India: Odisha iron ore fines index remains firm w-o-w, market awaits for OMC auction

...

- Buyers eye next week OMC auction to procure bulk material

- Miners keep the same offers this week, and selective deals continue

Iron ore prices in Odisha remained largely stable in the week ended 14 February as market participants adopted a cautious stance ahead of the upcoming auction by Odisha Mining Corporation (OMC) scheduled for 19 February. With limited fresh triggers in the spot market, both buyers and sellers preferred to maintain existing positions while awaiting clearer price signals from the auction outcome.

Price update

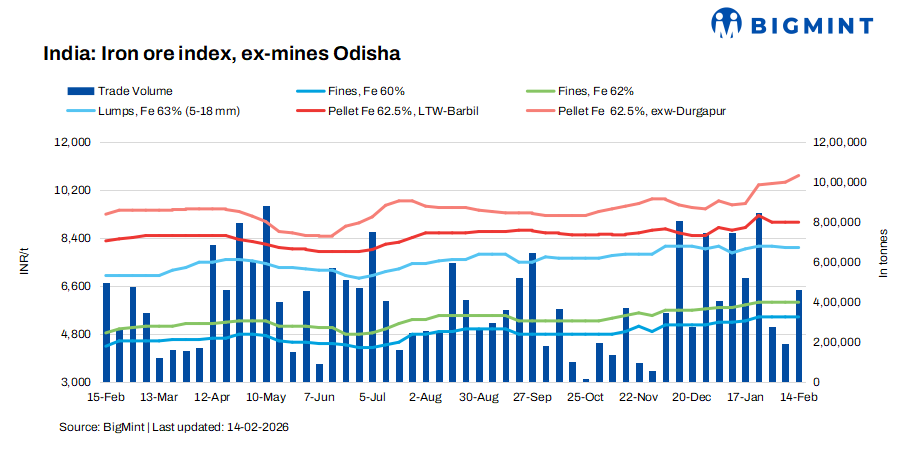

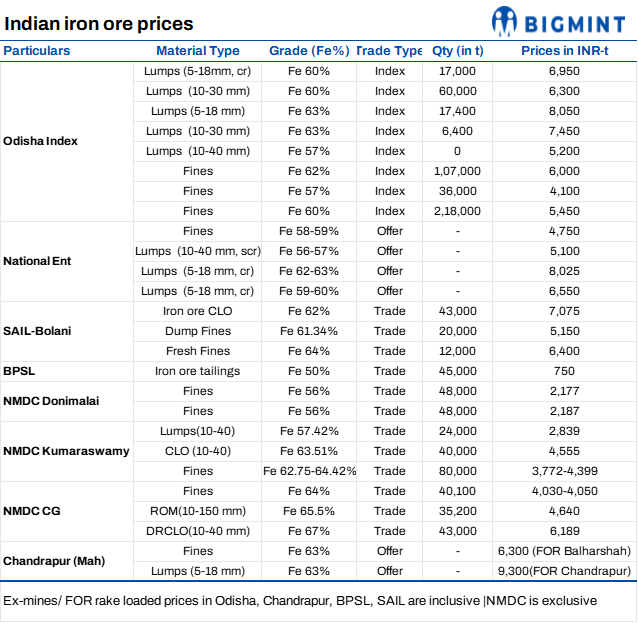

BigMint's Odisha iron ore fines (Fe 62%) index remained unchanged w-o-w at INR 6,000/t ($65/t) ex-mines on Saturday (14 February 2026). BigMint recorded deals for around 460,000 t this week, concluded directly by steelmakers.

In the SAIL iron ore auctions, around 43,000-t CLO (10-40 mm, Fe 62%) at INR 7,075/t against the base price of INR 6,675/t and 20,000-t dump fines (Fe 60.13%) at INR 5,150/t against the base price of INR 4,700/t. Around 12,000 t fresh fines (Fe64%) were sold at INR 6,400/t against the base price of INR 5,900/t. Prices include royalty, DMF, NMET, and extra premium.

Market highlights

Miners continued to offer material at levels similar to the previous week. Trading activity was moderate, partly due to certain miners nearing the expiration of their Environmental Clearances (EC), which has restricted aggressive spot sales. A miner stated, "Most of our volumes are already booked under previous deals, and dispatches are still ongoing. We are not entertaining large bulk orders at this stage."

Some miners reported that they have completed 85-90% of their EC extraction, and they have some pending deliveries of material for old orders.

On the demand side, steelmakers are closely watching the OMC auction to secure bulk quantities for the remaining weeks of FY26. According to a steel producer, "We anticipate potential material tightness in March due to year-end procurement cycles and EC expiration of miners. The OMC auction will play a key role in determining our raw material strategy."

Market sentiment has remained firm, supported by stronger sponge iron and semi-finished steel prices in the domestic market. Improved downstream realizations have provided a cushion to iron ore prices, keeping them steady with moderate trading activity continuing in the eastern region. Traders reported regular inquiries, particularly for higher-grade fines and lumps.

Recent auctions conducted by select miners also witnessed healthy premiums for higher-grade material, further reinforcing positive sentiment in the market.

A pellet producer noted that the merchant miners' previous deals are already pending. Not many bulk deals have been seen in the market. However, a few buyers will target next week's OMC auction for their advance raw material restocking.

Factors affecting iron ore prices

Pellet prices firm w-o-w: Pellet (6-20 mm, Fe 62.5%) prices in Odisha's Barbil remained unchanged w-o-w at INR 9,000/t ($98/t) loaded to wagon on 13 February. Pellet (Fe 62.5%, 6-20 mm) prices in Durgapur rose by INR 250/t ($2.5/t) to INR 10,750/t ($119/t) exw.

Sponge iron prices rise marginally w-o-w: According to BigMint's assessment, sponge iron C-DRI (FeM 80%) prices in Rourkela edge up by INR 100/t ($1/t) w-o-w to INR 27,400/t ($303/t) on 14 February.

Billet prices Fall w-o-w: Meanwhile, steel billet (100*100 mm) prices in Rourkela inched down by INR 300/t ($2/t) w-o-w to INR 40,700/t ($449/t) on 14 February.

Rationale

- T1- Five (5) deals for Fe 62% fines were recorded in the publishing window, and three (3) were considered for price computation. These were given 50% weightage for index calculation.

- T2 - BigMint received twenty (20) offers and indicative prices under the T2 category (offers, indicative, and bids) in this publishing window. Eighteen (18) were taken into consideration and given 50% weightage. To check BigMint's iron ore assessment, pricing methodology, and specification document, click here.

Outlook

Going forward, the outcome of the OMC auction is expected to provide clearer direction on price trends and supply dynamics, setting the tone for Odishas iron ore market in the weeks ahead.