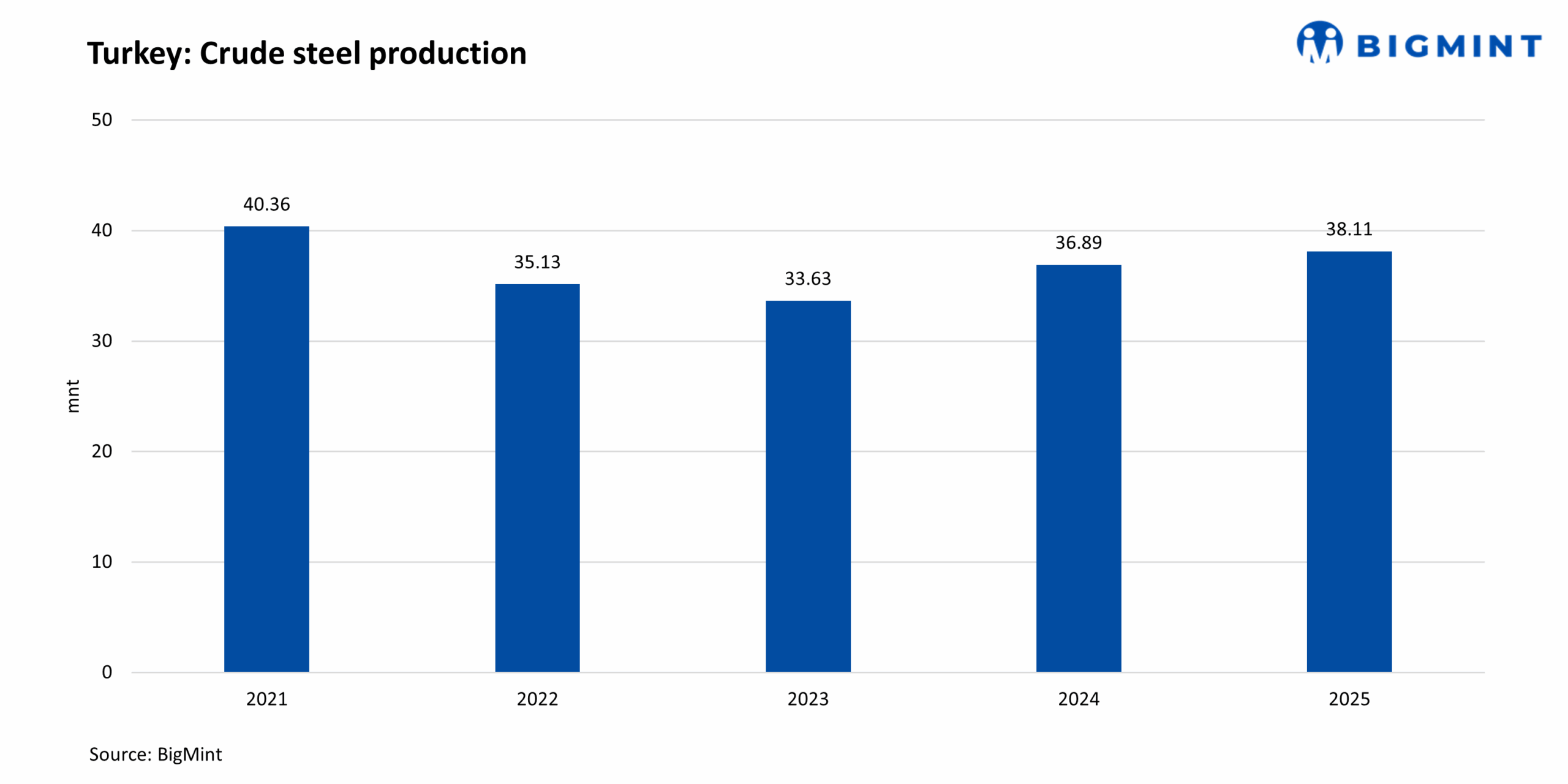

Turkiye's steel production expected to cross 40 mnt in 2026

...

- Steel imports reach highest level in history in CY'25

- Industry capacity utilisation drops to 61.6% from 74.8% in CY'24

According to a statement released by the Turkish Steel Producers' Association (TCUD), in December 2025 crude steel production increased by 18.5% y-o-y to 3.5 million tonnes (mnt) in Turkiye, the world's seventh largest steel producing country, while in 2025 production rose by 3.3% y-o-y to 38.1 mnt.

In December, Turkiye's billet and slab production amounted to 2.23 mnt and 1.29 mnt, up 16.5% and 22.1% y-o-y, respectively. In 2025, Turkiye produced 24.2 mnt of billet, up 6.1% against 13.91 mnt of slab, down 1.2% both compared to 2024.

In the given month, finished steel consumption in Turkiye rose by 3.8% y-o-y to 3.4 mnt, while in 2025 the country's finished steel consumption increased by 2.6% to 39.3 mnt.

Steel exports

In December, Turkiye's steel exports rose by 5.5% to 1.36 mnt, while the value of these exports increased by 2.1% to $898.87 million, y-o-y. In 2025, the country's steel exports rose by 12.5% to 15.1 mnt, while the value of these exports increased by 4.3% to $10.16 billion, both y-o-y. Flat and long product exports in 2025 amounted to 6.48 mnt and 5.11 mnt, respectively, with increases of 11.9% and 9.8% y-o-y, respectively, while semi-finished product exports amounted to 618,745 t.

Steel imports

In December, Turkiye's steel imports decreased by 18.6% to 1.48 mnt, while the value of these imports edged down by 16.6% to $1.03 billion, both y-o-y. In 2025, the country's steel imports increased by 8.6% to 18.8 mnt, while the value of these imports edged up by 0.7% to $13.08 billion, both y-o-y. Flat and long product imports in 2025 amounted to 8.94 mnt and 1.51 mnt, respectively, with increases of 10.4% and 11.5% y-o-y, while semi-finished product imports amounted to 8.42 mnt.

In 2025, Turkiye's steel export-to-import ratio increased to 77.63% from 73.91% recorded in 2024.

Imports surge, trade deficit widens

The year 2025 was an extremely challenging period for the Turkish steel industry. Rising financing costs, together with global price pressure stemming from dumped and subsidised products, particularly from Russia, China and other Far Eastern countries, placed a heavy burden on producers' costs. The intensifying export pressure in Russia, China and Far Eastern countries caused Turkiye's steel imports to reach 18.9 mnt, the highest level in history. The increase in imports of dumped and subsidised steel products also contributed to Turkiye's foreign trade deficit rising by 11.9% to $92.9 billion in 2025.

Low capacity utilisation

Although Turkiye's steel production capacity increased to 61.9 mnt in 2025, the sector's capacity utilisation rate declined from 74.8% to 61.6%. According to the TCUD, the EU's efforts to tighten quotas and restrict Turkiye's steel exports have increased pressure on the country's steel exports. In addition, with the Carbon Border Adjustment Mechanism (CBAM) entering into force, 2026 will mark a period in which competition will increasingly be shaped by a sustainability approach covering the entire product life-cycle.

Outlook

Within this framework, in 2026 a) the implementation of tonnage restrictions on steel imports, b) positive outcomes in negotiations with the European Commission, and c) a decline in inflation and interest rates are expected to lead to an approximately 7% increase in steel production and consumption, with production exceeding 40 mnt.