Turkiye: Ferrous scrap imports decline 7% in CY'25 despite higher crude steel production

...

- Margin squeeze forces mills to change metallic mix

- US supply weakens while European shipments remain stable

- Rising domestic scrap generation reshapes sourcing strategy

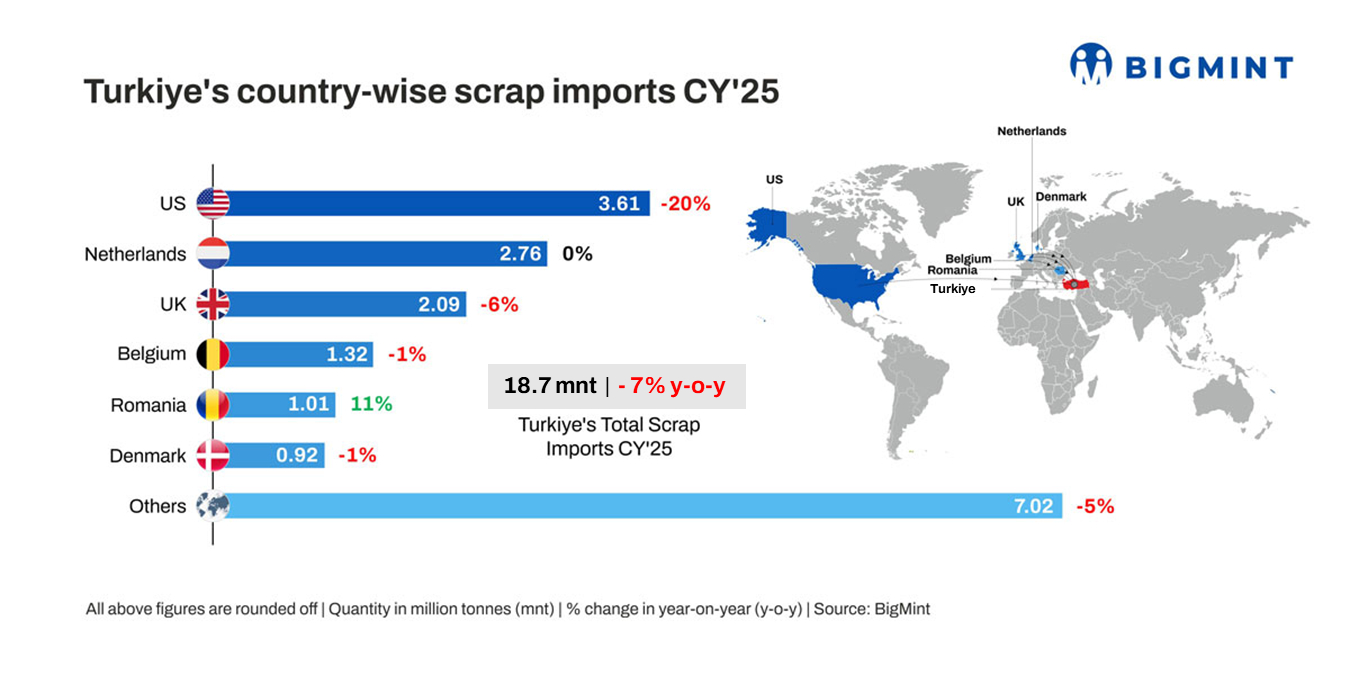

Morning Brief: Turkiye's ferrous scrap imports declined to 18.74 million tonnes (mnt) in CY'25, down 7% y-o-y from 20.07 mnt in CY'24. This was despite crude steel production increasing 3% y-o-y to 38.10 mnt in 2025 from 36.90 mnt in 2024.

Import trends, vessel bookings

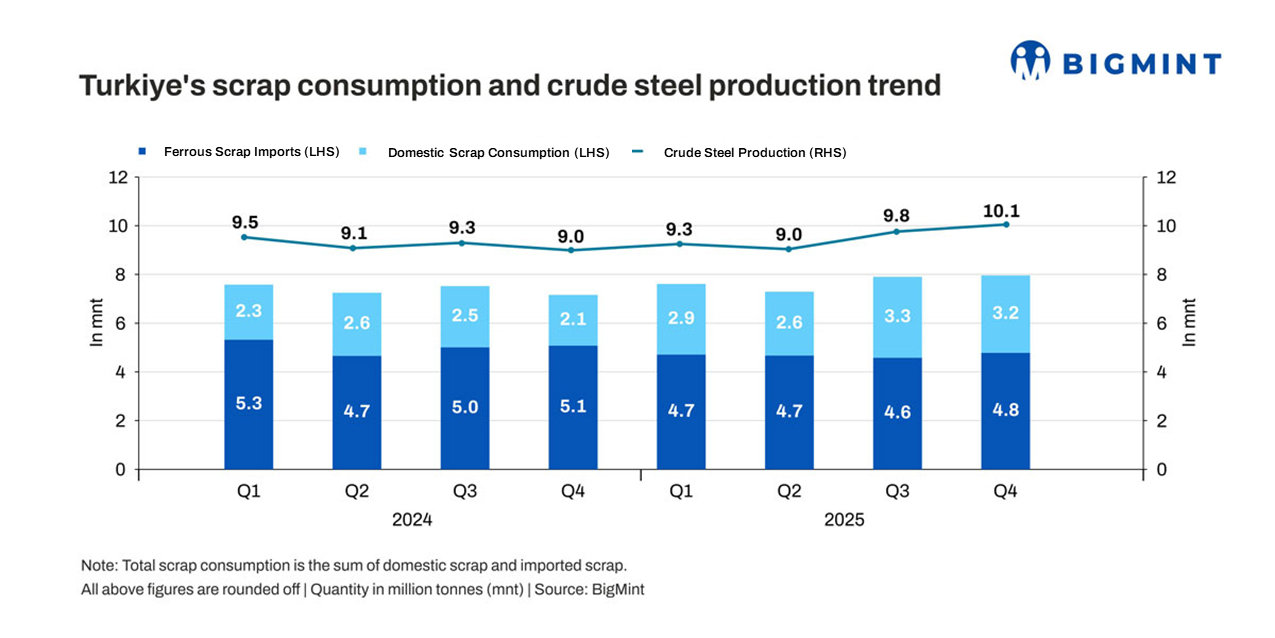

Monthly imports in CY'25 ranged between 1.2-1.7 mnt. The highest monthly volume was recorded in April at 1.87 mnt, marking the only notable y-o-y increase compared to April 2024 (1.52 mnt).

On a quarterly basis, scrap imports in 2025 were lower across all quarters compared to 2024. In 2024, imports ranged between 4.66-5.32 mnt per quarter. In 2025, volumes moved from 4.71 mnt in Q1 to 4.78 mnt in Q4, with Q3 at 4.58 mnt, marking the lowest quarterly intake of the year.

Around 250-260 vessels were booked for ferrous scrap, compared to approximately 280-290 vessels in CY'24. According to BigMint's bulk vessel line-up data, bulk vessel movement totaled approximately 15.65 mnt in 2025, versus 15.51 mnt in 2024. Including containerised cargoes, total arrivals were estimated at around 18.37 mnt in CY'25 compared with 18.51 mnt in CY'24.

Country-wise supply

The US remained the largest supplier, though volumes fell sharply by 20% y-o-y to 3.61 mnt from 4.53 mnt in CY'24, marking the steepest decline among major origins. Imports from the UK dropped 6% to 2.09 mnt, while Belgium and Denmark recorded marginal declines of 1% each.

In contrast, Romania registered 11% growth to 1.01 mnt from 0.91 mnt. Imports from the Netherlands remained unchanged at 2.76 mnt, showing relative stability despite the broader contraction.

Domestic scrap consumption

While imports declined, domestic scrap consumption increased significantly from 9.44 mnt in 2024 to 12.02 mnt in 2025. The largest quarterly domestic consumption in 2025 was recorded in Q3 at 3.32 mnt, compared to 2.51 mnt in Q3 2024. Monthly scrap consumption remained broadly stable, mostly ranging between 2.3-2.8 mnt.

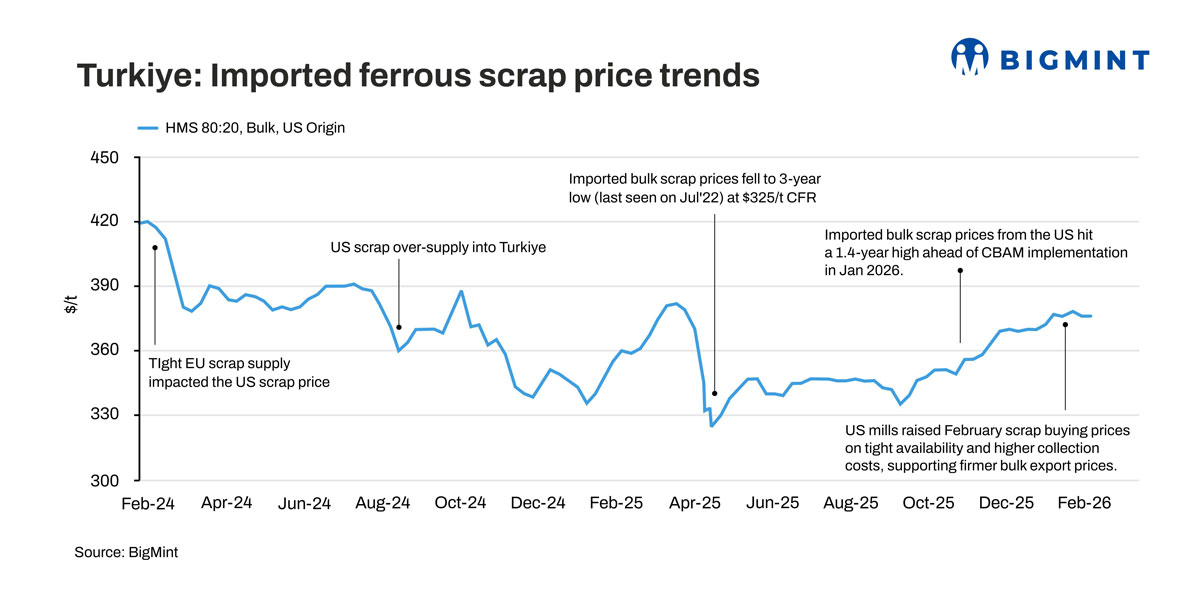

Yearly price averages

- US-origin HMS 80:20 CFR Turkiye averaged $351/t in CY'25, down 8% y-o-y from $382/t in CY'24.

- US-origin HMS 80:20 FOB East Coast US averaged $325/t, down 9% y-o-y from $356/t in CY'24.

- Rotterdam HMS 80:20 bulk FOB Europe averaged $323/t, down 9% y-o-y from $353/t in CY'24.

Despite lower yearly averages, Turkish imported scrap prices have traded above South Asian levels since early November 2025, reversing the traditional price spread. Turkish prices strengthened on short bursts of restocking, firmer rebar sales momentum and selective speculative buying, while South Asian markets largely followed a softer trajectory.

Why scrap imports declined?

Shrinking steelmaking margins: Turkiye's scrap imports declined in 2025 as steelmaker margins compressed to historic lows, reducing mills' purchasing appetite. The spread between finished steel prices and scrap costs narrowed sharply, limiting profitability and forcing producers to adopt more cautious procurement strategies.

Mills curtailed high-priced deep-sea bookings, particularly from the US. The contraction was most evident in US-origin shipments, as firm domestic US pricing reduced competitiveness for Turkish buyers. European suppliers maintained relatively stable flows, but this was not enough to offset the broader decline in imports.

Profitability under pressure: Lower capacity utilisation further reinforced cautious procurement behaviour. Operating rates remained subdued at around 60-65%. The main reason was that mills struggled to make money. The spread between scrap costs and finished steel prices narrowed sharply, dropping to below $200/t, compared with around $215-220/t a year earlier and nearly $240-250/t in 2023.

Still, Turkiye's large EAF base means scrap demand could rebound quickly if margins recover. With profitability under pressure, mills became far more cautious, especially when it came to high-priced US scrap. Shipments from the US declined nearly 20%, while European suppliers absorbed part of the shortfall. HMS grades still made up about 60% of total imports.

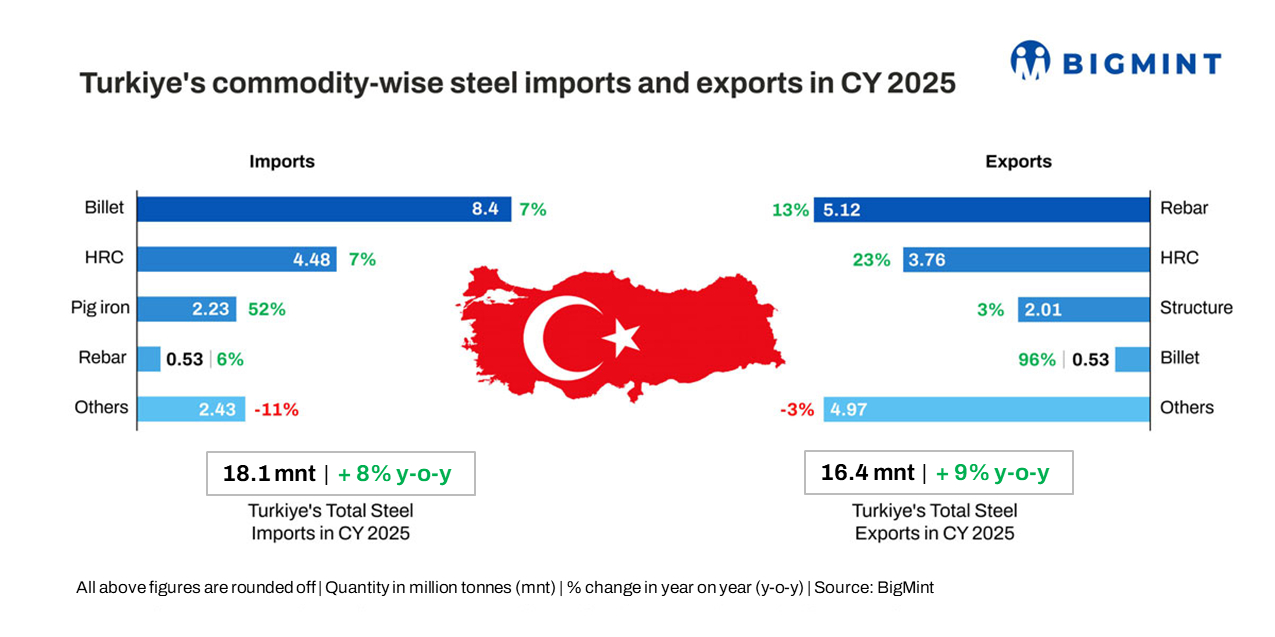

Changing metallic mix: At the same time, Turkish producers recalibrated their metallic mix to better manage costs. Greater reliance on pig iron and hot briquetted iron (HBI), combined with higher semi-finished steel imports, reduced dependence on imported scrap.

Pig iron inflows increased markedly, while HBI volumes nearly doubled, underscoring mills efforts to protect margins amid weak finished steel spreads.

Outlook

A sharp correction in prices appears unlikely in the near term due to supply constraints in key regions. The tighter 2026 CBAM framework continues to support Turkish EAF steel's relative cost positioning in Europe, providing a degree of underlying support to scrap demand. Mills are expected to re-enter the market more actively by mid-February as they prepare for spring production cycles.

The key swing factor remains Europe's 2026 quota reshuffle, with current allocations largely exhausted and US access constrained by tariffs. Any reduction in EU quotas could narrow export channels. This would increase Turkish mills' reliance on regional and domestic markets, making scrap procurement more sensitive to inventory cycles and shifts in market sentiment.

We believe that Turkiye's imported scrap share will decline, and domestic scrap will be used in line with capacity. At the same time, the share of iron-based alternative raw materials such as HBI will increase.