India: Stainless steel prices inch up w-o-w on higher input costs despite slow buying interest

...

- Bid-offer gap, LME nickel volatility weigh on demand

- Major coil producer raises prices by up to INR 4,000/t

Indias stainless steel prices inched higher w-o-w, supported by rising alloy input costs, particularly ferro molybdenum, even as demand remained sluggish across segments. Trading activity was moderate, with a persistent bid-offer gap and volatile nickel futures limiting aggressive bookings. Mills indicated that expectations of demand revival following recent trade developments have yet to materialise, especially in the longs segment.

Finished flats

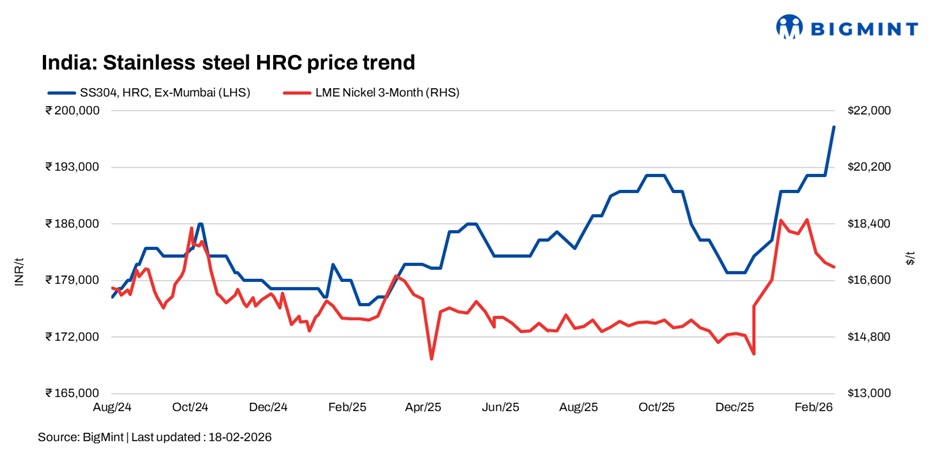

BigMint's benchmark 304 hot-rolled coils (HRCs) stood at INR 198,000/t ex-Mumbai, up by INR 6,000/t, while 316 HRCs stood at INR 348,000/t, up INR 5,000/t w-o-w.

Additionally, India's leading stainless steel coil manufacturer announced a price increase, effective 15 February, driven by global cost pressures and rising molybdenum prices. Revised prices are as follows:

- 304 grade coils & JT coils: +INR 2,000/t

- 316 grade coils: +INR 4,000/t

- 400 series grade coils: + INR 3,000/t

Market participants reported cautious procurement, with buyers restricting volumes to immediate requirements.

On the global front, Chinese markets remained closed due to Lunar New Year holidays, limiting external cues.

Finished longs

Finished longs prices remained under pressure, with BigMint's benchmark assessment for stainless steel 304L (25-100 mm) black round bars at INR 165,000/t ex-Mumbai, stable w-o-w, while SS 316L black round bars were assessed at INR 285,000/t ex-Mumbai, up INR 5,000/t w-o-w.

BigMint's assessment for stainless steel 304L (25-100 mm) bright bars stood at $2,100/t and 316L (25-100 mm) bright bars at $3,600/t, FOB Nhava Sheva.

The market remained highly volatile amid rising molybdenum costs and declining nickel prices on futures.

LME nickel prices

Benchmark three-month nickel prices on the London Metal Exchange (LME) closed at $16,875/t on 17 February, down around 5% w-o-w from $17,940/t on 11 February. LME-registered nickel stocks were reported at 287,730 t,up slightly from 285,750 t in the previous week.

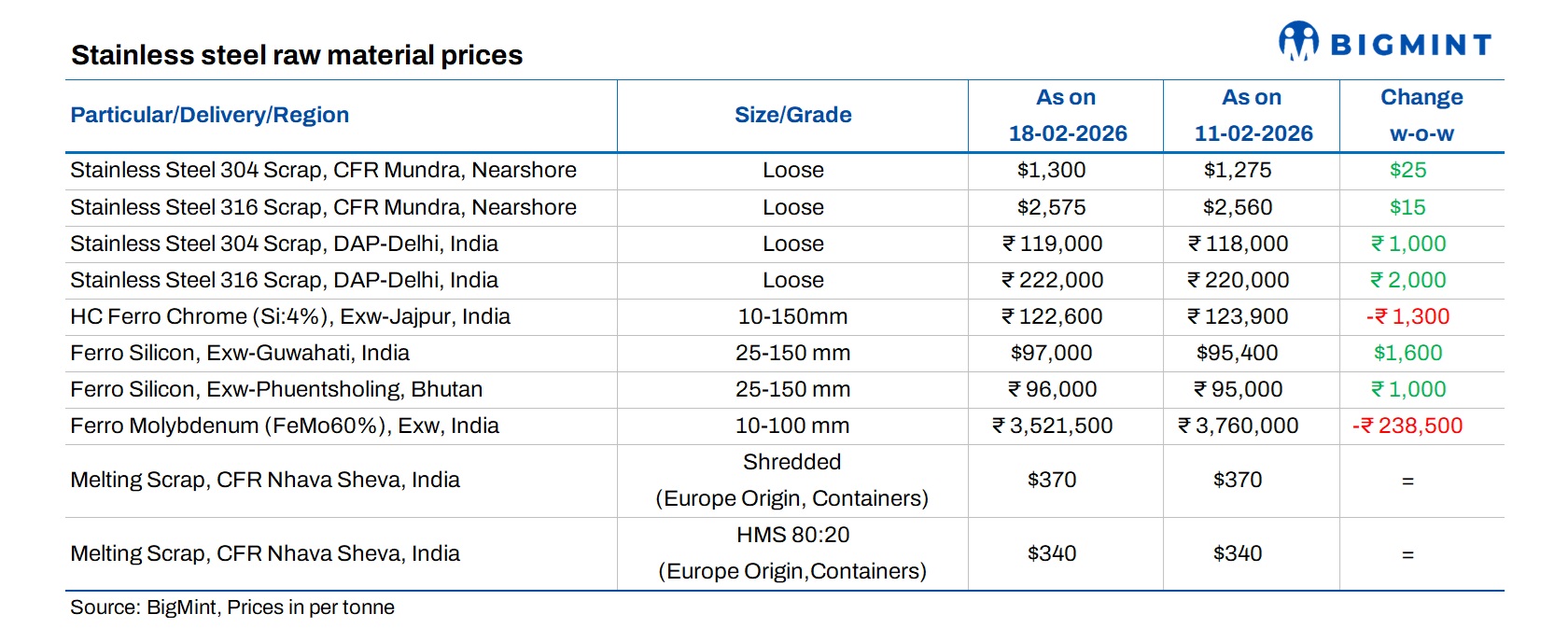

Raw material scenario

Outlook

Domestic stainless prices are likely to remain firm, supported by alloy cost pressures but capped by weak downstream demand and cautious mill buying. Near-term direction will depend on nickel stability, molybdenum availability, and clarity on export enquiries.