India pet coke imports decline in January amid firm prices

...

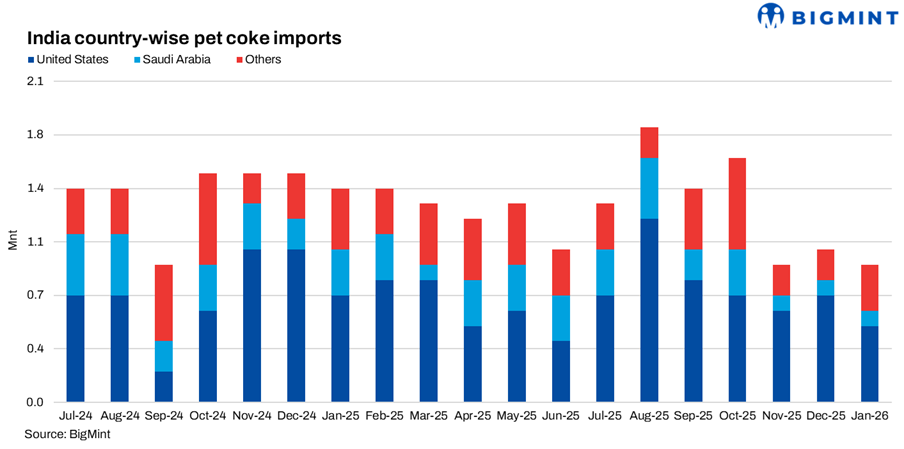

- Imports fell 18.2% m-o-m in January 2026

- US share declined sharply m-o-m

India's pet coke imports stood at 0.9 mnt in January 2026, declining 18.2% m-o-m from 1.1 mnt in December 2025. On a y-o-y basis, volumes were down 35.7% compared with 1.4 mnt in January 2025. The monthly decline occurred even as imported prices remained firm throughout January, with part of the requirement met through inventories procured earlier when prices were softer.

Top exporters

The United States remained the largest supplier at 0.5 mnt in January, accounting for 55.6% of total imports. However, volumes from the US fell 37.5% m-o-m from 0.8 mnt in December and were 28.6% lower y-o-y from 0.7 mnt in January 2025.

Saudi Arabia supplied 0.1 mnt, unchanged m-o-m but down 66.7% y-o-y from 0.3 mnt. Venezuela contributed 0.1 mnt, broadly stable compared with 0.0 mnt in December and unchanged y-o-y. Russia and Indonesia, which supplied 0.1 mnt each in December, recorded no shipments in January, highlighting a sharper m-o-m pullback from secondary origins.

Australia and Brazil, present in the trade matrix in January 2025 at 0.1 mnt each, did not feature in January 2026 shipments, reinforcing the y-o-y contraction.

Top buyers

Buyer concentration increased in January. Ultratech Cement imported 0.3 mnt, rising 200% m-o-m from 0.1 mnt in December, becoming the largest importer. Reliance Industries imported 0.2 mnt, up 100% m-o-m from 0.1 mnt.

Rain Cii, Sanvira Industries, Zuari Cement, Birla Corporation and Dalmia Cement each imported 0.1 mnt. In contrast, December imports were more evenly distributed, with multiple cement and industrial players lifting 0.1 mnt each. The January data indicates selective, volume-led procurement by key consumers rather than broad-based buying.

Market overview for prices

Imported pet coke prices remained firm across January. US-origin 6.5% sulphur material was largely indicated at $121 to $124 per t CFR India, while Venezuelan cargoes were heard at $117 to $118 per t. Bids generally trailed offers, keeping negotiations disciplined.

Freight levels from the US Gulf Coast to India stayed elevated, sustaining landed replacement costs. India continued to price at a premium compared with other destinations, supported by steady cement demand and limited prompt availability.

The m-o-m decline in volumes therefore reflected inventory adjustments and timing of cargo arrivals rather than any price weakness. On a y-o-y basis, the 35.7% drop highlights structurally lower import dependence compared with early 2025 levels, even as price benchmarks remained elevated in January 2026.