India: Portside US non-coking coal prices rise w-o-w on pet coke price spike, tight supply

...

- Near-term bullishness driven by port stock depletion, supply gap

- Structural price support from elevated petcoke sustaining coal substitution demand

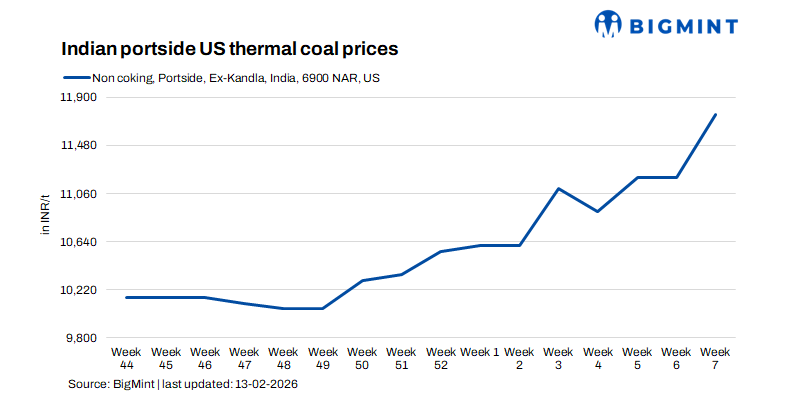

Prices of US high-CV non-coking coal on Indias west coast ports rose w-o-w on 13 February 2026, driven by petcoke inflation and tightening portside availability. BigMint assessed portside prices of US thermal coal in India at INR 11,750/tonne (t) ex-Kandla, increasing sharply by INR 550/t w-0-w.

At Tuna Port,spot prices were indicated in the INR 13,500-13,800/tonne (t) range ex-port (taxes extra) for prompt vessels. Multiple vessels were quoted at INR 13,650-13,800/t, indicating that spot prices have surged well beyond the earlier INR 12,200-12,400/t.

Prices at Kandla also firmed up on 13 February. Spot indications initially ranged between INR 11,575-12,500/t, but aggressive buying for January-February arrivals progressively lifted offers through INR 11,950/t, INR 12,150/t, INR 12,500/t, INR 12,800/t, and, eventually, INR 13,500/t within a single trading session. Sales were subsequently withdrawn by at least one active supplier -- though this is pending further confirmation -- signalling tightening availability.

Petcoke price spike drives gains in US non-coking coal

The rise in portside US non-coking coal prices is directly linked to a parallel price hike in petcoke.

Recent CFR India petcoke offers for 6.5% sulphur US-origin material were clustered in the $122-$125/t range, with bids largely between $118-$122/t. Saudi-origin 9.5% sulphur cargoes were offered between $121-$124/t. FOB US Gulf Coast levels for 6.5% sulphur were indicated in the mid-to-high $70s, with freights to India reportedly in the low-to-mid $50s amid heavy grain movement.

More significantly, at least one large refiner reportedly offered petcoke at $138/t CFR Kandla. At that level, delivered petcoke economics rise sharply, especially when freight inflation is factored in.

For cement producers, this shifts the heat-adjusted fuel balance. Rather than fully switching fuels, kiln operators are increasing coal blending ratios to offset rising petcoke costs. The substitution is incremental but broad-based, creating persistent coal demand support.

At the same time, freight constraints are amplifying the squeeze. Grain exports have tightened vessel availability, pushing freights higher and slowing replacement cargoes. Traders who sold US coal at $115/t CFR equivalent are reportedly struggling to cover at $140/t CFR levels, illustrating the cost of being short in a tightening chain.

Thus, three forces converged simultaneously:

- Petcoke inflation raised coal's relative attractiveness.

- Freight firmness constrained replacement flexibility.

- Rapid stock drawdown created a visible port supply gap.

This combination transformed what was earlier a short-covering rally into a structural repricing event.

A key price driver was stock depletion. Joint stock data showed over 207,000 t across Kandla and Tuna on 11 February. However, lifting of roughly 20,000 t/day reduced balance availability rapidly. Within two days, available stock was effectively halved. Updated figures suggest Kandla balance stock of roughly 82,000 t, equating to just four days of loading at current evacuation rates.

With the next vessel only expected to berth around 22 February and fresh loading commencing around 26 February, the market is now pricing in a visible supply gap between 20-25 February.

Market discipline: The end of casual shorts

The earlier episode in January exposed uncovered forward sellers.With port stocks visibly depleting and arrival schedules known, speculative forward selling without physical vessel cover has become materially riskier. Buyers are increasingly demanding stricter compliance on documentation, delivery windows, and vessel nomination. Suppliers, in turn, are scaling back aggressive forward offers.

The psychology has shifted from opportunistic trading to defensive inventory management.

Outlook

The near-term outlook remains firm.

On the supportive side, petcoke CFR India remains above $120/t, with upside risk toward the high $130s in tight prompt windows. Freight remains elevated due to grain movement,Kandla faces a temporary supply gap before fresh cargo discharge resumes, andTuna spot prices climbed higher and show limited immediate downside.

However, once fresh vessels discharge and stock normalises, some of the urgency premium could ease -- provided petcoke stabilises. The key variable remains petcoke. As long as delivered petcoke economics remain elevated, US high-CV coal will retain a firm cost floor in India.