India's non-coking coal imports fall in 10MFY'26 as power sector demand weakens

...

- Prolonged monsoon, milder summer reduce cooling demand

- Surge in renewable capacity additions limit coal-fired output

- Indonesian output curbs add uncertainty to near-term outlook

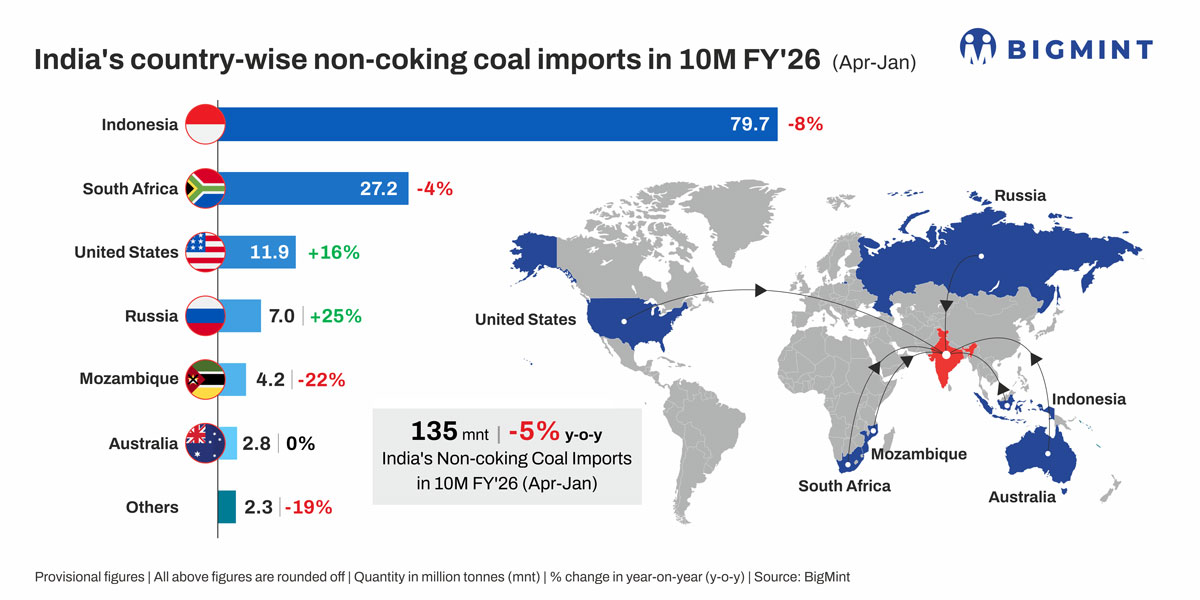

Morning Brief: India's non-coking coal imports dropped slightly by 5% y-o-y to 135 million tonnes (mnt) during April 2025-January 2026 (10MFY'26), as per data maintained with BigMint.

The decline was primarily driven by lower arrivals from Indonesia (-8% to 80 mnt), with overall power consumption increasing only marginally during the review period.

Factors influencing imports in 10MFY'26

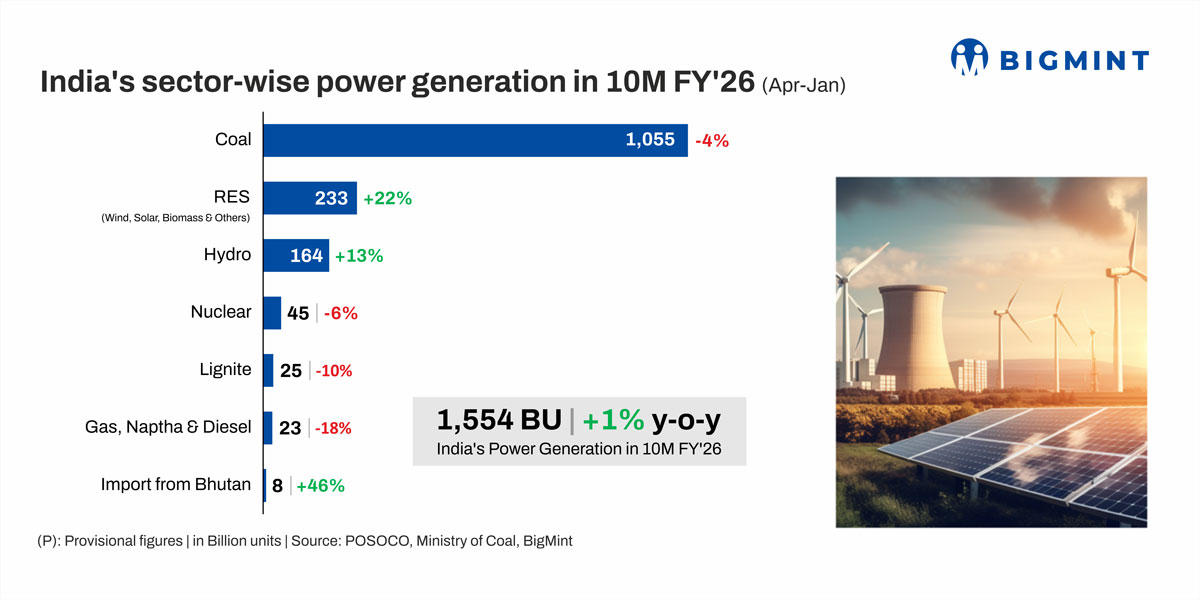

Coal-based power generation falls: India's power generation from coal dropped 4% y-o-y to 1,055 billion units during April 2025-January 2026 (10MFY'26), reducing demand for Indonesian thermal coal, which is primarily consumed by power plants. A milder summer and an extended monsoon, driven by the La Nina, also limited cooling demand. Consequently, growth in overall power consumption was a marginal 0.9% y-o-y at 1.4 trillion units during 10MFY'26, which was fulfilled largely by renewable sources.

In fact, lower coal-fired power generation kept demand for domestic coal equally subdued. During 10MFY'26, while India's coal production was relatively stable at 830 mnt, coal offtake by the power sector fell 4% to 662 mnt.

Renewable power generation surges: In 10MFY'26, power generation through renewable energy sources rose 22% y-o-y. In 9MFY'26, solar power generation rose 19% to 121 billion units, while wind-based output surged by 30% to 88 million units, driven by rapid capacity additions in recent years.

To illustrate, in January-November 2025, renewable energy capacity additions totalled a record 41 gigawatts (GW), while new coal capacity was merely 9 GW. As of November 2025, renewables rose to 40% of India's capacity mix, while coal's share shrank to 43%, as per a report from the Centre for Research on Energy and Clean Air.

Outlook

The big question right now is if Indonesian production curbs will significantly impact thermal coal availability in India. Although imports from Indonesia declined to 80 mnt, they still come to around 8% of domestic market availability (considering total production and imports) and 60% of overall imports. Reports suggest production cuts of 40-70% y-o-y are under consideration, with spot export trades under halt.

BigMint's bulk vessel line-up data suggests that Indonesia's thermal coal exports in January 2026 fell 20% m-o-m to 36.1 mnt. Coal shipments, comprising all variants, to India fell 12% to 6.6 mnt.

Meanwhile, domestic production growth has been muted so far this fiscal - it was on a declining trend before new mines of CIL subsidiaries started production. Therefore, it is uncertain if Indian miners will be able to fulfil a supply gap from lower Indonesian imports.

It is also important to note that there are high possibilities of an EL Nino forming this year, which could fuel intense heat waves across India and lift power demand. This may drive up domestic coal usage despite higher renewable generation.