India's iron ore production rises just 4% y-o-y in CY'25 - BigMint report

...

- Odisha's iron ore output declines over 3% y-o-y

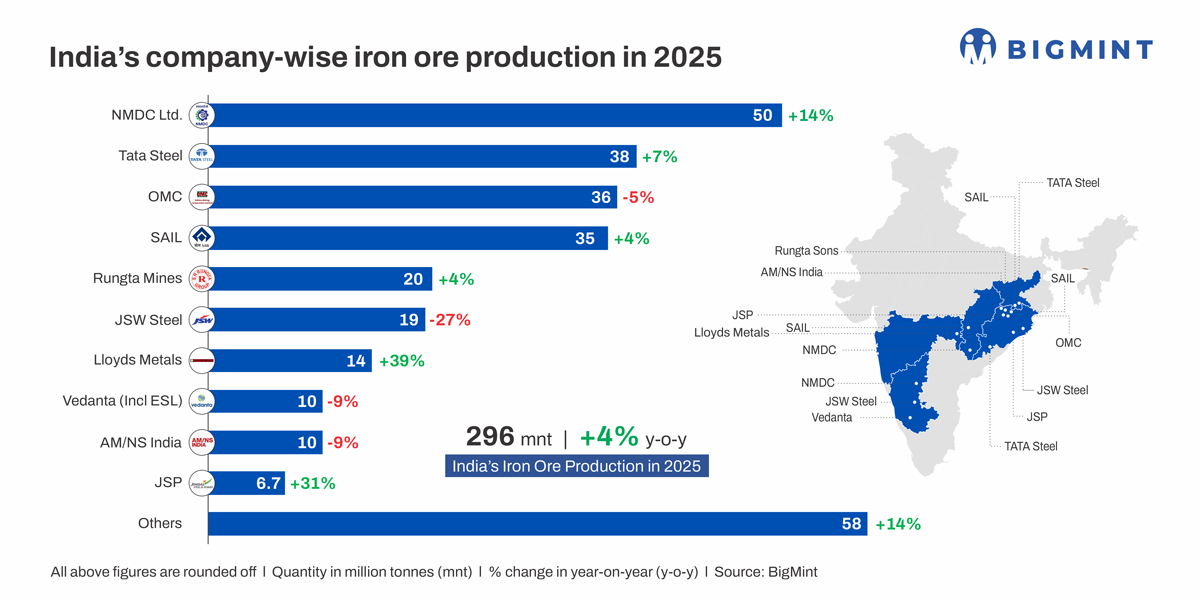

- NMDC's production up 14%, JSW records sharp drop

- Govt tightening rules to operationalise idle auctioned mines

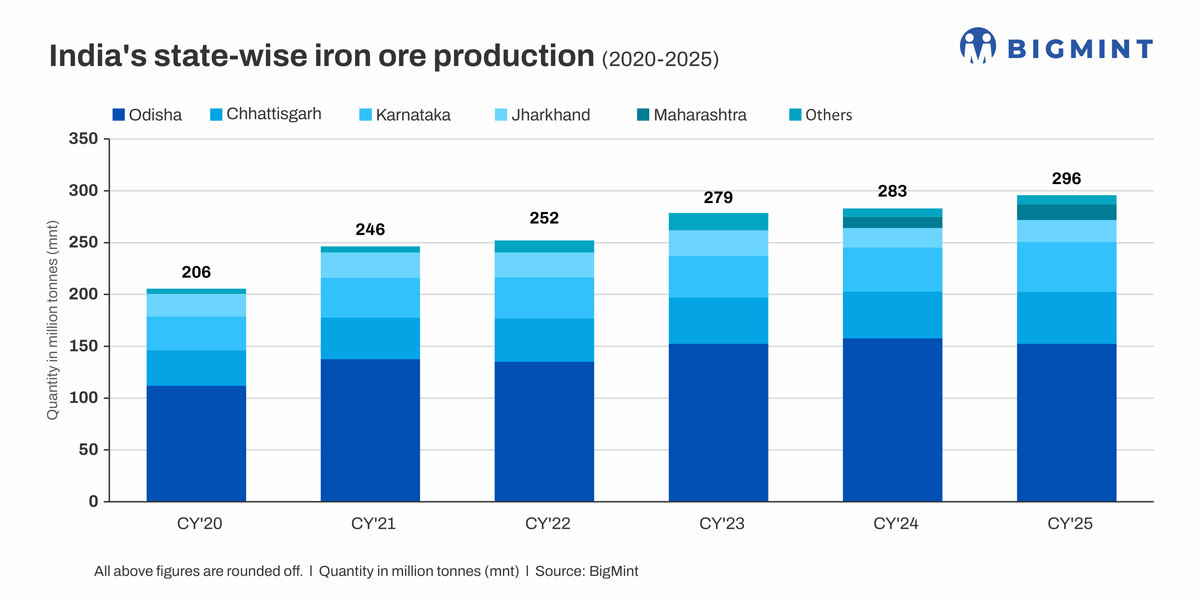

Morning Brief: India's iron ore production reached 296 million tonnes (mnt) in CY'25 compared with 283 mnt in CY'24, an increase of 4.59% y-o-y. Domestic iron ore production increased at a slower pace than steel production which recorded a growth of over 10% y-o-y in CY'25. This led to a tightening of supplies in the domestic market, BigMint notes.

India is the fourth largest iron ore producer in the world after Australia, Brazil and China.

State-wise production

Odisha retained the top spot among iron ore producing states with total output in CY'25 at over 152 mnt, which is more than half of national output. However, production edged down by 3.3% y-o-y due to loss of production by some major miners.

Except Odisha, the other states retained their record of sustained growth in mined output. Chhattisgarh, the second largest producing state in the country, recorded total output at 50 mnt, an increase of over 11% y-o-y. Likewise, Karnataka maintained its record of production growth by recording output at over 48 mnt, up 13% y-o-y.

Thanks to rapid capacity expansion by key miners in the state, Maharashtra recorded a nearly 40% increase in production in CY'25 with total output touching 14.9 mnt.

Top producers

PSU miner NMDC, the country's leading producer, recorded a 14% growth in production in CY'25 at over 50 mnt. Production was partly impacted in CY'24 due to labour problems. In order to achieve its target of 100 mnt by 2030, the miner has applied for EC in Bailadila for around 55 mnt and 17 mnt in Karnataka. It has recently secured approvals to expand output at Bailadila, covering capacity increases at Deposit-5 and Deposit-14 and a recommended clearance for Deposit-11.

The other top PSU miner OMC, however, recorded a decline in production of 4.5% y-o-y. Weak steel prices and offtake in domestic auctions impacted OMC's production strategy and an extended monsoon also affected operations.

Both Tata Steel and SAIL witnessed an increase in production at a time of rising steel capacity, while JSW actually suffered a 7 mnt decline in production due to the surrender of the Jajang mine in Odisha. Moreover, delay in operationalisation of auctioned mines due to forest clearances, etc. is affecting the company's overall production.

Among the merchant miners, Rungta raised production to over 19 mnt, while Lloyds lifted total output by nearly 40% to 14.3 mnt. Alongside investments in DRI and downstream steel assets, the company is targeting to raise iron ore capacity to 26 mnt in the short term.

Iron ore market in CY'25

- Non-functioning auctioned mines: The inordinate delay in operationalisation of auctioned mines led to the tightening in domestic iron ore production. Not even a third of the 137 mines auctioned since the amendment of the MMDR Act in 2015 have started operations. The burden of auction premiums and higher taxes, as well as delay in issuing of environment and forest clearances by central and state authorities are obstructing fast operationalisation.

- Merchant share 60% of national output: The share of the merchant mines in the total iron ore output of the country in CY'25 stood at over 59%, as per BigMint assessment. With the growth in production by NMDC and other miners, the share of merchant is witnessing an increase.

On the other hand, the share of iron ore lumps in total ore production in CY'25 was around 27% at around 81 mnt. Fines production was assessed at 215 mnt. Production of lumps recorded a marginal growth of 4 mnt in CY'25 compared to 77 mnt in CY'24.

- Policy thrust: Domestic iron ore production lagged behind the fast-paced growth in crude steel production in CY'25, and imports of iron ore and pellets touched a multi-year high. The Ministry of Mines has issued the Mineral (Auction) Second Amendment Rules, 2025, introducing stricter timelines, enhanced performance security mechanisms, and automatic online transparency measures to expedite the operationalisation of mineral blocks.

The Ministry is tightening the window to operationalise mines won through auctions. Currently, under Section 4A (4) of the MMDR Act preferred bidders have two years to operationalise the mine they have bid for and begin dispatches of ore.

Outlook

Policy pressure is expected to inject some momentum in terms of a ramp up of production from the auctioned leases. Among the top miners, NMDC is exploring different deposits in Chhattisgarh. After a change in the MDO model, OMC is also expecting higher production, especially from the Gandhamardhan blocks. Tata Steel is expected to commence operations at the Kalamang and Gandhalpada mines.

Therefore, production is poised for growth in CY'26, although the depletion of high-grade ore and the tightening in supplies of lumps will be acutely felt by the domestic industry.