India's steel exports surge by over 36% y-o-y in 10MFY'26. Will India turn net exporter in FY26?

...

- Frontloading to avoid CBAM costs drives India's export push to EU

- Volumes to Vietnam surge, exporters explore alternative markets

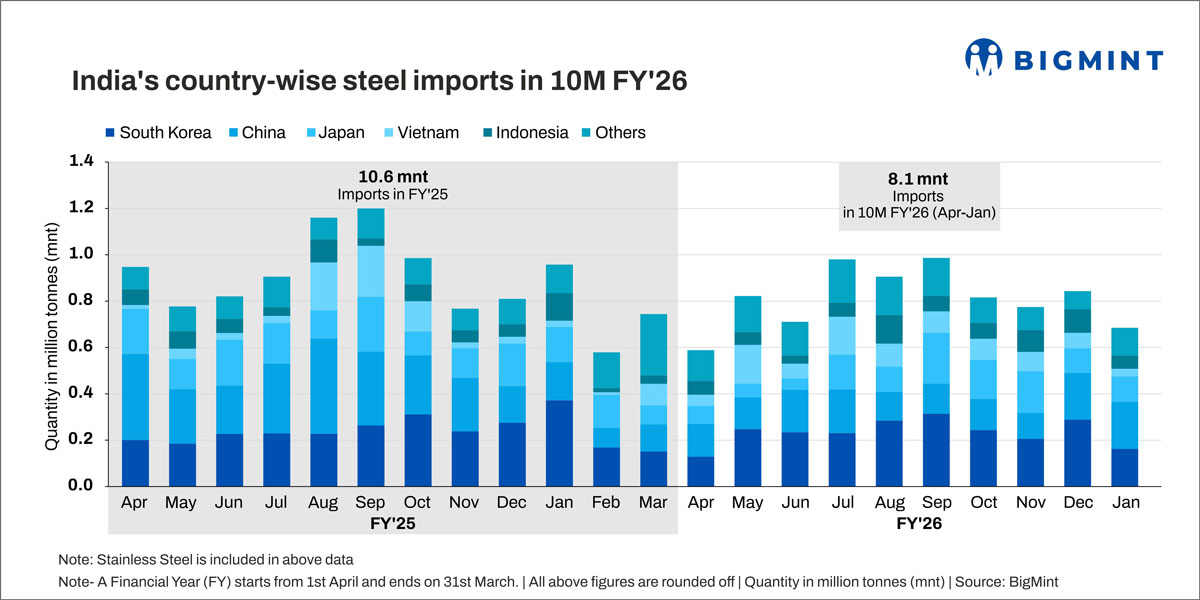

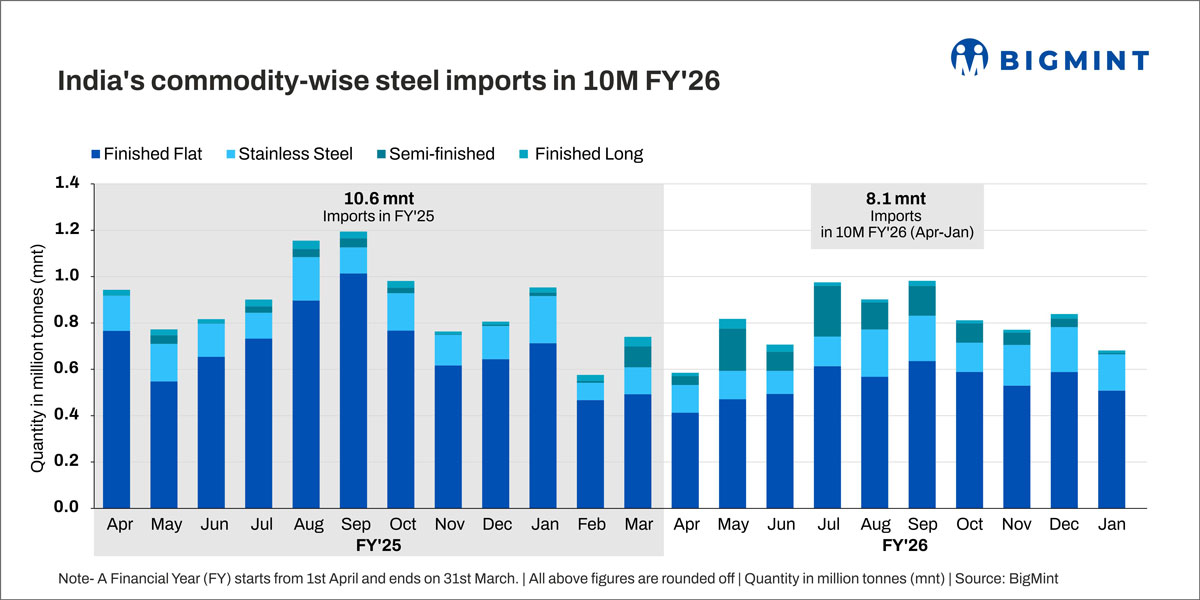

- Steel imports fall 13% y-o-y due to safeguard duty on flat products

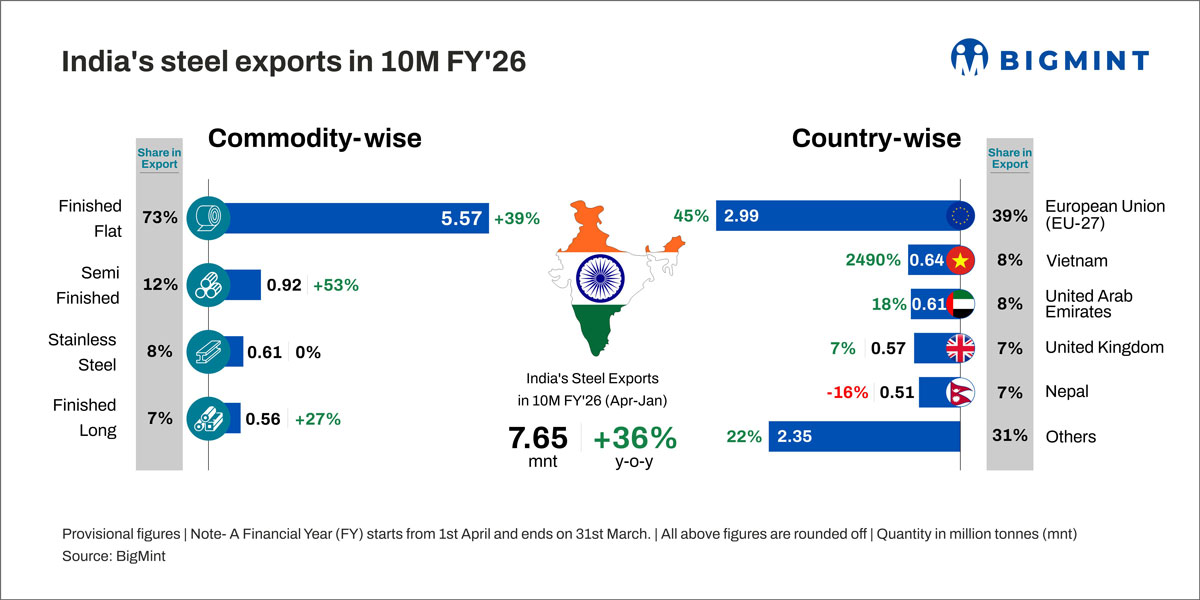

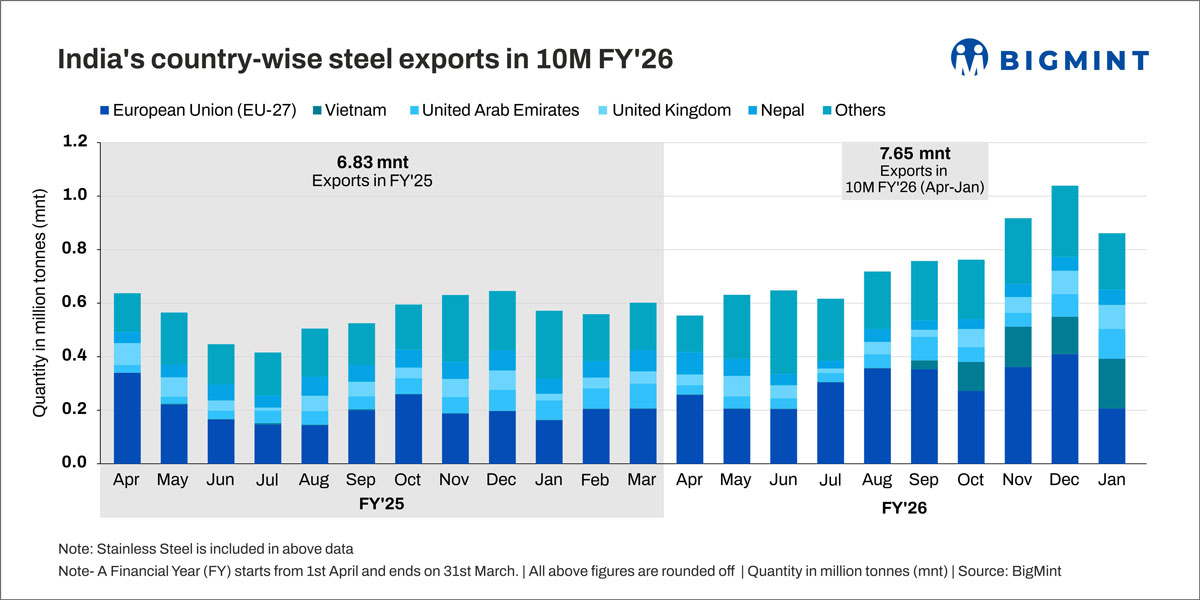

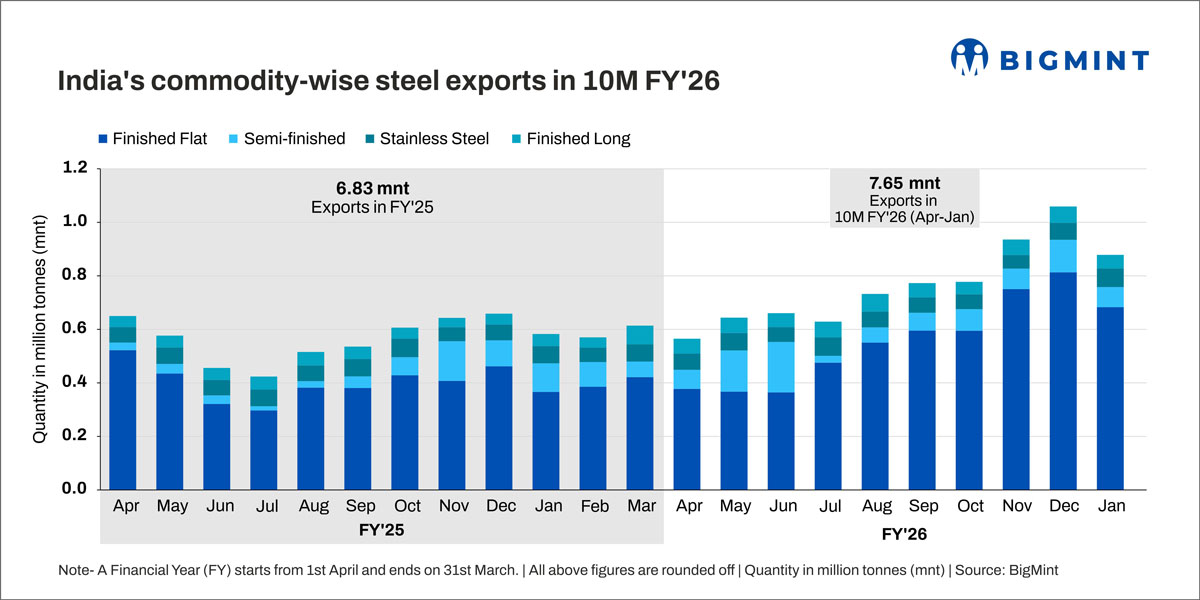

Morning Brief: India's steel exports (including stainless steel) surged by 36% y-o-y to 7.65 million tonnes (mnt) in April 2025-January 2026 (10MFY'26), as per provisional data maintained by BigMint. From August 2025, India's steel exports have exceeded 0.7 mnt every month, even reaching over 1 mnt in December, primarily driven by frontloading of shipments to the EU.

Key trends in 10MFY'26

EU demand spikes on CBAM confusion, competitive offers: The start of the definitive period of the Carbon Border Adjustment Mechanism (CBAM) from January 2026, as well as stricter safeguard measures in 2026, drove importers in the EU to stockpile on cheaper imported material.

First, there was significant uncertainty over additional carbon costs, and buyers accelerated procurement to avoid potential complications.

Secondly, expectations of reduced import supply in the future made EU-based mills bullish about price hikes. At the same time, fearing a steep drop in demand, Indian exporters ramped up shipments while reducing prices to make offers more attractive.

During December, the EU's domestic HRC prices were near EUR 630/tonne (t) ($738/t), up from around EUR 560/t ($655/t) in August, according to reports. Conversely, Indian offers of $570/t CFR Antwerp (monthly average) in December were down 7% from $604/t in August, as per BigMint's assessment. The wide price gap ultimately lifted India's exports to the EU-27 by 45%.

HRC exports to Vietnam surge after India cleared of dumping charges: Indian exporters gradually resumed offering HRCs to Vietnam after the Vietnamese government concluded its anti-dumping investigation in July 2025. India was cleared of dumping charges and exempt from duties. Previously, from around March 2024, Indian HRC exports to Vietnam had almost stalled because of the anti-dumping investigation, leading to a low base.

Meanwhile, after Vietnam imposed anti-dumping duties on Chinese HRCs from March 2025, concerns emerged over the steady stream of inflows and possible circumvention of anti-dumping measures. Chinese exports retreated as a result, allowing Indian mills to increase shipments to Vietnam.

Regional diversification expected amid uncertain EU export future: Due to the impact of CBAM, there is uncertainty over future shipments to the EU, the largest steel export destination for India. Consequently, Indian mills are considering diversifying exports beyond the EU, with Southeast Asia, Africa, and the Middle East emerging as the top choices.

In 10MFY'26, some regions that witnessed a sharp rise in Indian imports are as follows:

1. HRC exports to France have increased exponentially since October 2025, totalling around 140,000 t in 10MFY'26 compared to merely 50 t in the year-ago period. This is in addition to significant spikes in deliveries to Italy, Belgium, and Spain, the major destinations for Indian exports to the EU.

High energy costs and low-priced Chinese imports pressured the French steel industry last year, with ArcelorMittal announcing job cuts across seven facilities. The company also had to shut down a blast furnace at Fos-sur-Mer facility until December due to a fire in October.

2. Taiwan's imports of Indian pipes and tubes have increased to around 230,000 t compared to 280 t in the year-ago period.

While Taiwan has been increasingly trying to reduce its reliance on Chinese steel, substantial investments in tech facilities and business parks -- driven by chip manufacturing demand and the AI boom -- are likely to keep its steel demand robust.

3. India's pipes and tubes and HRC/plate exports to Oman increased sharply, totalling around 95,000 t and 48,000 t, respectively, from slightly over 10,000 t. The expansion of oil and gas pipeline networks in Oman, strong policy push on boosting green steel and green hydrogen production, and development of cross-border rail networks with the UAE have supported steel demand in the country.

4. Qatar received 120,000 t of pipes and tubes from India compared to 47,000 t in the year-ago period. Expansions to its LNG capacity and the construction of a massive blue ammonia plant likely spurred higher steel demand.

Outlook - Can India turn net exporter in FY'26?

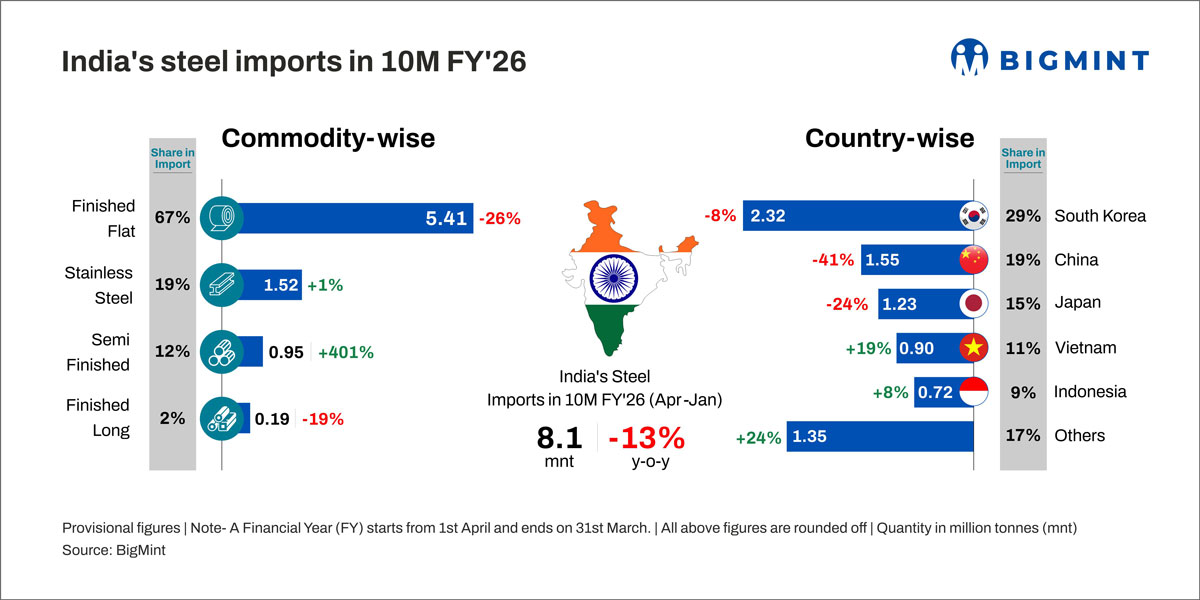

India's total steel imports (including stainless steel) fell 13% y-o-y to just above 8 mnt during 10MFY'26, driven by the safeguard duty imposed on finished flats imports and other trade interventions. Given that imports have averaged around 0.8 mnt every month, India's full-year total is likely to come to around 9.60 mnt at the current pace.

The volume could also fall below that if flat steel inflows shrink further in February and March, driven by high import costs due to the depreciating rupee and the final implementation of the safeguard duty, which has kept the landed costs of imports consistently higher than domestic prices.

Semi-finished steel inflows, which had surged by 400% y-o-y in 10MFY'26, have also declined since November, which could pull down the total.

On the other hand, exports could total over 9 mnt in FY'26 if February and March record shipments of around 0.7 mnt. In January, exports were at 0.87 mnt, but we expect volumes to moderate in February and March, as Indian mills have shifted focus to the domestic market, where demand has improved with the start of fourth quarter. Additionally, Indian mills have also exhausted their HRC safeguard quota for this quarter, which would limit intake by the EU.

As such, we expect India to be a net steel importer in FY'26 as well, with imports exceeding exports by around 0.6 mnt. However, this margin is much less than the 3.64 mnt recorded in 10MFY'26.