Indian steel prices witness sharp rally in Jan'26 on surging raw materials costs, policy support

...

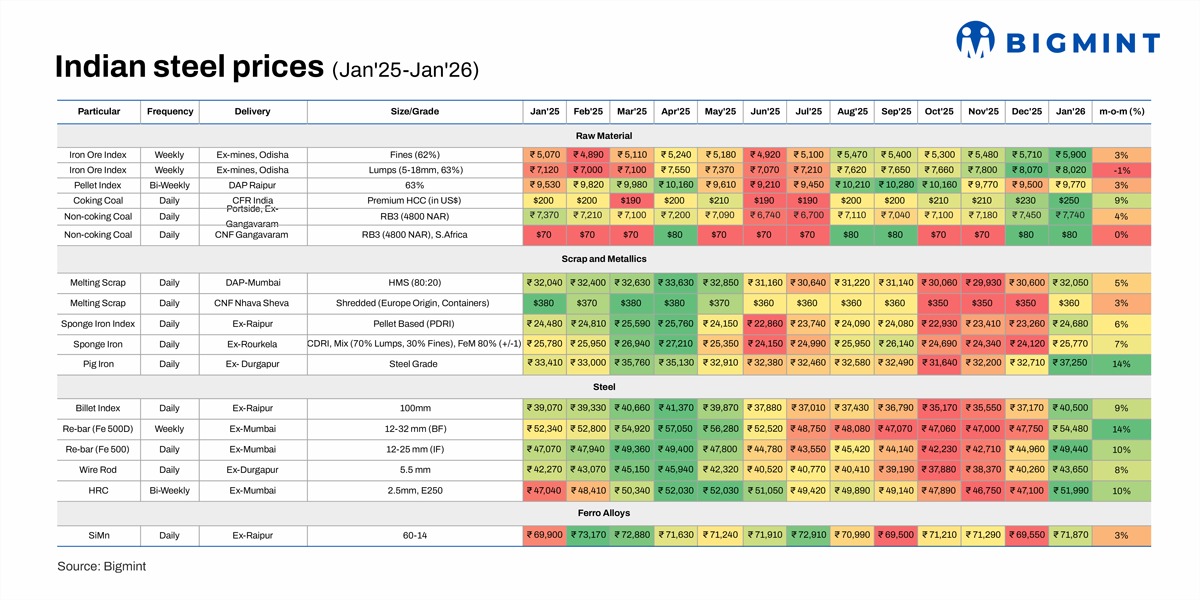

- Average HRC prices up 10% m-o-m in Jan, rebar rises 14%

- Imported coking coal prices edge up 9% on weather disruptions

- With safeguard duty in place, mills may hike HRC prices further

Morning Brief: The domestic steel market witnessed a rally in January 2026 after prices had sunk to five-year lows in November-December. The primary mills raised flat and long steel prices successively throughout the month coinciding with the surge in raw material prices and the implementation of the safeguard duty on steel imports. Sustained inventory depletion throughout the month and brisk activity on the spot market prompted the leading mills to opt for hikes.

The uptrend in steel prices directly impacted the raw materials and metallics markets, with prices witnessing an uptick across segments. Below are highlights:

Iron ore & pellet: BigMint's Odisha iron ore (Fe 62%) fines index averaged at INR 5,900/t, an increase of 3% m-o-m. However, the lumps index witnessed a marginal correction after bids in OMC's mid-month auction for lumps remained largely stable m-o-m. The fines auction, however, fetched premiums. Although domestic iron ore production has recovered over the last few months, tight supply amid non-operationalisation of auctioned mines is providing support to prices.

Average pellet (Fe 63%) prices in Raipur edged up m-o-m, with BigMint's pellet index rising 3%. Pellet prices received support from downstream steel and sponge iron prices, upward revision in prices by NMDC, strong bids in OMC auction, and the increase in prices in neighbouring markets.

Coking coal: Premium hard coking coal (PHCC) averaged at around $250/t CFR India in January, an increase of 9% m-o-m. Prices rose on weather disruptions, as heavy rainfall from Cyclone Koji disrupted mining and port operations and force majeure declarations by miners following heavy rainfall which affected supplies.

Non-coking coal: Indian portside South African thermal coal prices touched a one-year high in January, supported by low port inventories, constrained export availability and firmer global benchmarks, although trading remained thin amid holidays and cautious buying. Average portside prices inched up by 4% m-o-m while imported seaborne prices remained unchanged m-o-m.

Ferrous scrap: Domestic scrap prices edged up tracking the hike in domestic steel and metallics prices. Average BigMint benchmark prices for melting scrap increased by 5% m-o-m. However, the imported scrap market stayed weak amid persistent bid-offer disparity with steel sales remaining poor, while the INR-USD conversion touched its highest level, further tightening affordability. Prices for imported shredded and other high grades struggled as buyers resisted elevated offers.

Sponge and pig iron: Average direct reduced iron (DRI) prices in the domestic market increased by 6-7% m-o-m on rising steel and scrap prices, as well as pellet and semi-finished steel prices. Sponge iron prices trended up from the second week of January onwards alongside the rise in induction furnace steel prices. However, rapid growth in domestic production of sponge iron naturally weighed on prices.

Monthly average steel-grade pig iron prices, moreover, witnessed a sharp uptick of 14%. The rapid escalation in steel prices, steady surge in imported coking coal and domestic coke prices, as well as increasing prices of metallic feedstock and scrap were the key drivers. Auctions conducted by leading PSU steel players saw pig iron prices edging up toward the latter half of the month.

Billet: BigMint's domestic billet index for Raipur increased by 9% m-o-m following the rally in rebar prices as well as strengthening sponge iron prices. However, buyer caution and resistance to higher prices was also seen throughout the month.

Rebar: Average BF rebar prices increased by 14% m-o-m while IF-route prices recorded a 10% uptick. The primary steel mills increased rebar prices thrice in January on strong material lifting in the trade channel and robust demand from the infrastructure and construction segments. The distribution channel experienced limited material availability for some sizes, as highlighted by market participants.

Inventories at primary mills declined by 15-20% in January. Strong demand from the projects segment and the distribution network led to inventory reduction at mill yards. Most steelmakers are booked out for the coming days, and some are not offering to the projects segment owing to low stocks. Higher coking coal cost burden accounted for the somewhat steeper rise in BF rebar prices.

Wire rod: Steel wire rod prices with the rally in constructional steel prices and turnaround in market sentiment. Average prices rose by 8% m-o-m, while firmIoIorn orern ore raw material prices continued to underpin the market, encouraging manufacturers to maintain prices at higher levels.

HRC: In the last week of December, the primary mills hiked HRC and CRC prices following a hike in mid-December. The trade market moved higher underpinned by mill price hikes and elevated raw material costs during the year-end holiday period. Steelmakers raised prices following the safeguard duty announcement, supported by restocking activity, and positive market expectations.

Towards the end of January, the market remained firm as the tier-1 mills hiked prices again following a parallel hike in the longs segment. While festive holidays kept demand and trading subdued, mill-led price hikes sparked a rebound in trade-level prices as activity resumed post-festivities. Fast inventory drawdown, too, supported prices.

Silico manganese: Domestic silico manganese prices continued their upward trajectory in January, rising 3% m-o-m, supported by strong domestic demand and sellers maintaining firm pricing amid tight availability. Rising manganese ore costs, particularly from imports, added upward pressure to prices.

Outlook

Given that the safeguard duty has rendered steel imports unfeasible and will act as a buffer against dumping, the domestic mills have still have space to increase prices amid surging raw material costs. The tier-1 mills are likely to take another round of HRC list price hike sometime soon. Strengthening steel prices amid positive peak season sentiment are expected to keep the domestic market anchored in February.