Outlook

High-carbon ferro chrome prices in CY'26 are expected to hinge on a recovery in stainless steel demand and supply discipline among producers. Improved export opportunities, especially if stainless steel output and ferro chrome prices strengthen in China, could lift Indian realisations.