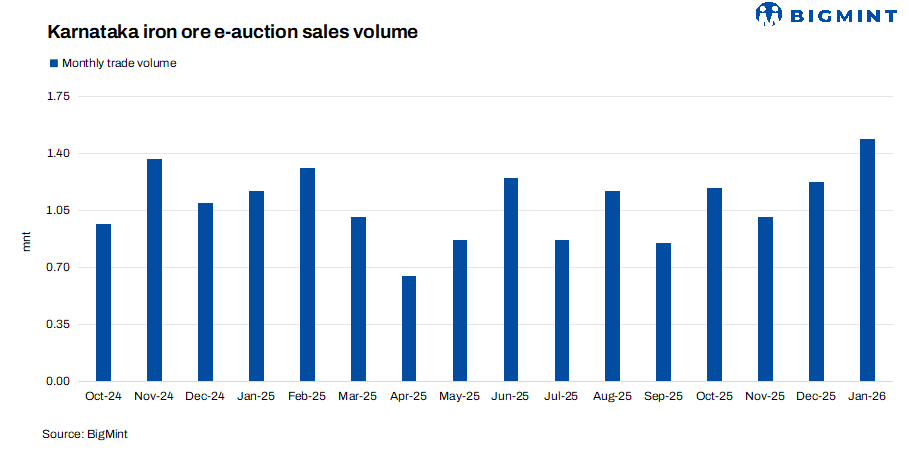

India: Karnataka iron ore e-auction sales volumes increase 20% m-o-m in Jan'26

...

- Buyer participation improves across major auctions

- Smaller miners witness limited auction response

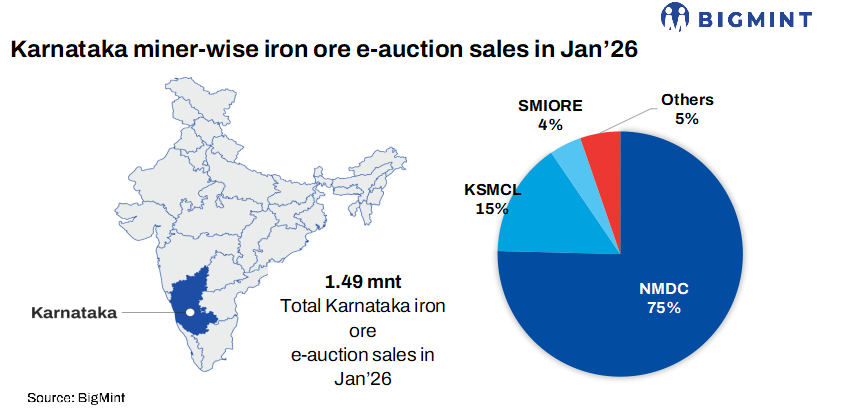

Iron ore e-auction sales in Karnataka staged a strong comeback in January 2026, rising nearly 20% m-o-m to 1.49 million tonnes (mnt) from 1.24 mnt in December, as per data maintained by BigMint. The notable increase reflects a clear improvement in market activity, supported by stronger steel demand at the start of the month, which significantly lifted raw material requirements across the value chain.

The revival in downstream demand translated into more active participation in auctions. Several miners who had been witnessing weak or negligible responses in previous months finally saw healthy bidding interest. Steelmakers stepped up procurement to secure supplies amid firm sponge iron prices and tight availability of high-grade material in the spot market. This supply constraint further intensified competition in auctions, particularly for better-grade ore.

Of the total quantity sold, iron ore fines accounted for 831,996 tonnes, while lumps stood at 658,850 tonnes, reflecting balanced demand across both segments.

NMDC Ltd. tightens grip on Karnataka auctions

NMDC Ltd, India's largest iron ore producer, further strengthened its dominance in Karnataka's e-auction space by recording robust sales of 1.12 mnt in January, up 9% m-o-m from 1.03 mnt in December. The total included 692,000 tonnes of fines and 432,000 tonnes of lumps, underscoring its commanding presence in the market.

The surge in NMDC's sales was largely driven by a strategic reduction in base prices, which significantly improved buyer participation. The more competitive pricing encouraged steelmakers to secure volumes at attractive rates, resulting in stronger bid closures and higher auction clearances. Additionally, NMDC revised its pricing mechanism by shifting from an inclusive to an exclusive model, bringing greater transparency to price components and further influencing buyer behaviour. These strategic moves collectively reinforced the company's leadership in the state's auction market.

Other miners report mixed trends

Karnataka State Minerals Corporation Limited (KSMCL) emerged as the second-largest seller, with sales jumping sharply to 224,996 tonnes in January comprising 89,000 tonnes of lumps and 135,996 tonnes of fines compared to just 40,000 tonnes in December. The steep rise was mainly supported by improved pricing and stronger buyer turnout.

Sandur Manganese and Iron Ore Limited (SMIORE) ranked third, though its sales declined to 63,000 tonnes (4,000 tonnes of fines and 59,000 tonnes of lumps) from 97,000 tonnes in December, indicating selective buying interest.

Vedanta Limited stood fourth, selling 59,000 tonnes entirely in lumps, including siliceous and hematite grades. However, its volumes dropped 18% m-o-m from 72,000 tonnes, reflecting cautious procurement trends.

Sri Kumaraswamy Minerals Private Limited (SKMEPL) secured the fifth position with around 16,000 tonnes of lumps sold during the month.

Meanwhile, R Praveen Chandra saw 3,850 tonnes of lumps booked in its auction.

On the other hand, auctions conducted by BKG Mining Private Limited and U Krishna Prasad Company once again failed to attract meaningful buyer interest. This highlights that despite the broader improvement in sentiment, procurement remained highly selective, with buyers focusing primarily on competitive pricing and quality advantages.

Iron ore prices fall m-o-m in lumps, fines remain stable

Iron ore prices decreased in January, with monthly weighted average prices of Fe 63% lumps fell and Fe 60% fines remains firm. Weighted average prices of Fe 60% fines remained steady at INR 3,100/t, while Fe 63% lumps dropped by INR 200/t to INR 4,400/t. Prices are exclusive of taxes.

Outlook

Looking ahead, Karnataka's iron ore e-auction market is expected to remain cautiously optimistic in the near term. Steady steel production levels and supportive sponge iron prices are likely to sustain procurement activity, particularly for high-grade material where availability remains tight. If downstream steel demand maintains momentum, auction volumes could remain firm; conversely, any slowdown in steel offtake or further price corrections may moderate bidding aggression in the coming months.