South Asia: Bangladesh ship breaking market rises after elections, Alang faces volatility amid tight supply

...

- Alang faces volatility despite firm bidding

- Infrastructure hopes lift Chattogram outlook

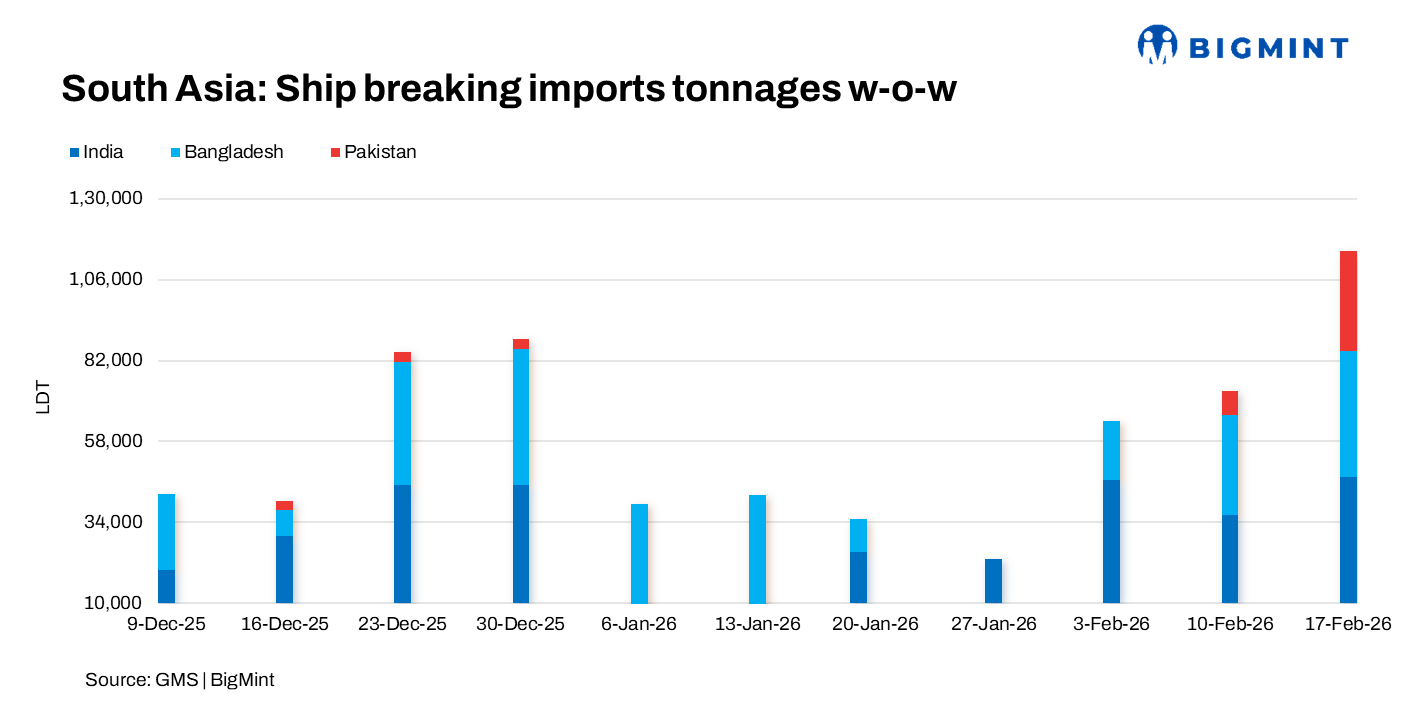

Sub-continent ship recycling markets remained driven by tight vessel supply, shifting fundamentals, and fresh political developments in the week ended 17 February. Bangladesh saw renewed optimism following the Bangladesh Nationalist Party (BNP)'s election victory and progress on HKC-related compliance, though currency weakness and stagnant steel prices tempered sentiment.

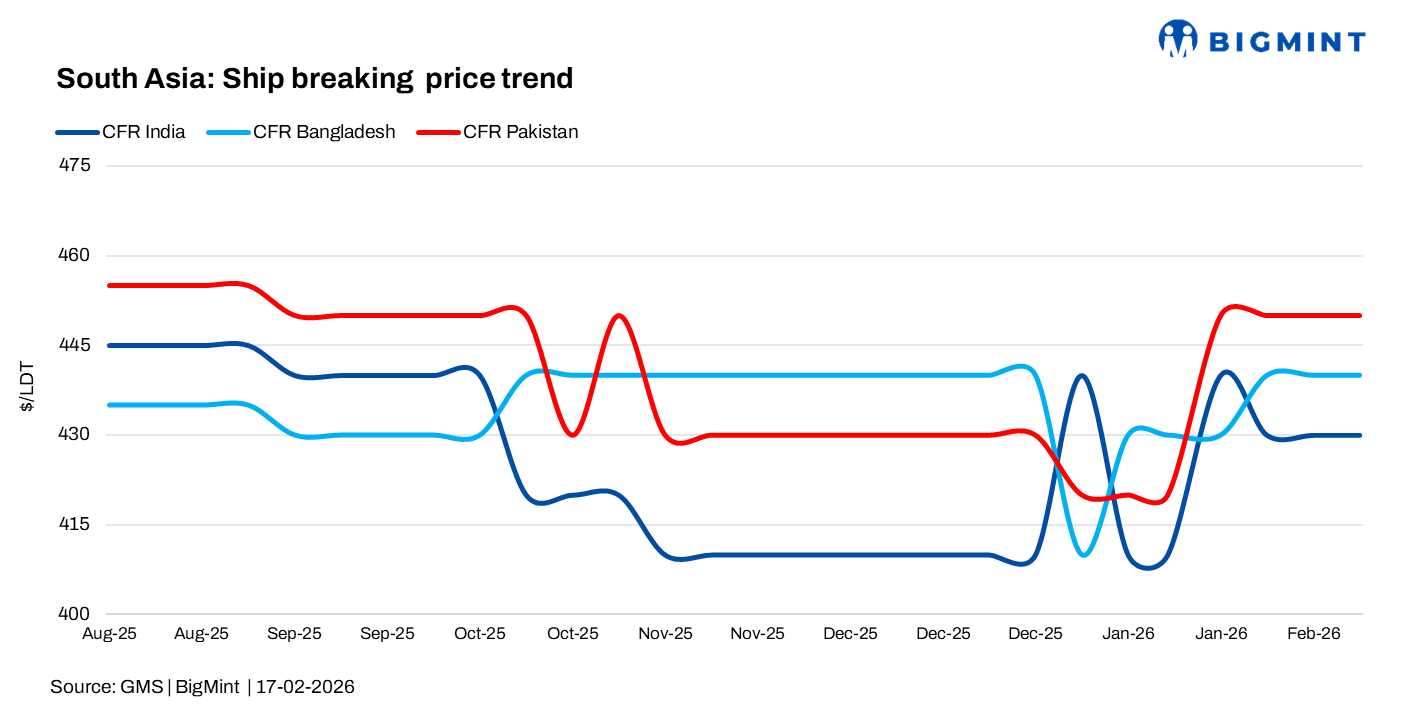

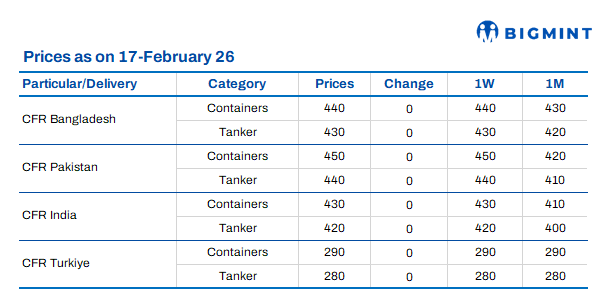

India's Alang market stayed volatile amid falling plate prices and currency swings, even as recyclers competed aggressively for limited tonnage. Meanwhile, Pakistan's Gadani yards maintained their lead, supported by firm steel prices, relative currency stability, and improved arrivals.

India: Volatility persists despite firm competition

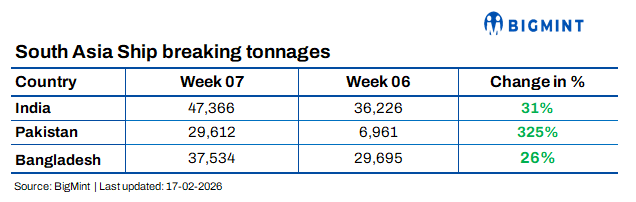

Alang's market remained volatile, though recyclers continued bidding competitively amid scarce vessel supply. India once again ranked toward the lower end of regional pricing, yet appetite for quality tonnage stayed firm. Around 47,000 LDT was reported delivered or awaiting beaching, including two uncommon large-LDT tankers, reflecting sustained demand for sizable units.

However, underlying fundamentals were unsettled. Domestic steel plate prices dropped nearly $10/t, erasing much of the recent recovery, while the Indian rupee strengthened slightly to Rs. 90.6 per US dollar. Weak downstream steel demand combined with currency movements has pressured recycler margins. Despite these headwinds, limited global tonnage availability has driven recyclers to bid aggressively when suitable vessels surface, underscoring resilient but cautious sentiment.

Bangladesh: Political clarity lifts sentiment

Chattogram witnessed improved optimism following the decisive election victory of the Bangladesh Nationalist Party (BNP), which strengthened expectations of progress on delayed infrastructure projects and potential recovery in domestic steel consumption. Regulatory developments also supported sentiment, as the Bangladesh Ship Breakers and Recyclers Association adopted the International Ready for Recycling Certificate (IRRC) framework in line with Hong Kong Convention standards, enhancing compliance credibility.

Nevertheless, market fundamentals were mixed. The Bangladeshi Taka weakened to BDT 122.25 against the US dollar, while local steel plate prices remained stagnant at approximately $494/t for the third consecutive week, reflecting subdued mill demand. Despite this, recyclers secured several smaller vessels along with a notable 24,000 LDT unit, indicating continued interest in attractively priced tonnage.

Pakistan: Gadani retains leadership

Pakistan's Gadani yards maintained their leading regional position. Stable steel prices and a steady Pakistani rupee at PKR 279.59 supported buying confidence. Domestic plate prices remained firm at roughly PKR 594/t-significantly higher than Bangladesh and Alang-providing stronger margins.

Improved local activity and private fixtures lifted anchored tonnage to nearly 30,000 LDT across four bulk carriers. Progress on Hong Kong Convention compliance, including accreditation of two yards and further infrastructure upgrades, reinforced Pakistans competitive edge.