LME base metals mixed d-o-d; Trump considers easing metal tariffs

...

- Vale hit by nickel asset impairment

- Indonesia to curb 2026 nickel output

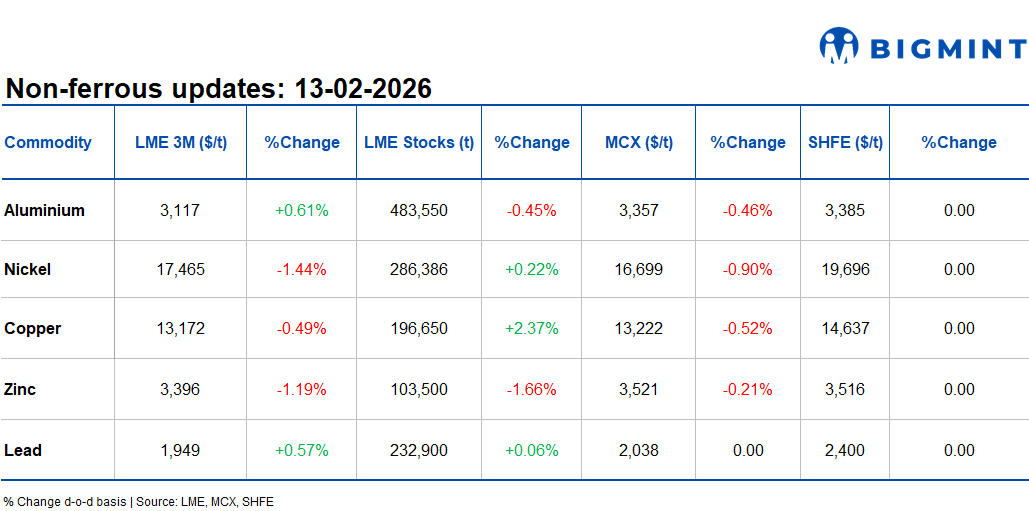

Base metals prices on the London Metal Exchange showed a mixed trend, with aluminium and lead posting gains while the rest of the complex edged lower. Aluminium rose 0.61% to $3,117/t and lead climbed 0.57% to $1,949/t. In contrast, nickel fell 1.44% to $17,465/t, copper slipped 0.49% to $13,172/t, and zinc declined 1.19% to $3,396/t.

Warehouse inventory movements were also varied. Aluminium stocks dropped 0.45% to 483,550 tonnes, and zinc inventories decreased 1.66% to 103,500 tonnes. Copper stocks increased 2.37% to 196,650 tonnes, while nickel inventories rose slightly by 0.22% to 286,386 tonnes. Lead stocks were broadly stable, inching up 0.06% to 232,900 tonnes.

Domestic market overview

Domestic non-ferrous scrap prices in India showed limited movement across key markets. Aluminium Tense Scrap (Loose), ex-Delhi, remained unchanged at INR 213,000/t, while Aluminium Tense Scrap (Loose), ex-Chennai, was also steady at INR 218,000/t, reflecting stable demand conditions. Meanwhile, Copper Armature Scrap (Cu 99%), ex-Delhi, increased by INR 5,000 or 0.4% to INR 1,150,000/t from INR 1,145,000/t, indicating mild buying support in the copper scrap segment.

Other market updates

Trump may scale back steel and aluminium tariffs

US President Donald Trump is planning to roll back some tariffs on steel and aluminum goods, according to a media report citing people familiar with the matter. Officials believe the levies--previously raised to as much as 50% on more than 400 products--have pushed up consumer prices on items such as food and beverage cans. The administration is reviewing the list of affected products and is expected to exempt certain goods, pause further expansions, and shift toward more targeted national security investigations. The move comes as voters express growing concern over the rising cost of living ahead of the November midterm elections.

Vale reports $3.8 billion quarterly loss on nickel impairment

Brazilian miner Vale posted a $3.8 billion net loss in the fourth quarter, widening from a $694 million loss a year earlier, mainly due to a $3.5 billion impairment on its Canadian nickel assets following lower long-term price assumptions. The company also recorded a $2.8 billion write-off of deferred tax assets and increased provisions related to its Samarco joint venture with BHP. Despite the loss, adjusted EBITDA rose 21% to $4.6 billion, or $4.8 billion excluding non-recurring items, beating expectations, while revenue climbed 9% to $11.1 billion on stronger iron ore and copper sales.

Indonesia to reduce 2026 nickel mining quota

Indonesia plans to cut its 2026 nickel production work plan and budget (RKAB) quota to 260-270 million tonnes, below the 379 million tonnes approved for 2025 and under the estimated 330 million tonnes of ore consumption next year. The move, aimed at supporting domestic nickel prices, has raised concerns about supply gaps, with some market participants expecting limited imports or potential smelter output cuts to balance demand. Nickel prices on the London Metal Exchange recently climbed to a 1-year high of $18,950/tonne, supported by geopolitical tensions and expectations of tighter Indonesian supply. The revised quota is expected to take full effect from April, with the possibility of further adjustments later in the year.