Weekly round-up: Semi-finished prices remain strong, finished steel demand moderate

...

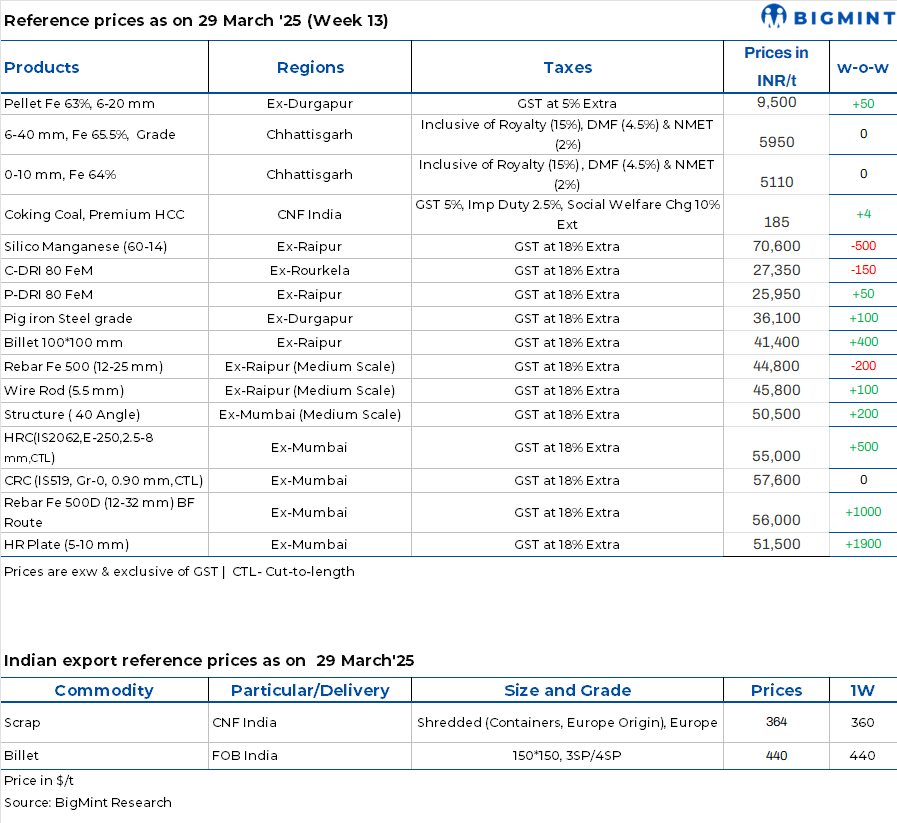

- Rebar prices up by INR 100-600/t across regions

- Trade-level HRCS spurt by INR 1,000/t w-o-w

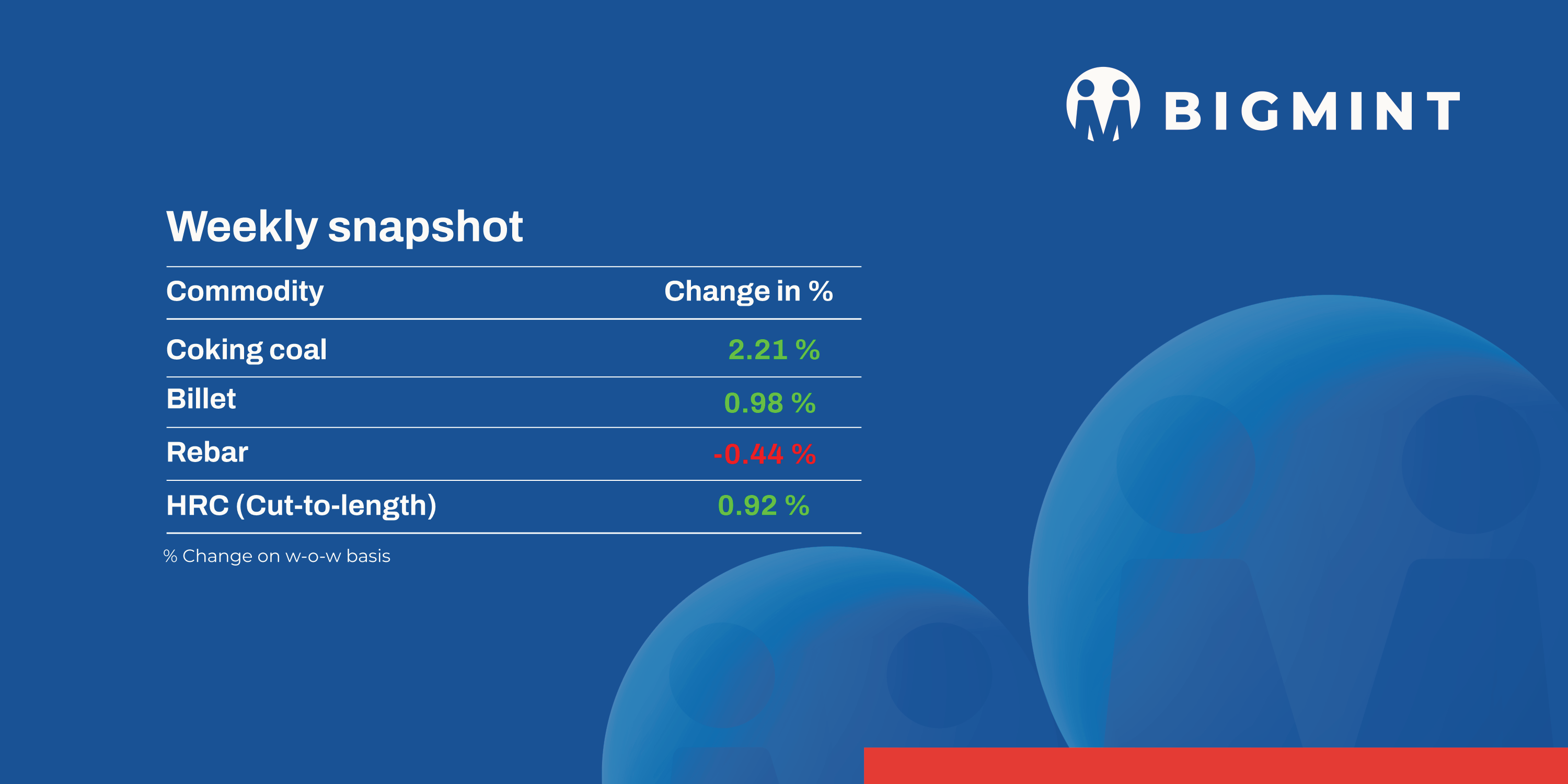

Domestic induction furnace finished long steel prices saw an upward trend, rising by INR 50-450/t. Trade reference prices of hot rolled (HR) and cold rolled (CR) coil remained strong in key markets, with a maximum increase of INR 1,300/t.

Iron ore and pellets

- BigMint's bi-weekly domestic pellet (Fe63%) index increased by INR 150/t w-o-w to INR 10,250/t ($120/t) DAP Raipur on 28 March. In the last week, around 55,000 t of pellet (Fe62/63%) deals were concluded by Raipur-based steelmakers. Raipur-based plants increased their pellet offers by INR 200/t to INR 10,100-10,200/t exw mid-week.

- BigMint's bi-weekly Indian low-grade iron ore fines (Fe 57%) export index increased by $2/t w-o-w to $64/t FOB east coast, India, on 27 March. Export trades picked up this week, with three deals of around 160,000 t of fines (Fe57%) concluded at $73-76/t CFR China recently. Overall, around 600,000 t of fines export deals were concluded in the Indian ocean for Fe 50-57%. In pellets, an Indian pellet exporter floated a 50,000-t tender (Fe 60%, 2.5-3% Al2O3, and 9.5% SiO2), which received bids from some buyers and was concluded at $90/t FOB.

- In this week's iron ore auction in Chhattisgarh, two blocks were acquired by AM/NS India, while Rungta Sons secured. Notably, Sagar Stone Industries won the Hahaladdi North Extension iron ore block, emerging as the highest bidder with an impressive premium offer of 210%.

- Iron ore fines (0-10mm, Fe 63%) offers in Chandrapur, Maharashtra, increased by INR 250/t ($3/t) to INR 5,650/t ($66/t) FOR Balharshah on 28 March. Meanwhile, lumps offers rose INR 300/t ($4/t) to INR 9,550/t ($112) FOR Chandrapur. Around 1,7 mnt of fines and 0.3 mnt of lumps were traded at the previous offers of INR 5,400/t($63/t) and INR 9,250/t($108/t), respectively.

Coal

- Portside South African thermal coal prices saw mixed trends. RB2 (5500 NAR) remained steady at INR 8,450/t exw-Gangavaram but offers rose to INR 8,500-8,600/t exw-Paradip. RB3 (4800 NAR) increased to INR 7,350/t exw-Paradip, while it stayed at INR 7,100/t exw-Gangavaram.

- Indonesian thermal coal prices remained volatile. 4200 GAR increased by INR 150/t to INR 6,200/t. At Vizag, 4200 GAR rose by INR 200/t to INR 6,100/t. However, 5000 GAR at Kandla stayed at INR 7,800/t.

- In domestic coal, 4500 GCV was stable at INR 4,500/t, while 5000 GCV dropped by INR 50/t to INR 4,950/t exw-Bilaspur. SECL's 2.5-mnt auction on 29 March may push prices lower.

- Thermal coal port stocks in India fell 0.9% w-o-w to 11.72 mnt in week 12 of CY'25, with stock reductions seen at Vizag, Gangavaram, and Mundra.

- Indian met coke prices remained stable w-o-w. BF-grade (25-90 mm) stood at INR 34,500/t exw-Jajpur and INR 32,300/t exw-Gandhidham.

Ferrous scrap

- India's imported scrap market remained moderate as early-week restocking interest faded amid firm offers from suppliers. Fiscal year-end closures and the availability of cost-effective domestic sponge iron and scrap further restricted trades.

- Shredded scrap prices edged up 1% to $390/t CFR from $385/t, driven by Turkish market trends. Initial deals closed at $385/t CFR, but later offers climbed to $390-395/t CFR, limiting buying activity.

- HMS 80:20 from the UK/Europe and West Africa saw offers rising to $365-375/t CFR from $355-365/t, but buyers resisted above $360-365/t, slowing transactions.

- Sellers preferred Pakistan, where prices were higher at $405-410/t CFR.

- An estimated 9,000-10,000 t of scrap were booked during the week, including 3,000-3,500 t of HMS 80:20 at $355-367/t CFR, 1,000-1,500 t of shredded at $390-395/t CFR, and 750-1,000 t of HMS 1 at $378-384/t CFR. Additionally, 1,500-2,000 t of hand-loaded HMS traded at $377-380/t CFR, while 2,000-2,500 t of Bonus (bulk partial) was booked at $402/t CFR. Smaller lots of HMS bundle mix, LMS, Blue Steel, and HMS-PNS also completed transactions.

Ferro alloys

- Silico manganese: Indian silico manganese prices went down w-o-w by INR 650/t ($8/t) to INR 70,600-72,300/t ($825-845/t) in the key regions of Durgapur, Raipur and Vizag. The decline was driven by need-based buying and competitive pricing from other regions across India.

- Ferro manganese: Indian ferro manganese (HC 70%) prices decreased w-o-w by INR 680/t ($8/t) to INR 75,000/t ($877/t) exw in Durgapur. Meanwhile, prices exw-Raipur, also declined by INR 640/t ($7/t) to INR 75,000/t ($877/t). Prices dropped due to need-based buying and limited inquiries.

- Ferro silicon: Indian ferro silicon prices inched down by INR 475/t ($6/t) w-o-w to INR 98,400/t ($1,150/t) exw-Guwahati. Prices also dropped by INR 600/t ($7/t) in Bhutan to INR 98,600/t ($1,152/t) exw. Prices were slightly down, as market conditions remained stagnant. Routine trades were carried out, and no major movements were observed.

- Ferro chrome: Indian high-carbon ferro chrome (HC 60%, Si: 4%) prices were largely stable with a slight decline of INR 400/t ($5/t) w-o-w to INR 100,400/t ($1,173/t) exw-Jajpur. Prices were steady as majority of the market players were in a wait-and-watch mode and looking for clarity on market trends.

Semi-finished

- Indian semi-finished steel prices showed a mix trend as per BigMint's assessment. Domestic billet prices in almost all key locations increased by INR 50-450/t across regions with a major increase of INR 450/t seen in Mandi Gobindgarh. Other regions saw a drop of INR 200-500/t. However, sponge iron prices showed mix trends in almost all key locations with prices moving down by INR 50-150/t. The highest decrease of INR 150/t was seen in the Rourkela and Bellary markets, whereas, Durgapur and Ramgarh witnessed an uptrend by INR 100-200/t.

- Indian DRI export offers increased by $11/t CPT Raxaul to $365/t while CPT Benapole offers increased by $3/t to $366/t.

- NMDC's Nagarnar steel plant in Chhattisgarh conducted an auction for 15,000 t of steel-grade pig iron (for road transport) on 24 March. Of the total offered quantity, 8,500 t were booked at the base price of INR 34,300/t. At the previous auction, out of the 20,000 t on offer, 17,000 t were booked at the base price of INR 34,000/t.

Finished longs

- IF-rebar: India's induction furnace route finished long steel prices exhibited a mixed trend w-o-w. Market activity remained limited as buyers had already secured sufficient quantities earlier and were now purchasing only as needed. Meanwhile, the lifting of previously booked orders is progressing smoothly, though mills are facing logistical and delivery challenges due to a significant backlog. Traders have also reported delays in receiving their orders, as manufacturers struggle to fulfill pending deliveries. However, there is no inventory pressure on manufacturers, leading them to either adjust their discount offers or marginally reduce prices based on order sizes. Despite this, market participants anticipate that prices may remain firm, with a potential upward trend in the near term.

- On a weekly basis, in rebar steel, prices witnessed variations in the range of INR 100-600/t across regions, as per BigMint's assessment.

- The trade reference prices of IF-grade Fe500 rebar of 10-25 mm was assessed at INR 44,600-45,000/t exw Raipur, and at INR 49,000-49,600/t exw Jalna.

- Trade reference price of heavy structurals of 150mm stood at INR 46,300-46,600/t exw-Raipur.

- Trade reference prices of wire rods hovered at INR 45,500-46,000/t ex-Raipur.

- BF-rebar: Trade-level blast furnace (BF) rebar prices witnessed an increase on a weekly basis as major steel mills increased list prices by INR 500-1,000/t during the week. Post revision, list prices hovered at INR 54,500-55,500/t on landed basis. The market is experiencing limited material availability due to supply disruptions from mills, leading to higher quotations in the distributor network.

- Current week's rebar prices (12-32mm) in the trade segment increased by INR 1,000/t w-o-w to INR 56,000/t exy-Mumbai. Prices are exclusive of GST at 18%.

- In the projects segment, prices hovered at around INR 54,500-55,500/t FOR Mumbai. End-user demand has been consistent for some time, with active procurement observed as project completion deadlines approach before the financial year closure.

Flat steel

- Trade-level HRC offers surged by up to INR 1,000/t w-o-w to INR 50,200-52500/t across domestic markets. Cold-rolled coil (CRC) prices increased by up to INR 1,300/t w-o-w, settling at INR 56,000-59,000/t.

- HRC prices increased, but the pace of growth slowed as buyers resisted higher prices due to the impact on their raw material costs.

- India's bulk imports of HRCs and plates reached 319,404 t as of March 24, based on vessel line-up data from BigMint. Another 26,977 t are expected by the end of this month, with an additional 35,817 t expected in the first week of next month.

- India's steel industry is seeing a notable rise in export activity, with hot-rolled coil (HRC, SAE 1006) export offers to Europe increasing by $20/t w-o-w, driven by stronger domestic prices in Europe. However, Indian mills are taking a cautious approach toward exports to the Middle East and Vietnam, as market activity slows ahead of the Eid holidays in the Middle East and domestic demand remains weak in Vietnam.