Global petcoke prices increase as freight costs surge, supply tightens

...

- Freight surge lifts landed costs, buyers resist high CFR levels

- Cement producers shift toward coal amid elevated petcoke offers

Petroleum coke prices moved higher across all major grades and origins in recent weeks, driven by a sharp increase in freight costs and tightening supply conditions, though rising delivered prices have begun to test buyer resistance in key markets like India and Turkiye.

US origins lead price gains

On the US Gulf Coast, all sulphur grades have recorded gains. FOB USGC 6.5% sulphur petcoke rose to $81/t, while 5.5% sulphur material climbed to $84/t. Mid-sulphur 4.5% petcoke reached $87/t, marking its fourth consecutive weekly increase.

West Coast prices saw even steeper increases. FOB USWC 4.5% sulphur petcoke jumped to $86/t, while low-sulphur 2% material surged to $150/mt -- a 10-month high.

US suppliers have shown little willingness to reduce offers, with one trader noting, "There is somewhat limited supply. And you can't buy that much from a producer."

Freight costs add pressure

The price rally has been amplified by sharply rising freights. The cost to ship from the US Gulf Coast to Turkey's Iskenderun port has jumped $4.50/t since February began, reaching $31/t. Freight to India's east coast rose to $46/t, up $6.75/t this month alone.

"Freight has gone higher, and that is pushing the prices higher while making the buyers cautious," a Spain-based trader explained.

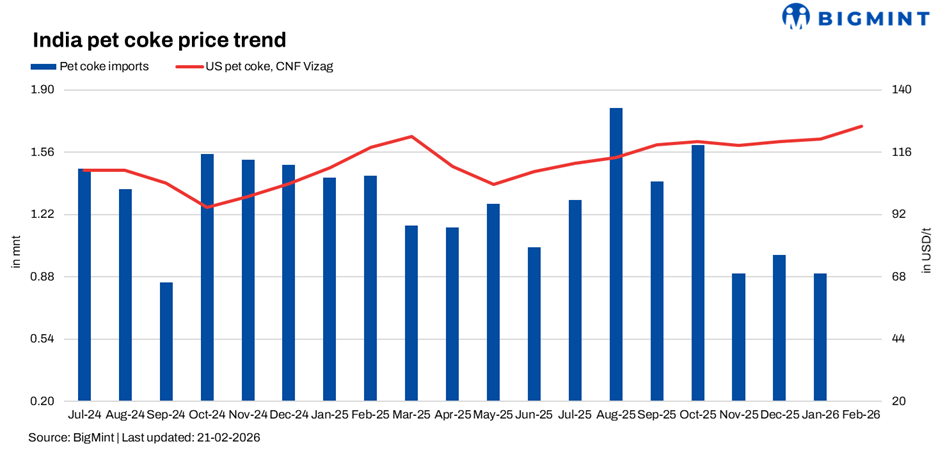

Indian market under pressure

In India, rising prices have created challenges for cement manufacturers, who are major petcoke users. US seaborne petcoke exports rose 12.7% w-o-w, with India receiving 211,258 mt -- a massive increase of 194,350 mt from the previous week.

However, Indian buyers are resisting current prices.

India's largest cement producer indicated that petcoke offers are around $130/t CFR, but the company would look to conclude at $125/t. The company noted that petcoke is tight with no prompt vessels available. The earliest availability is April-loading cargoes at $130/t and above.

Another major cement manufacturer stated that current offers above $120/t are "not viable" because cement prices are not rising, hurting profitability. The company is relying more on domestic coal and exploring Indonesian options. Ramco noted that Venezuelan coke has been offered at $117/t CFR, which seems viable.

A south India-based cement producer reported receiving petcoke offers at $130-$132/t CFR east coast India and US NAPP offers at $126-$127/t CFR. While describing these prices as "not workable," the company is considering them closely, as alternatives are few. The company needs coal with ash below 15%, as only one kiln can use higher ash. They recently secured South African coal at $112/t CFR, though with ash above 15%, and will need to supplement with low-ash, low-moisture fuel.

EMEA market also cautious

In Turkiye and Egypt, restocking needs have supported demand amid stronger cement exports. However, the sharp rise in delivered prices is causing hesitation.

CIF Turkey 5.5% sulphur offers were heard at $115-$122/t for March and April-loading cargoes, with bids lower. A trade for 5.8% sulphur material was heard at $115/t.

Some buyers are reconsidering fuel choices. "Egyptians are not buying petcoke at these levels, and they are finding better value in going for coal, particularly from the US," the Spain-based trader noted.

Market dynamics

The price strength appears sustainable in the near term due to limited supply. US refiners have been reluctant to cut offers, and some suppliers are leveraging higher coal prices to boost petcoke values.

However, end-users are becoming increasingly selective. One trader noted that some cement producers are "happy to go for coal at the moment since petcoke prices are high." The price difference between petcoke and coal is making buyers cautious.

A Turkiye-based buyer suggested that while there is caution, cement manufacturers are likely to return to restock for the coming quarters. With cement demand expected to remain firm and supply constrained, consumers may eventually need to accept the new prices.

Another market participant noted that some suppliers are "taking advantage of the rising cost of coal to boost their prices, considering that for the past few years, prices have been suppressed."

Outlook

The petcoke market faces competing pressures. On the supply side, limited availability from US refiners and strong agricultural exports tying up vessels are likely to keep freights elevated. On the demand side, industrial consumers in India and the Mediterranean are signalling clear resistance to current prices.