India: Ferro chrome prices ease w-o-w on bid-offer gaps, market waits for OMC auction outcome

...

- Base prices rise 13% m-o-m at OMCs chrome ore auction

- Stainless steel prices edge up on rising costs; demand weak

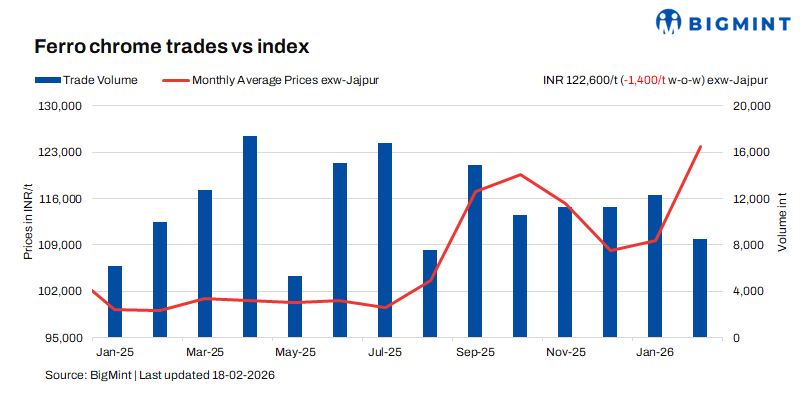

Indian high-carbon ferro chrome (HC 60%, Si: 4%) prices declined by INR 1,400/t ($15/t) on 18 February as compared to the assessment on 11 February. Prices declined, as higher offers no longer found support due to cautious buying from end users. Bid-offer gaps emerged, limiting trade.

As per BigMints assessment on 18 February, high-carbon ferro chrome (HC 60%, Si: 4%) prices in India were at INR 122,600/t ($1,346/t) exw-Jajpur. Deals for nearly 2,400 t were concluded last week in the price bracket of INR 117,000-124,000/t ($1,284-1,361/t) exw.

Low-silicon high-carbon ferro chrome (HC 60%, Si: 2%) prices declined by INR 1,000/t ($11/t) w-o-w to INR 129,000/t ($1,416/t) exw-Jajpur, with around 150 t traded in the price range of INR 129,000-130,000/t ($1,416-1,427/t) exw. However, low-carbon (C: 0.1%) ferro chrome prices increased by INR 6,000/t ($66/t) w-o-w to INR 222,000/t ($2,437/t) exw-Durgapur.

Market summary (12-18 Feb'26)

Prices ease ahead of OMC auction: Domestic ferro chrome prices softened as offers of INR 124,000-125,000/t ($1,361-1,372/t) exw, prevailing earlier, failed to sustain amid cautious buying interest from end users. Market participants were hesitant to conclude deals, largely awaiting clarity on raw material costs from the upcoming chrome ore auction by Odisha Mining Corporation (OMC). As a result, spot availability in the market stayed limited, with sellers refraining from aggressive offers.

OMC is scheduled to auction 114,600 t of chrome ore on 19 February 2026, reflecting a m-o-m increase of 6,200 t in offered volumes. Notably, base prices have risen sharply, with grades above 40% up by 13% (INR 2,598-3,340/t) m-o-m, while below 40% grades increased by 10% (INR 997/t), potentially impacting ferro chrome cost dynamics going forward.

Stainless steel prices edge up amid cost pressures:Prices of stainless steel 304 grade cold-rolled coils (CRCs) went up by INR 3,000/t ($33/t) w-o-w to INR 205,000/t ($2,250/t) exw-Mumbai. Prices rose mainly due to rising alloy costs, especially ferro molybdenum, while overall demand remained weak. Trading activity was moderate, as buyers and sellers continued to differ on price expectations, and volatile nickel futures discouraged aggressive buying.

Mills noted that a demand pick-up, as hoped for after recent trade developments, has not yet materialised, particularly in the longs segment. Prices of finished flats increased, supported by benchmark gains and a mid-February price hike announced by a leading coil producer due to higher global costs and rising molybdenum prices. However, buyers remained cautious, purchasing only for immediate needs.

Chinese markets stayed shut for the Lunar New Year, limiting global price signals. Finished longs prices stayed under pressure with mixed movements, influenced by higher molybdenum costs and falling nickel futures on the London Metal Exchange. Overall, domestic prices may remain firm on cost support, but upside is limited by weak demand.

Merafe resumes ferro chrome production at Lion smelter: Merafe's Lion Smelter has restarted ferro chrome production at 50% capacity on 16February 2026 following a shutdown of around nine months. This follows the National Energy Regulator of South Africa reducing electricity tariffs for a 12-month interim period. The Glencore-Merafe joint venture expects the smelter to return to its full operational capacity by 31 March 2026.

Outlook

The results of OMCs chrome ore auction scheduled for today will determine the ferro chrome price trajectory in the days ahead.