Indian mills raise HRC-CRC list prices by up to INR 2,000/t for Oct'23 sales

...

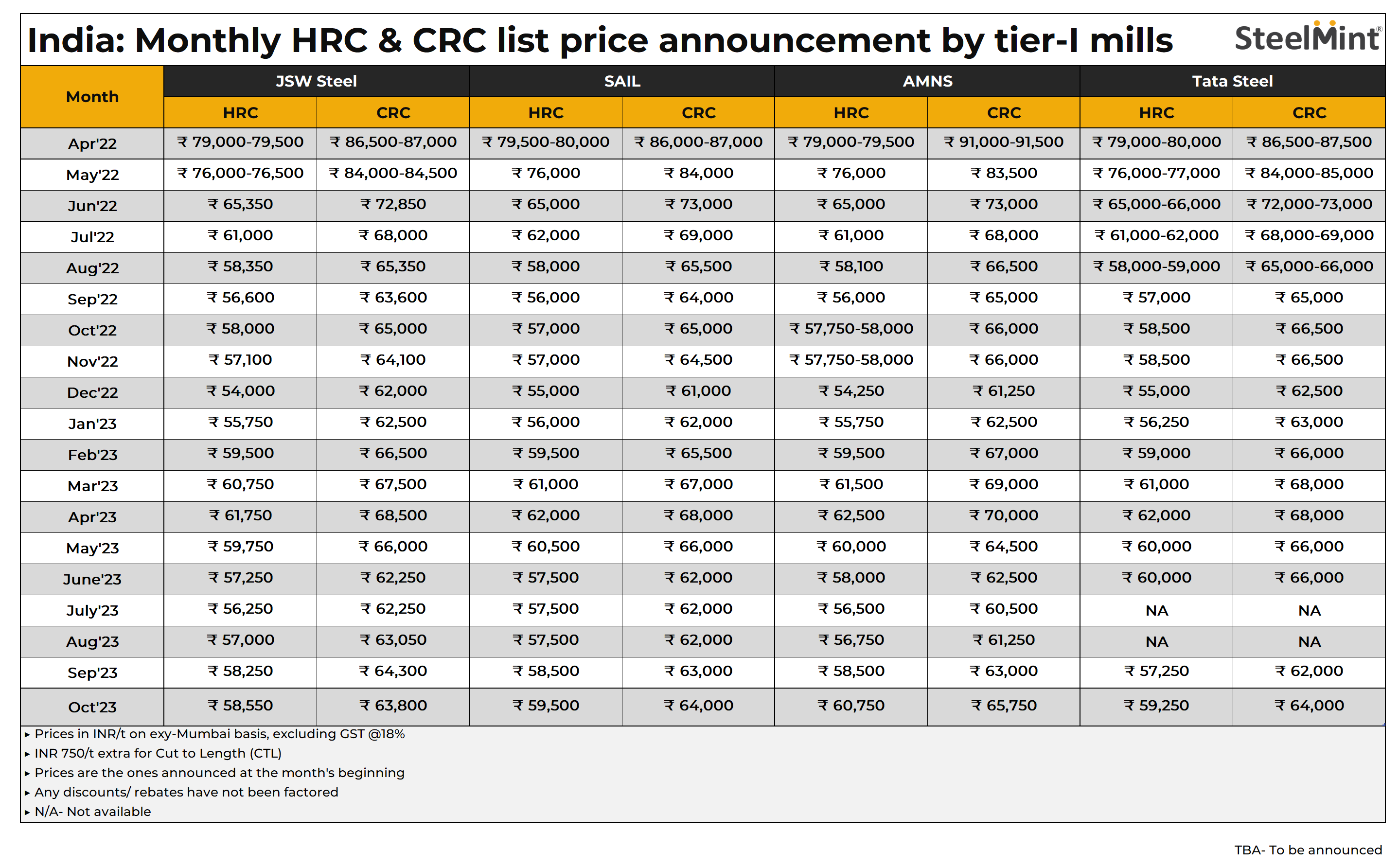

India's prominent flat steel manufacturers have increased their list prices of hot-rolled (HR) and cold-rolled (CR) coils earlier this week. The quantum of increase for HRC was around INR 750-2,000/t ($9-24t) and CRC was INR 750-2,000/t ($9-24/t), SteelMint learnt from industry sources. The price increase follows an interim hike of INR 750/t ($9/t) taken by a few mills towards the end of September. However, a few mills have factored-in their price support extended in the previous month, which has resulted in deviation in the effective list price levels for October sales.

Factors behind the list price increase:

1. Domestic prices rise in September: The trade level prices had increased in September month despite a slow-paced demand and ample of imported stock being available in the market. On a monthly comparison, the bi-weekly assessed trade prices of HRC increased by a staggering INR 2,150/t ($26/t) in August. The prices of HRC stood at around INR 59,700/t ($717/t) exy-Mumbai, at the beginning of September edging up to INR 61,800 ($743/t) exy-Mumbai by the month-end.

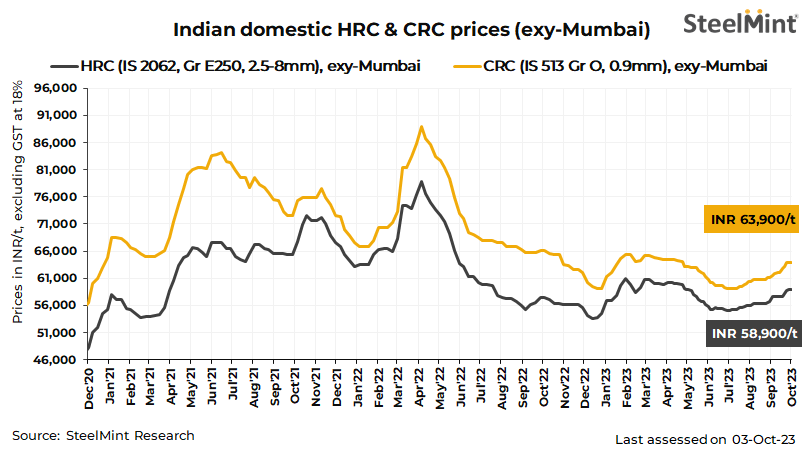

As the market sentiments remained buoyant in the market, and previous price increase was absorbed this in turn made mills go for an interim price hike. SteelMint's benchmark assessment (bi-weekly) for HRC (IS 2062, Gr E250, 2.5-8mm) was recorded higher at INR 58,900/t ($708/t) as on 3 October 2023 compared with INR 58,800/t ($707/t) on 26 September. However, that of CRC (IS513 Gr- O, 0.9mm) stood unchanged at INR 63,900/t ($768/t) in the period under review. Prices mentioned are on an exy-Mumbai basis, excluding GST at 18%. (INR 1 = USD 0.0120165 ; USD 1 = INR 83.2187)

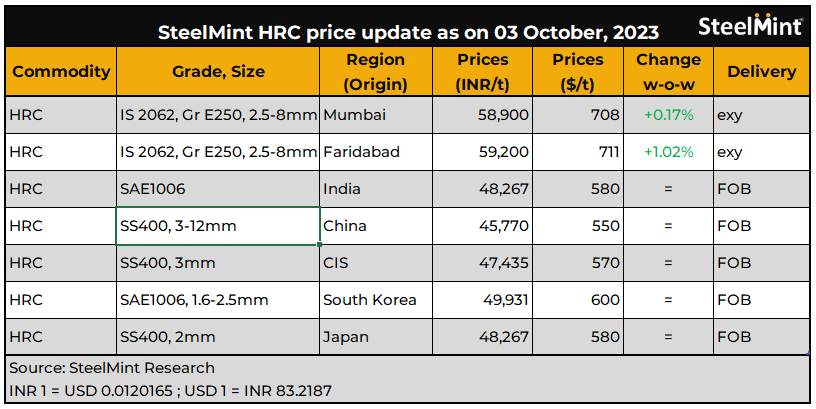

2. Shifting focus of mills to domestic supplies over exports: In September 2023, Indian steel mills prioritized supplying the domestic market over exports due to higher realizations. Thus, mills have stopped exporting HRC to Southeast Asia and the Middle East, as domestic prices are higher. Also, in the Middle East, there is competition from China and Japan whose prices and quality stand competitive at present. For instance, the Chinese HRC (SS400) export offers hovered around $550/t FOB Rizhao as on 3 October 2023.

Meanwhile, European buyers are hesitant to trade, as they are waiting for more clarity on HRC import quotas expected to be released this week.

Moreover, market is cautious amid the news of scheduled maintenances at a few mills in October. Hot Strip Mill (HSM) of a major private mill in Angul is likely to be put on maintenance this month. The impact of this maintenance run is anticipated to be around 100,000-120,000 t and could span over 7-12 days, SteelMint learnt from reliable sources. A few have also shared that the above mentioned volume includes the impact from the maintenance downtime of additional assets of the mill.

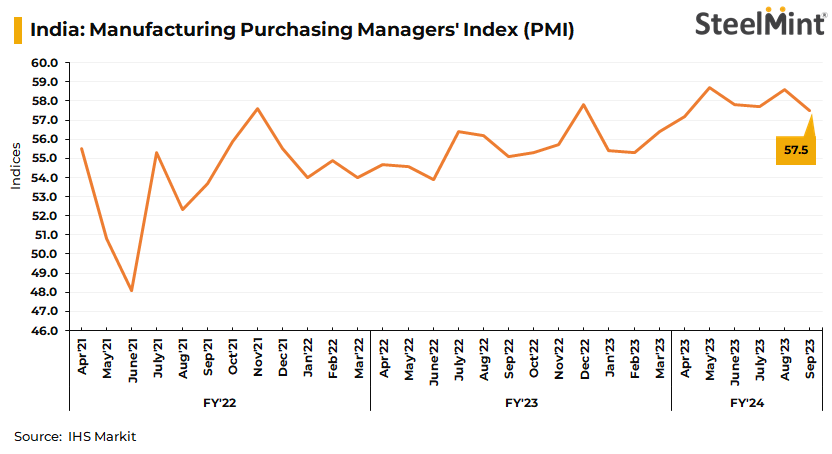

3. Market indices continue to show growth in September 2023: The market indices continued to grow although at a slower pace in September compared with the last four months. India's manufacturing Purchasing Managers' Index (PMI) closed at 57.5 points in September, after registering 58.6 points in August and 57.7 points in July marking the first fall in the last 3 months. Slow buying from the end-user industrial buyer in the traders' market over the month was the reason coined by a few market participants. However, the boosted activities in the government projects and other civil construction space kept the demand and the metrics above the 57 point mark for the first eight months this fiscal year (April-September 2023), opined distributor sources.

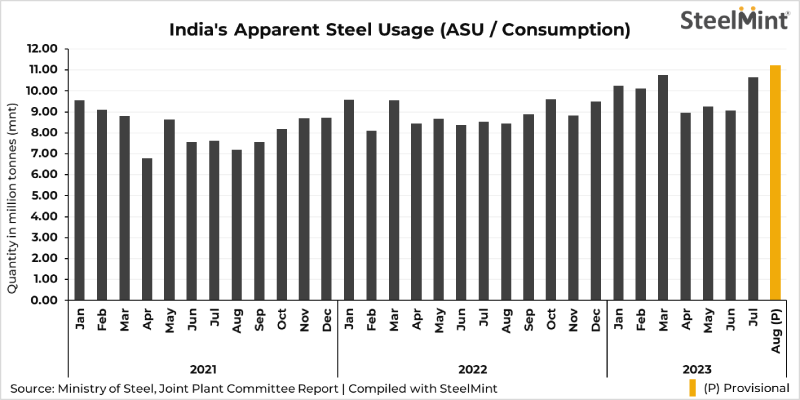

The Apparent Steel Usage (ASU) was reported at 11.22 million tonnes in August 2023 as per the recent provisional report from the Joint Plant Committee (JPC). This stood higher by 5.4% against 10.65 mnt in July 2023 and 32.8% against 8.45 mnt in August 2022. The share of finished flat steel in the above stood at around 4.84 mnt in August and was second highest in line since January 2022. The same was recorded at 5.03 mnt in July 2023. This affirms that despite a low volume (per order) procurement pattern of flat steel buyers in the country, the overall steel consumption has continued to grow over the period.

Outlook:

Trade level prices of HRC and CRC should continue to increase further in the near-term but at slower pace. Expedited activities from the projects in the infrastructure and construction space shall keep the momentum going, shared sources close to mills. There is speculation in the market that more mills might undergo maintenance this month, but this has not been confirmed as of the publication of this article. Whereas, the distribution network sources opine that the hand-to-mouth procurement strategy of buyers in the spot market shall keep any steeper inclines in check.