LME Zinc rebounds w-o-w on steady buying, inventories extend decline

...

- Stocks dip below 102,000 t as physical tightness persists

- SHFE market closed for Lunar New Year holidays

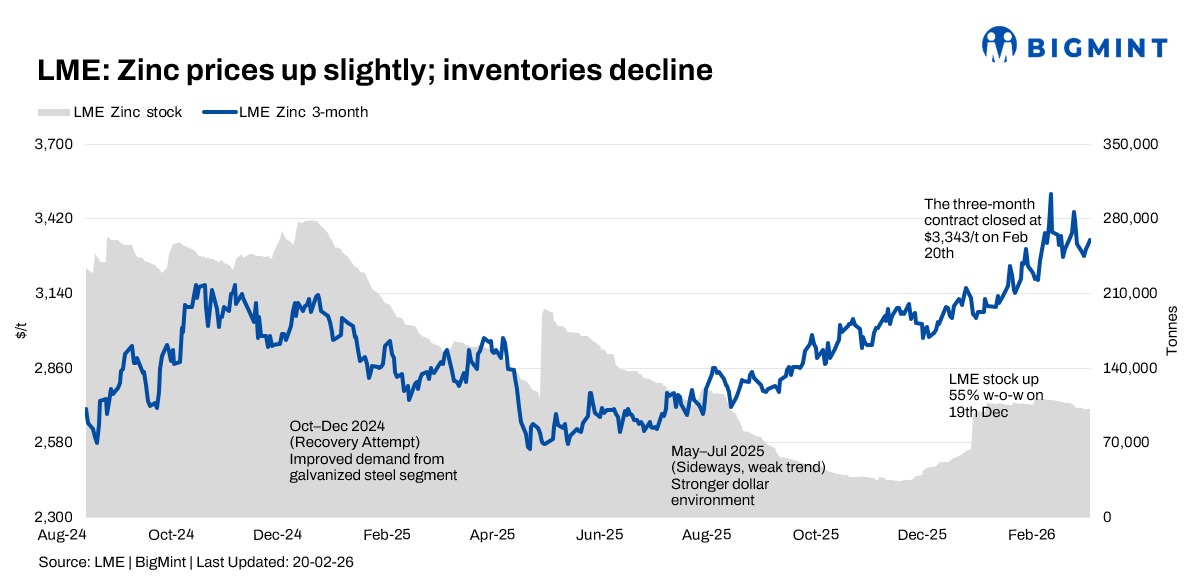

London Metal Exchange (LME) zinc prices recovered in the week ended 20 February, supported by steady buying interest and continued inventory draws. While upside remained measured, the absence of aggressive selling pressure allowed prices to stabilise after the prior week's dip.

Price trends

LME zinc cash prices opened at $3,256/t on 16 February and initially slipped to a weekly low of $3,250/t on 17 February. However, prices strengthened in the latter half of the week, climbing to settle at $3,309/t on 20 February, marking a 0.4% w-o-w gain.

The three-month contract followed a similar path, rising from $3,295/t at the start of the week to $3,343.5/t on Friday, up around 0.6% w-o-w. The contract gradually moved closer to the $3,350/t resistance zone but did not test recent highs near $3,400/t.

Inventory analysis

LME zinc inventories continued their downward trajectory, extending the drawdown trend seen in recent weeks.

Stocks declined from 102,175 t on 16 February to 101,575 t on 20 February, reflecting a weekly draw of 600 t. Although the pace of decline slowed compared with the previous week's sharper fall, inventories dropped below the 102,000 t threshold, signalling continued tightening in visible supply.

The relatively modest stock movement suggests a more balanced physical market, even as concentrate tightness continues to constrain smelter margins.

MCX zinc trends (16-20 Feb)

On the MCX, zinc futures traded within a relatively narrow yet active range, largely mirroring global cues. The active March 2026 contract moved between INR 319,400328,250/t during the week. Prices opened at INR 325,250/t on 16 February and settled higher at INR 326,100/t on 20 February, up around 0.6% w-o-w.

Trading activity gathered pace in the latter half of the week, with volumes improving alongside intraday swings, indicating renewed participation. Open interest also trended higher through the week, pointing to fresh positioning as prices stabilised.

Domestic supply conditions remained comfortable, while galvanising demand continued to be steady but largely need-based.

SHFE zinc trend

Trading activity on the Shanghai Futures Exchange (SHFE) remained suspended from 16 to 24 February due to Lunar New Year holidays. As a result, Chinese price signals were absent during the week, limiting arbitrage and cross-market directional cues.

The temporary closure has reduced the regional volatility, with LME movements largely driven by broader macro and fund positioning flows.

Outlook

In the near term, zinc is likely to consolidate between $3,250-3,400/t. Support is underpinned by low LME stocks at 101,575 t and structurally tight concentrate supply, which keeps the cost curve elevated and limits downside below $3,200-3,250/t.

However, upside beyond $3,400/t would require either a sharper inventory draw exceeding 2,000-3,000 t per week or a clear recovery in Chinese demand once SHFE resumes trading. If post-holiday Chinese buying remains muted and inventories stabilise above 100,000 t, prices could retest $3,250/t. Conversely, renewed warehouse cancellations or stronger galvanised steel demand could push zinc towards $3,450/t in the short term.