Middle East: HRC import offers range-bound w-o-w in absence of trade

...

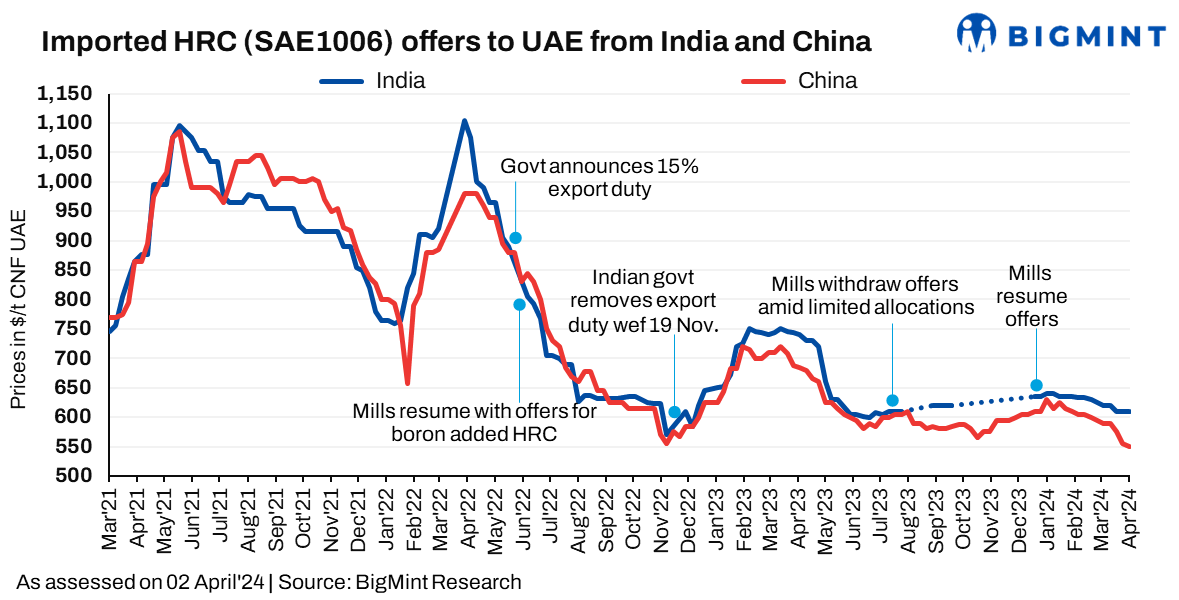

Chinese hot-rolled coil (HRC) export offers to the Middle East (ME) remained range-bound for the week. The offers from Chinese tier 1 mills are hovering around $570-580/t CFR UAE, while, Chinese tier 2 mills' current offers are ranging between $545-550/t CFR for the week.

However, Indian HRC export offers to the Middle East remained range-bound w-o-w to $605-610/t CFR, informed a source. Moreover, no deal has been heard concluded.

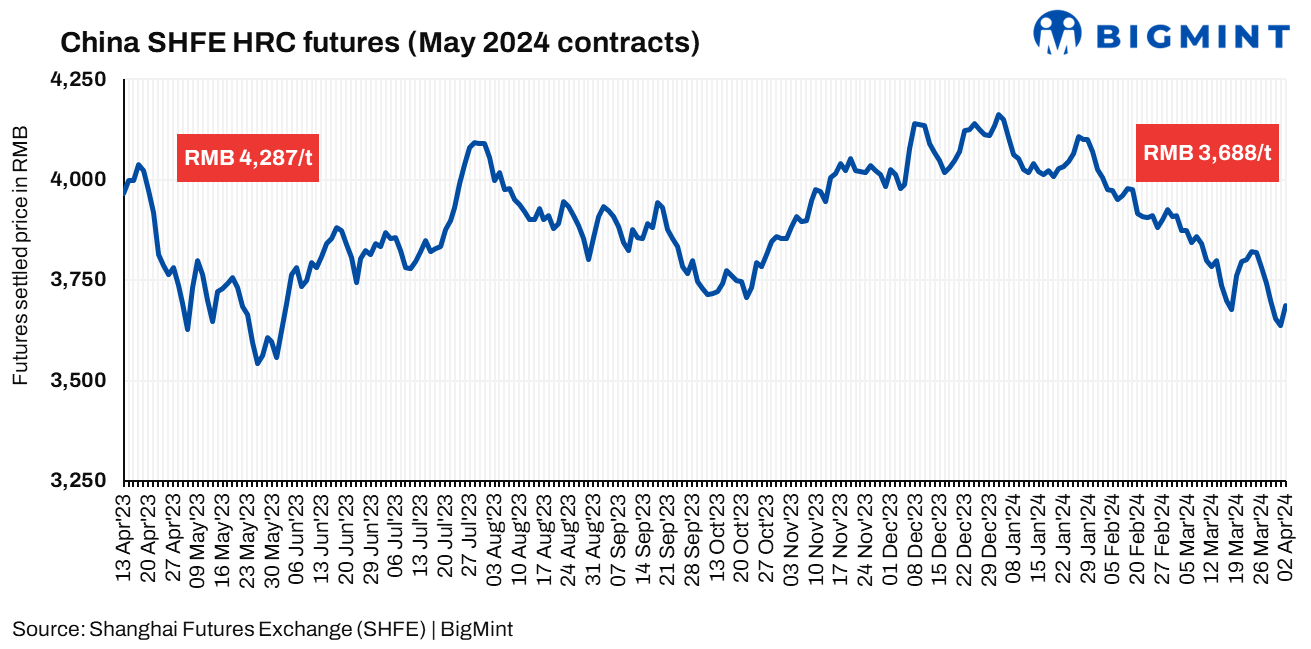

"Offers had come down last week. However, with recovery in SHFE HRC futures since last couple of days, Chinese mills are planning to lift offers," said a UAE based steel trader.

Factors influencing imported HRC prices

Chinese SHFE HRC futures fall w-o-w: The Shanghai Futures Exchange (SHFE) witnessed decline in prices due to subdued domestic demand and declining prices of raw materials. SHFE HRC futures fell by RMB 94 ($13/t) w-o-w to RMB 3,688 ($510/t) against RMB 3,782 ($523/t). However, on d-o-d basis the same increased by RMB 50 ($7/t) as compared to RMB 3,638 ($503/t) on 1 April 2024.

Slow market demand: Steel imports in the UAE and Saudi Arabia were slow as prices fell. The buyers are cautious due to weak demand and falling prices. Buyers are holding off on purchases because they expect prices to drop even lower during Ramadan and also waiting for new steel offers from Indian companies.

China's steel industry is facing a slowdown despite a pick up in manufacturing. This is due to problems in the real estate sector and government restrictions on infrastructure projects, which have reduced demand for steel. Even during the peak construction season, stockpiles of steel remained high, indicating a weak market.

Outlook: Indian offers may also remain under pressure if Chinese prices continue to drop. Weak demand and a potential price drop during Ramadan are key factors to watch.